New data highlights the increasing cost of car insurance, with rates rising 15 percent last year, according to a recent Insurify report.

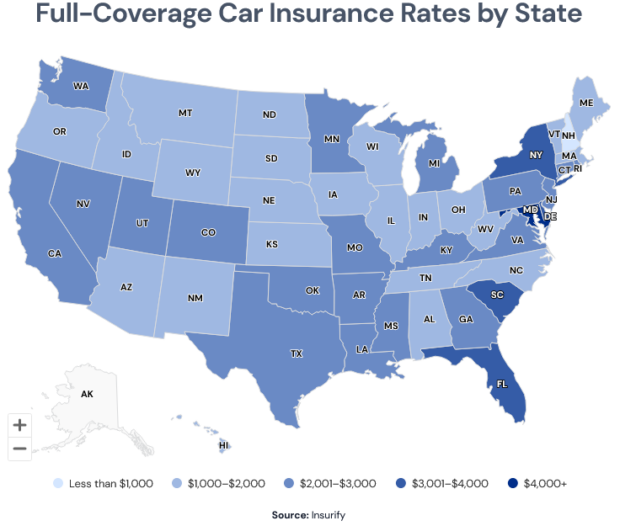

Average car insurance rates range from $2,300 to $3,000 in the U.S.

Rate hikes were fueled by rising car repair costs for both gas-powered and electric vehicles and their costly technology. In addition, climate change and related weather risks have also impacted rising premiums, Insurify stated.

According to the report, full-coverage policy costs surged by 24 percent in 2023, a response to record underwriting losses of $33.1 billion in 2022. Together with the 2024 jump, rates climbed more than 42 percent since 2022.

Related article: IRC Finds Personal Auto Insurance Affordability Better Than in the 2000s

While the industry recovers, rate increases have slowed, with average premiums declining in 21 states in the second half of the year, according to Insurify data.

The rates for full coverage are expected to slow to 5 percent in 2025, Insurify predicts, indicating that by year-end, the average annual cost of full coverage will rise to $2,435.

The analysis showed that car insurance costs increased fastest in Minnesota, Maryland, California, Virginia and Pennsylvania, with average rate hikes of 33 to 58 percent in 2024.

Maryland drivers pay the most for car insurance, with an average annual full-coverage premium of $4,060.

The report found that the high rates in the state were likely due to legislative changes, surges in vehicle thefts, rising accident rates and climate risks.

Rapid rate hikes ranging from 48-58 percent in three states, California, Maryland and Minnesota, were the result of a mix of legislative changes and severe weather.

Full-coverage rates are expected to rise by up to 10 percent in Florida, New York, Georgia, Nevada and Delaware in 2025, according to Insurify projections.

In the five states where rates are rising fastest, drivers already pay more than the national average ($2,313) for full coverage, the report noted.

EV insurance costs for nine popular models rose by 28 percent in 2024, twice as fast as comparable gas-powered models, the data showed.

EVs are now 23 percent more expensive to insure than comparable gas models, with an average annual full-coverage cost of $3,430.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market