The Doctors Company said it has entered an agreement to acquire ProAssurance Corp. for $1.3 billion, taking the company private.

Birmingham, Ala.-headquartered ProAssurance is a specialty insurer with expertise in medical liability, products liability for medical technology and life sciences, and workers compensation insurance.

The Doctors Co. of Napa, Calif. is the nation’s largest physician-owned medical malpractice insurer.

The transaction is expected to close in the first half of 2026. Upon completion, ProAssurance’s common stock will no longer be listed on the New York Stock Exchange, and ProAssurance will become a wholly owned subsidiary of The Doctors Co., creating a combined company with assets of approximately $12 billion.

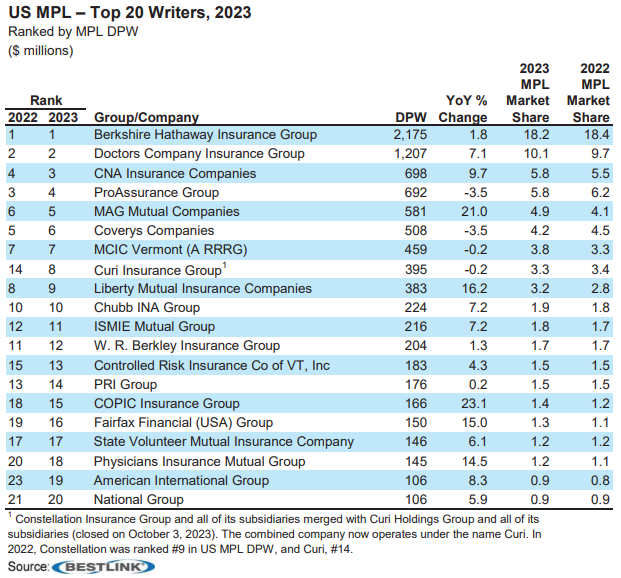

Rating agency AM Best said The Doctors Company Insurance Group is the second-largest writer of medical professional liability (MPL) insurance in the U.S. based on 2023 direct premiums written (AM Best said it is in the process of collecting 2024 data). ProAssurance is the fourth largest. Berkshire Hathaway is first with more than 18 percent market share. Together with ProAssurance, Doctors Co. would have nearly 16 percent of the MPL market.

AM Best added it does not expect the transaction to affect the financial strength rating of A (Excellent) for the The Doctors Co. The financial strength rating of A (Excellent) for ProAssurance also remains unchanged, the agency said.

Under the terms of the agreement, ProAssurance stockholders will receive $25.00 in cash per share, representing approximately a 60 percent premium to the closing price per share of ProAssurance common stock on March 18, the last trading day prior to the deal announcement on March 19.

The Board of Directors of ProAssurance unanimously approved the deal and will recommend shareholders do the same.

“Healthcare is a team sport, and the teams are getting larger. In order to provide them the best imaginable service requires a mission-based company with nationwide scale, resources, and dedication to all medical professions and healthcare providers,” said Richard E. Anderson, chair and chief executive officer of The Doctors Co., in a statement. “The addition of ProAssurance to The Doctors Co. significantly enhances our ability to serve healthcare professionals now and well into the future.”

“Both ProAssurance and The Doctors Co. were founded by physicians in response to the medical liability crisis of the 1970s,” according to Ned Rand, ProAssurance’s president and chief executive officer.

“This shared history has helped both companies fulfill our shared mission to protect others and given us similar operating philosophies and cultures,” he added. “Bringing the strengths and capabilities of our companies together now will allow our teams to continue to serve today’s healthcare providers with the necessary scale and breadth of capabilities.”

In a report on the MPL market published May 2024, AM Best said insurers in this line of business continue to face many of the same challenges as the last several years—a rising frequency of high-severity losses driven by social inflation factors as well as staffing shortages, growth in alternative care facilities, and an erosion of tort reform in some jurisdictions.

This article was previously published by Insurance Journal

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday