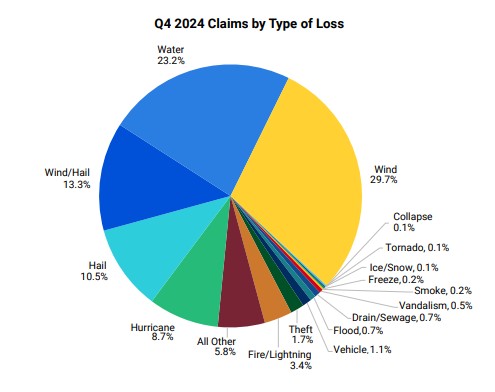

A significant rise in claims from hurricanes rather than winter storms was to blame for a 36 percent increase in total fourth-quarter 2024 claims.

A new report from Verisk Analytics found catastrophe claims more than doubled year over year during the last three months of 2024, as hurricane claims made up nearly 9 percent of fourth-quarter volume — more than an 1,100 percent compared to fourth-quarter 2023.

Flood and wind claims increased 221 percent and 195 percent, respectively, according to Verisk data.

Verisk said its initial look at Q4 shows a 7 percent decrease in average claims severity compared to the same period in 2023. However, the firm noted how the replacement cost value (RCV) in Q3 2024 increased 10 percent to $16,800 as complex claims reached completion. Based on this claims-maturation pattern, Verisk said it projects Q4 average RCV at about $18,600.

Verisk’s observations during Q4 include possible challenges in skilled-labor availability since labor costs accelerated fasted than material costs during the period. Looking at the last 12 months, billable labor rates went up about 5.3 percent in the U.S.

Residential reconstruction costs have gone up 4.5 percent from January 2024 to January 2025 while commercial reconstruction costs climbed 5.5 percent year over year, Verisk noted in the quarterly property report.

“This shift in risk patterns demands new approaches to risk assessment and resource planning, particularly in the Southeast where costs increased at six times the national rate following hurricane activity,” Verisk said, adding that Hurricane Milton has generated about 187,000 claims with RCV of about $2.7 billion. Average RCV per claim is $19,100, with about 85 of claims still outstanding as of the report.

Increased claims were seen in Florida, Georgia, and South Carolina from the hurricane activity. In addition, “unexpected surges” in claims were seen in the Great Plains and Pacific Northwest mostly from water, hail, and wind perils, Verisk added.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut