The global cyber insurance market is projected to reach approximately $16.3 billion in premiums by 2025, according to a newly published report: “Cyber Insurance – Risks and Trends 2025” by Munich Re.

The market’s continued growth is due to escalating cyber threats and increasing reliance on digital infrastructure.

Market growth could continue with Munich Re estimating it at $29 billion by 2027, more than doubling from 2023 levels.

Cyber threats have grown in scale and impact, according to the report, driving investment in cybersecurity options and insurance to control losses.

Four types of attacks make up the majority of losses:

- Ransomware

- Scams

- Supply chain

- Data breach

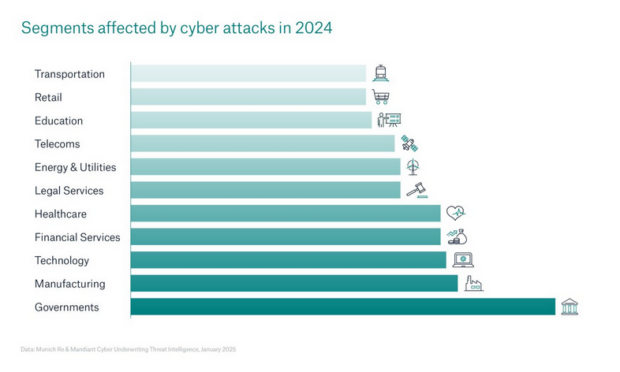

The government, manufacturing and technology sectors are particularly prone to cyber-attacks, according to the report.

Micro and small sized businesses are particularly vulnerable due to inadequate cybersecurity measures.

A separate survey conducted by Munich Re found that 87 percent of C-level respondents consider their organization’s protection to be inadequate.

Ransomware was the leading cause of cyber attack and the manufacturing industry tended to be the top target. Healthcare ranked second.

The analysis found that business interruption (BI) accounted for the largest share of costs (51 percent) among all cost components.

BI risk due to cyber attacks is increasing across all sectors.

Data breaches remained high, with the average cost of a breach rising by 10 percent to an all-time high of $4.88 million.

Supply chain digital bottlenecks will continue to pose major risks from software compromise, managed service provider compromise or single service disruption, according to Munich Re.

The report found that artificial intelligence ranks as the biggest challenge for cyber security.

Nation-state cyber activities invite the potential for digital battlefields, misinformation and disinformation adding to cyber risk challenges.

Technological advances, such as quantum computing and robotics, will also play an increasingly important role in business operations in the future.

The global cyber insurance market totaled $15.3billion in 2024, corresponding to less than 1 percent of the global premium volume for P/C insurance in 2024.

Munich Re’s experts expect the global premium volume to more than double by 2030, growing at an average annual growth rate of more than 10 percent.

“As digitalization advances, cyber protection against one of the biggest threats to economy and society is becoming more and more important,” said Thomas Blunck, CEO Reinsurance. “And yet, a large number of organizations lack adequate safeguards and coverage. Munich Re strives to reach the still un- and underinsured, we aim to increase cyber resilience and progressively close a critical protection gap.”

North America is the largest cyber insurance market with total premium of $10.6 billion and a 69 percent share of global premiums in 2024.

The report found that Europe’s total premiums for 2024 were $3.3 billion, accounting for 21 percent of global premiums and showing a compound annual growth rate (CAGR) of 26 percent (2020-2024).

Europe and Asia/Oceania are expected to increase their share of the global market.

By 2027, Europe is expected to account for 24 insurance of global cyber insurance market premium and Asia/Oceania for 8 percent.

Cyber insurance is expected to remain one of the most rapidly growing sub-sectors of the global insurance market.

Large corporations account for the majority of premiums, while small and medium-sized enterprises (SMEs) continue to bear their cyber risks independently or lack sufficient awareness of the exposure to prompt them to buy adequate cyber insurance, the report added.

There continues to be a cyber insurance protection gap, offering an untapped potential for cyber insurance, largely due to pricing concerns, lack of product awareness and understanding, and insufficient scope of services.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll