Lloyd’s executives said the market has continued to demonstrate its value to stakeholders by delivering 6.5 percent premium growth while maintaining underwriting discipline.

Lloyd’s saw a continuation of positive returns with profit before tax of £9.6 billion ($12.4 billion) during 2024, down from £10.7 billion ($13.8 billion) in 2023. The market achieved a combined ratio of 86.9 for full-year 2024, compared with 84.0 for FY2023. (A combined ratio below 100 indicates an underwriting profit.)

Lloyd’s Chief Financial Officer Burkhard Keese said that 2024 was a year when the market once again “proved our underwriting discipline and delivered profitable growth of 6.5 percent,” or gross written premium totaling £55.5 billion ($71.7 billion), compared with £52.1 billion ($67.3 billion) for FY 2023.

Keese and Chief Executive Officer John Neal both spoke during a recent media briefing to discuss Lloyd’s full-year results for 2024.

“Lloyd’s has been relentless in pursuing sustainable profitable performance in the market. We’ve been on a seven-year journey to deliver the change our stakeholders wanted — to consistently focus on the delivery of disciplined underwriting, to modernize our performance and oversight frameworks, to address the cost of doing business at Lloyd’s, and to show leadership on the issues that matter,” said Neal, who will exit the market this year to become global CEO of Aon Reinsurance and chairman of Aon’s Climate Solutions unit.

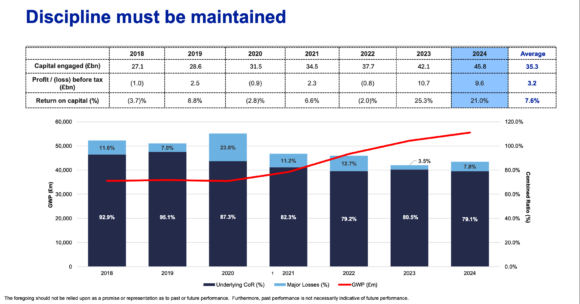

“Our track record since 2017 speaks for itself. To date, we’re reporting a combined ratio for 2024 of 86.9. We have reduced our underlying combined ratio to 79.1, (which excludes major claims), or a 16 percentage point improvement on that same ratio from 2019,” Neal said, adding that Lloyd’s strong reserving position continued to support some positive prior year reserve releases, which reduced the 2024 combined ratio by 2.4 percent.

“The key components of the combined ratio are moving positively. Importantly, the attritional loss ratio, most directly under the underwriters’ control as they select, manage and price risk, has reduced to 47.1 and is now consistently below 50. Operating expenses have fallen over the period from 40 percent [in 2017] to 34 percent [in 2024], with opportunities to manage this ratio further post digitalization,” Neal added.

The market’s 2024 expense ratio of 34.4 remained flat with 2023, which Keese described as “a small disappointment.”

Most Important Measure

Both Keese and Neal focused a lot of their commentary on Lloyd’s underlying combined ratio, which Keese described as “the most important measure…”

“With our underlying combined ratio of 79.1, we have achieved our profitability threshold of 80 for the third consecutive year, proving once again how well our Lloyd’s system works,” said Keese who also is stepping down from his CFO position this year.

“An underlying combined ratio of 80 means that we can absorb losses up to £8 billion [$10.3 billion] net of reinsurance before our underwriting result turns negative [and the combined ratio rises above 100],” said Keese, noting that this allows Lloyd’s to absorb another £4.9 billion ($6.3 billion) of net large losses before it would report an overall loss of net income.

“As our normal net major claims are usually around £4 billion [$5.2 billion], this resilience is reassuring for both our policyholders and capital providers,” he said.

Since 2018, Lloyd’s has achieved top-line growth of over 50 percent and its underlying combined ratio has been reduced from 93 in 2018 to 79 in 2024, which represents an increase in annual underwriting profit of £6.4 billion ($8.3 billion), Keese said.

“Strong underwriting discipline is our north star, and we expect the market to consistently target an underlying combined ratio of around 80. We’ve seen strong performance on both sides of the P&L with the underwriting profit of £5.3 billion [$6.9 billion], complemented by another strong investment return totaling £4.9 billion [$6.3 billion],” Neal said. (The underwriting profit in 2023 was £5.9 billion and that year’s investment return was £5.3 billion.)

Keese noted that Lloyd’s profit before tax stands at £9.6 billion, or £1 billion less than reported for 2023, but this decrease was expected after the exceptional year of 2023 when nat-cat activity was relatively low.

While 2024 is the second consecutive year when Lloyd’s reported very high profitability, Keese warned the market shouldn’t get “carried away” — in other words, it should avoid resting on its laurels. “We have not earned our cost of capital over the last seven years, meaning the high profits in 2023 and 2024 were not enough to offset the results since 2018, and I believe it is very much true for the whole industry,” he said.

Return on Capital

“This means we must maintain underwriting discipline. We can all agree that 7.6 percent of return [on capital since 2018 ] is not sufficient for existing and new investors. Without setting a specific target and depending, of course, on the nature of the book, an investor typically would expect to see 10 percent to 15 percent returns,” Keese said, adding that for the market to reach an adequate return on capital, it needs to achieve double-digit returns for several years. The 2024 return on capital of 21.0 percent is down from 25.3 percent in 2023, which brings the seven-year average to 7.6 percent. See related graphic above. (Note: The 2023 number has been corrected from an earlier version of the article.)

The return on capital at Lloyd’s was 21 percent for 2024, down from 2023’s significant 25.3 percent but taking the seven-year average now back to 7.6 percent.

Keese further explained during the Q&A session that investors need to be paid for their cut of the risks they take. “We have earned 7.6 percent return on capital over the last eight years, and we must give the investors a chance to earn that money back. And I think that will force discipline because there’s a certain fatigue still in the investor community of deploying money into the insurance sector.”

Both Keese and Neal expressed confidence that Lloyd’s wouldn’t see widespread rate softening, given investor demand for better returns and the nature of evolving risks.

“We’re in an unusual world of protectionism, nationalist behaviors and geopolitics,” said Neal. “I mean there’s a whole heap of complexity out there, which … has heightened the perception of risk amongst the buyers of insurance.”

He noted that Lloyd’s is growing at three times the rate of gross domestic product while insurance globally is growing at twice the rate of GDP. “So I think there is plenty of opportunity for underwriters to see risk, accept risk, but only accept risk where the price is right.”

Indeed, Neal said the market 2023 and 2024 has shown discipline around the right price for the right risk – a trend that will likely continue.

“The 2024 results demonstrate clearly that the Lloyd’s market is in good shape, underpinned by that commitment to performance, discipline and sensible scale,” said Neal in his wrapup commentary. “And to remain in this position, we will remain laser focused on underwriting profitability to deliver exceptional value to our market, our investors, and of course to our customers.”

Related:

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers