After reporting a $13 billion underwriting loss in 2022 and $14 billion in 2023, State Farm recorded another underwriting loss last year—but the total for 2024 was less than half of those prior reports.

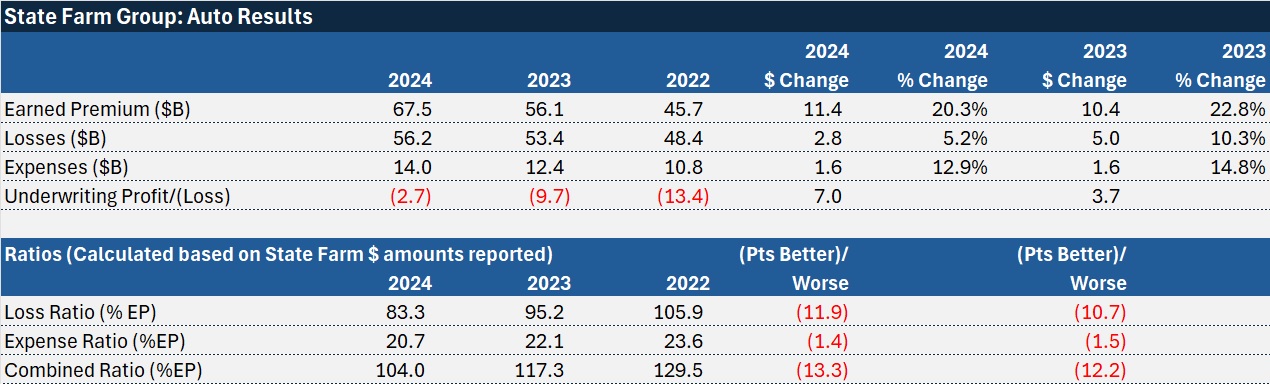

Coming in at just over $6 billion for 2024 overall, State Farm’s auto underwriting results drove the improvement. With auto earned premiums jumping 20 percent to $67.5 billion, auto underwriting results were still written in red ink, but the underwriting loss figure was $2.7 billion in 2024—$7 billion less than the $9.7 billion auto underwriting loss recorded in 2023.

Translated to a combined ratio, that’s about a 104 for 2024—more than 13 points better than 2023’s auto combined ratio of roughly 117.

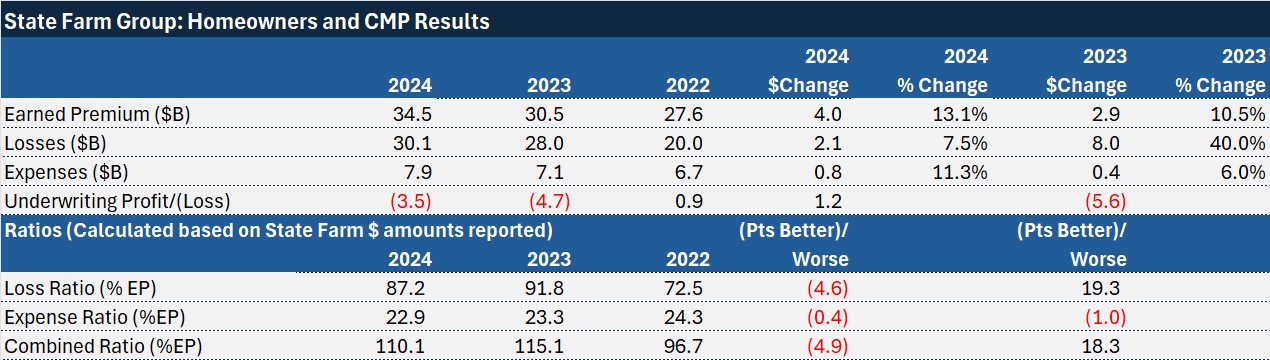

For property lines, earned premiums rose 13.1 percent to $34.5 billion, but underwriting losses improved by only $1.2 billion, coming in at $3.5 billion for 2024.

In total, State Farm said that its property/casualty companies reported a combined underwriting loss of $6.1 billion on earned premium of $103.0 billion. The 2024 underwriting loss, combined with investment and other income of $6.0 billion, resulted in a P/C pre-tax operating loss of $111 million, compared to operating losses of more than $8 billion in the prior two years (an $8.5 billion loss reported in 2023 and an $8.3 billion operating for 2022).

Total revenue, which includes premium revenue, earned investment income and realized capital gains and losses was $123.0 billion for 2024, up 18.0 percent from $104.2 billion for 2023.

On the bottom line, State Farm ultimate reported a net income figure of $5.3 billion in 2024 compared to a net loss of $6.3 billion in 2023. The reported net income for 2024 includes the impact of $3.0 billion of realized capital gains, net of tax.

Financial Strength and Parental Support

The media statement about the financial results stressed the financial strength of State Farm Mutual Automobile Insurance Company, noting that the net worth for State Farm Mutual Auto ended the year at $145.2 billion compared to $134.8 billion at year-end 2023. The change during 2024 includes an increase in the value of the P/C companies’ unaffiliated stock portfolio, driven by increases in the U.S. equities market, partially offset by the P/C group’s pre-tax operating loss.

“The financial strength of State Farm Mutual Automobile Insurance Company and each of its affiliates is key to fulfilling our promises to customers in the future and expanding and enhancing the way we serve customers,” the media statement from the nation’s largest insurance group said.

The statement also provided an update on State Farm’s service to customers in response to the January 2025 California wildfires. “As of February 26, we’ve received more than 11,750 total fire and auto claims related to the fires and have paid nearly $2.2 billion to our customers,” said Senior Vice President, Treasurer and Chief Financial Officer Mark Schwamberger.

“Our customer-centered approach leads us to measure success in the number of promises kept. The financial strength of each affiliate is critical to our ability to keep those promises, and we will continue to take a state-specific approach in the way in which we operate.”

“Our customer-centered approach leads us to measure success in the number of promises kept. The financial strength of each affiliate is critical to our ability to keep those promises, and we will continue to take a state-specific approach in the way in which we operate.”

The reference to the separate financial strength of each affiliate appeared again in a footnote to the media statement: “State Farm Mutual Automobile Insurance Company and each of its affiliates must meet solvency and regulatory requirements on an individual entity-by-entity basis without regard to the solvency or financial condition of any other affiliated entity.”

That footnote is not new. It was included at the bottom of prior financial reports from State Farm. But this year, it seemed to take on more significance, with the focus on one particular affiliated entity—State Farm’s California homeowners insurance company, State Farm General.

The question of whether State Farm’s parent company, State Farm Mutual Automobile Insurance Company, “would be willing or able to provide financial support to” State Farm General was raised by California Insurance Commissioner Ricardo Lara during a meeting to discuss State Farm General’s request for his approval of an emergency interim rate increase last week. The meeting, which involved representatives of State Farm General, the department of insurance and consumer group Consumer Watchdog, took place just two days before State Farm’s overall financial results were published.

Beyond written responses State Farm General executives sent to Commissioner Lara in a letter the day before the meeting, a transcript of the proceedings that Carrier Management located online shows that executives again stressed the need for individual affiliates to remain financially viable but indicated that the approval of a 22 percent emergency rate increase would help them in taking a request for support to the parent company board.

Related articles: S&P Puts State Farm General Ratings on CreditWatch; Not So Fast: State Farm Didn’t Prove Its Case for Rate Hike, CDI Says; LA Fire-Related Capital Hit Prompts State Farm Emergency Rate Request

Keesha-Lu Mitra, senior vice president and general counsel, noted that the State Farm Mutual board is comprised of all external, independent directors except for the State Farm Mutual chief executive officer. “[T]heir fiduciary duties require them to exercise reasonable care, judgment, and diligence of what is in State Farm Mutual’s best interest as an entity and its policyholder group as a whole of State Farm,” she said, according to the online transcript. She went on to say that the California company would expect the members of State Farm Mutual’s independent board to give “robust consideration” to any request that might be presented to them for potential assistance.

Dan Krause, president and CEO of State Farm General, then noted that he would be the one who would be tasked with making such a request. “There has to be some sort of positive sign that State Farm General would be able to sustain itself from a capital position to support its risk profile….That’s the purpose of the interim rate request. That would give us that type of a positive sign, both to the rating agencies and to any potential investors, including State Farm Mutual….

That’s the emergency basis of this—because it would help, at least, me [in] building a case to go to the Mutual board to ask for consideration,” Krause said according to the transcript.

Later Lara asked again to clarify his understanding: An approval would “help you potentially make a successful request to the parent company for additional support?”

Krause replied: “It would allow a positive sign that would show that this is a market that we can compete, generate a return in, and stay in—and give us a chance for consideration for the parent company. Yes.”

Exposure vs. Capital

That response came after some back and forth on questions of how an approval of the emergency rate increase being sought would benefit consumers. Would it prompt State Farm General to pause non-renewals? To write more in California?

Not immediately, Krause and Schwamberger said.

In fact, when the commissioner asked the executives to comment on the idea he’s heard from some constituents suggesting that there is no benefit to consumers—that the rate increase is just a step in a financial bailout of State Farm General—Schwamberger ultimately said, “The only other thing that we could do without rate and without the ability to increase capital, is to substantially reduce exposure.”

“Any other actions aren’t going to be enough…to prevent the unfortunate situation that could arise should we not have positive signs about the prospective ability to be self-sustaining,” the CFO told Lara, who asked what other actions the company is undertaking.

“Meaning, you would continue to non-renew or have to cancel policies?” Lara asked.

“At the end of the day, yes, sir. To the degree you cannot be self-sustaining and you don’t have viability and the capital to stand behind promises, [then] we’re left with no other alternative,” Schwamberger responded, according to the transcript.

Asked directly whether approving the emergency rate increase would pave the way to pause non-renewals, Schwamberger said, “I think the short-term answer to that is no,” explaining that it takes time to get rate and grow. “[G]iven our current exposure and where we are, we would not be in a position to fiscally and responsibly starting to regrow within the California market just because of this rate in the very near term,” he said, according to the transcript.

Both Schwamberger and Krause talked about State Farm’s desire to remain in California, however.

“We look forward to some of the reforms,” Schwamberger said, referring to the department’s “Sustainable Insurance Strategy” reforms, which include allowing insurers to include the cost of reinsurance and to use forward-looking catastrophe models for provisions included in rate filing indications.

“We literally just want to survive to be able to see that day when the reforms are there and we continue to serve… millions of customers in the state of California.”

Commissioner Lara pressed on to try to get some guarantee to provide a benefit to customers in exchange for his stamp of approval on the immediate emergency rate increase. What about making a commitment not to non-renew any more customers, the commissioner asked.

“I think that’s an appropriate way to think about it,” said Schwamberger in the transcribed remarks. “That prospective ability to generate capital and be self-sustaining—that is the positive sign that [Krause] talked about earlier, which is what we need to see.”

Said Krause: “We’ve been here for almost 100 years. We want to be here for 100 more, but we’ve got to be able to have this—[for] State Farm General [to] survive…”

Beyond P/C

According to the media statement summarizing State Farm Group’s overall financial results published on Feb. 28, 2025, the State Farm life insurance companies paid out more than $817 million in dividends to policyholders, and issued a record $122 billion in new policy volume bringing the year-end 2024 individual life insurance in force to $1.2 trillion.

The two life companies, State Farm Life Insurance Company and State Farm Life and Accident Assurance Company, reported premium income of $6.7 billion and net income for 2024 was $1.7 billion.

The State Farm insurance operations consist of 14 P/C companies and two life insurers, each of which is managed on an individual affiliate level. In addition auto, homeowners and CMP, the P/C companies are also engaged in health and reinsurance lines of business. The life companies are primarily engaged in individual life insurance and annuity business.

In addition, State Farm group makes third-party products, such as annuities, banking, health, mutual funds and pet medical insurance.

Auto Improvement vs. Competitors

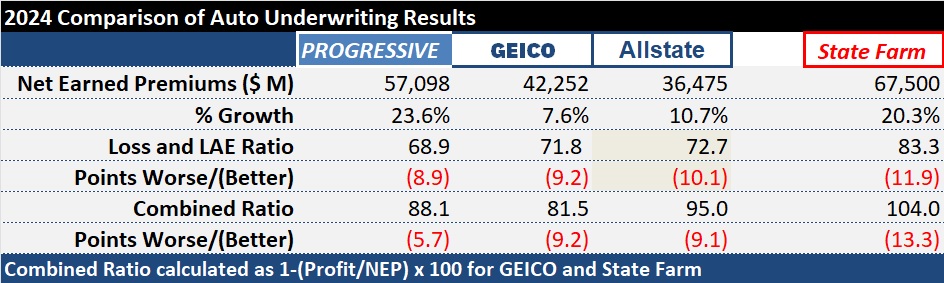

Focusing on just the most improved part of State Farm’s P/C businesses—the personal auto results—the nearly 11.9-point drop in its loss and loss adjustment ratio was larger than three competitors, Progressive, GEICO and Allstate.

All four carriers reported improved underwriting results, but State Farm’s personal auto loss and LAE ratio, at 83.3, remains higher than the 81.5 auto combined ratio of GEICO, which includes underwriting expenses for the direct writer, GEICO.

Progressive’s 2024 combined ratio, 88.1, was only five points higher than State Farm’s loss ratio.

According to figures compiled by Carrier Management from financial reports of all four carriers, State Farm also reported lower growth in auto earned premiums than Progressive in 2024, with Progressive’s earned premiums jumping nearly 24 percent, beating State Farm’s 20 percent jump in earned premiums.

Featured image: AI-generated (Adobe/Firefly); State Farm headquarters from State Farm media assets

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market