Claims, communication, and technology round out the top three concerns for independent agents when placing new business with a carrier, according to InsurTech firm Vertafore.

The findings were the result of a survey of nearly 1,300 insurance professionals including account managers, agency owners and principals, producers (and others with sales titles), customer service representatives (CSRs), and operations professionals. A smaller segment of responses came from administrative, human resources (HR), data or accounting professionals.

The report, “Independent agents on improving carrier partnerships: Report for insurance carriers,” highlights the wants, needs and challenges agents encounter in their daily interactions with carriers, and the technology carriers can use to strengthen relationships.

The largest segment (33.2 percent) work with 11-20 carriers regularly.

The survey’s most well-represented respondents can be summarized as: Gen X, women, having 20 or more years of experience in insurance, being in an account manager role, at independent agencies with 7 to 25 employees, and working on behalf of 11 to 20 carrier partners.

Agents’ Top Factors When Placing Business With a Carrier

When asked how carriers could get more of their business, respondents indicated that besides offering competitive products and pricing, responsiveness of underwriting ranked as the most important consideration for 84 percent of survey takers.

Claims service emerged as a very significant factor influencing independent agents when placing business with a particular carrier. Delving into the impact of specific factors on placing business, producers and account managers ranked claims service as their most important criteria, with 75 percent of respondents deeming it a must-have. The second-ranked specific factor considered when placing business is personal relationships—a must-have for 60 percent.

More than three-quarters of independent agents (77 percent) of respondents agreed carriers should invest in better onboarding and licensing tools and processes. Only 33 percent of all respondents felt their primary carrier partners offered great service in their onboarding, licensing and compliance practices.

Sixty-four percent said a must-have for a better onboarding and licensing experience is being able to easily view authorization, appointment and renewal status.

Further insights into onboarding and licensing are summarized in the graphic below.

Continuing on the theme of recommended carrier investments, 77 percent of producers and account managers also said that efficient, effective, and navigable carrier portals is a top area to improve. Fifty percent said participation in commercial lines raters is also an important area for carriers to invest in. That contrasts with just 42 percent who cited the high importance of the ability to bind within a comparative rater for personal lines.

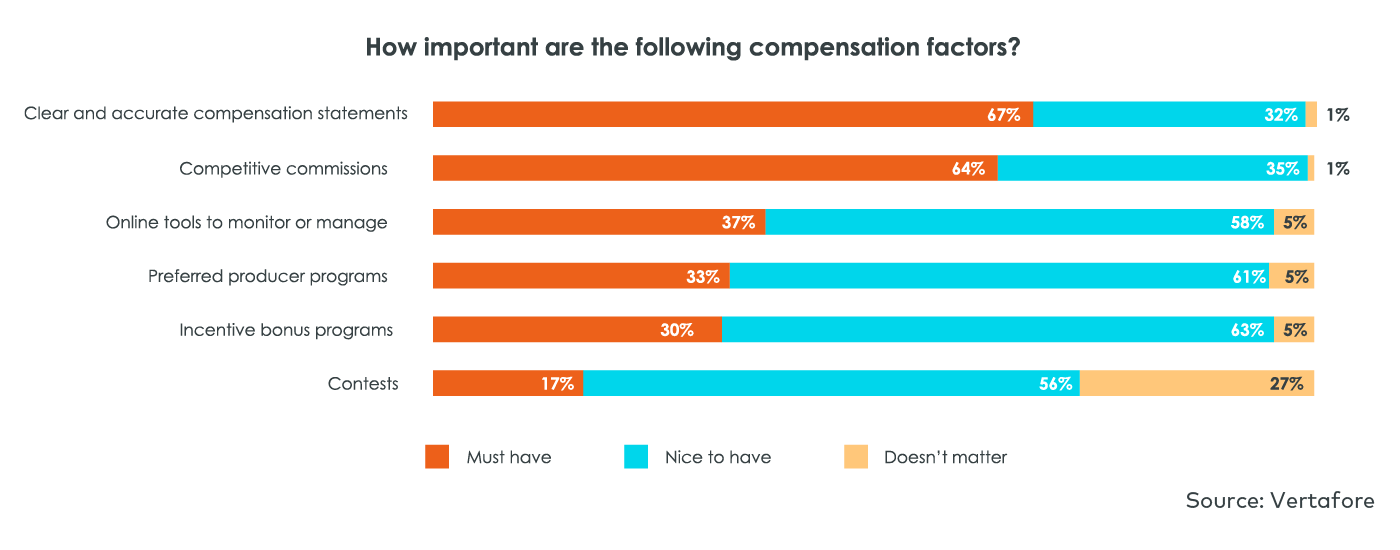

Roughly two-thirds of respondents (67 percent) indicated clear and accurate compensation statements as the top compensation-related factor for working with carriers, while competitive commissions came in second among various compensation factors that respondents ranked as important (64 percent).

Weighing the importance of various carrier technologies, 69 percent of independent agents said digital personal lines rating and submission was a must-have—the most for any technology.

Underwriting service is an area where carriers could improve, according to the survey.

A little over a quarter of respondents (28 percent) indicated top carriers provided great underwriting service. Almost half, 46 percent, described their carrier partners’ service as average and 26 percent of respondents said they typically experienced below-average service.

The top three underwriting capabilities sought by independent agents included responsiveness, competitive products and pricing.

In the servicing category, 83 percent of independent agents listed the ability to check policyholder billing status online as the most important servicing area for carriers to invest in. Nearly as many—80 percent of customer service representatives—also shared that the ability to view and make changes to policies online remains an important area for carrier investment.

On the claims front, survey analysis revealed that only 23 percent considered their primary carrier’s claims service to be excellent.

Seventy-eight percent of survey takers ranked ease of communication as a way for carriers to get more of their business, while 77 percent said the availability of efficient, effective and navigable carrier portals is a critical area for investment.

Increasing Carrier-Agent Bond With Better Technology

Overall, responses show that a key differentiator in the agent experience is whether carriers use modern technology.

Customer service representatives (CSRs) said the ability to both check policyholder billing status (83 percent) and view and make changes to policies online (80 percent) should be the top priorities for carrier investment.

At the top of the rankings, survey respondents cited the necessity of digital rating and submission in personal lines as the most important technology capability, with more than two-thirds (69 percent) rating it a must-have. For digital rating and submission in commercial lines, 51 percent called this a must-have.

Digital document and policy delivery demonstrated its widespread utility, too, with 59 percent of respondents agreeing it was a must-have technology. Direct bill and commissions download (57 percent), as well as digital appetite and eligibility solutions (53 percent) ranked highly, as well.

Carriers that invest in integrated, easy-to-navigate systems reduce the time agents spend on manual tasks, allowing them to increase the volume and quality of business the independent agent channel generates, the survey noted.

Agents, with more than 250 employees, tend to interact with the most carrier partners—more than 50—have greater technology expectations.

Not unexpectedly, carrier chatbots were viewed negatively.

Areas Where Carriers Can Place Less Emphasis

Respondents also provided insights on areas where carriers could reduce spending. These included mobile tools, with 23 percent of respondents said indicating mobile tools are only of minor value in terms of how carriers could get more of their business.

Vertafore suggests this could be due to agents primarily working on their laptops while relying on their mobile devices for on-the-go or ancillary support.

As expected, there were some generational differences when it came to mobile app preferences.

Younger agents were significantly more likely to consider mobile apps to be more than a convenience: 37 percent of respondents aged 18 to 27 and 32 percent of those aged 28 to 43 labeled carrier mobile apps a must-have technology.

Likewise, contests, incentives or preferred producer programs were of relatively minor importance to 25 percent of respondents, mainly with those who have worked in the industry longest. However for new agents, 53 percent felt contests and incentives were a must-have when choosing a carrier.

Marketing materials were deemed the least important factor and, as such, an area where carriers could reduce investment.

“Efficient, streamlined processes are the foundation of the agent-carrier relationship and a positive agent experience,” said Kelly Maheu, vice president of partnerships and industry relations at Vertafore. “This report highlights how carriers and agents rely on technology to make agents’ work easier while bringing the human element into the process to strengthen relationships across the distribution channel.”

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid