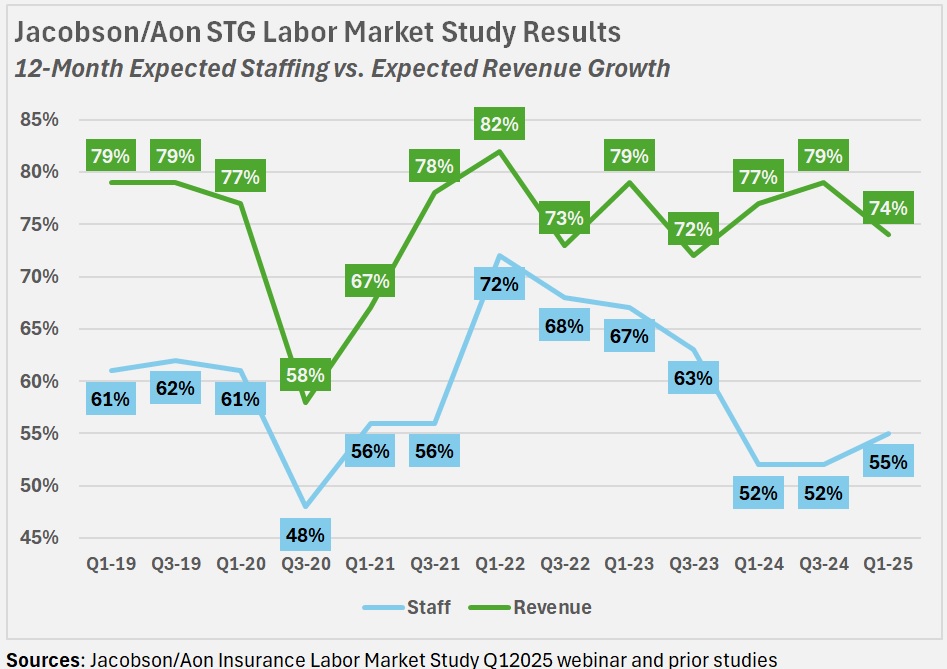

Continuing a trend that’s persisted for several quarters, the latest Insurance Labor Market Study from Jacobson Group and Aon finds a big gap between the percentage of carriers expecting to boost top lines and those anticipating staff growth.

The latest installment of the semi-annual collaborative study of insurance carrier hiring expectations, based on a January survey of insurers that employ just over 200,000 people (mostly property/casualty), finds that nearly three-quarters of survey respondents (74 percent) expect to grow revenue in the coming year. At the same time, just 55 percent expect to grow staff to support their biggest businesses.

While the 19 percentage point gap between those two figures is actually below the 25 and 27 percentage point gaps of the two prior surveys, Jeff Rieder, partner and head of Strategy and Technology Group Performance Benchmarking at Aon, drew attention to the recent persistence of the low-to-mid-50s percentage on the staffing side.

Speaking during a webinar last week, Rieder noted that survey results, which date back to 2009, have historically shown a high correlation between the staff and revenue growth expectations. The graphic created by Carrier Management above, showing only a portion of the historical results dating back to 2019, reveals that correlation for the 2022 and prior years. Starting in 2023, however, the staff and revenue lines move in different directions.

“Normally if we were looking back 10 years ago, we’d see that typically [there was] a direct correlation”—and 60 percent or more carriers expected to increase staff in subsequent 12-month periods, Rieder observed. “That’s not really holding true here in the last three cycles of the study,” he said, noting that while the 55 percent expecting staff growth is up slightly from last year’s July survey, “it’s a relatively small number—and it’s down significantly from where we were emerging from the pandemic.”

In the surveys done immediately after the COVID lockdowns, the percentage of insurers expecting staff growth dipped below 50 percent. When insurers were surveyed in 2022 and 2023, expectations rebounded, with 60-70 percent forecasting staff growth in their one-year projections, and 70-80 percent indicating revenue growth was on the near-term horizon.

Rieder said he is often asked whether automation is translating to less job growth now at insurance companies. While that’s happening, and it’s expected to continue, Rieder sees market dynamics in the P/C personal lines as a key driver of diverging trends in staffing and revenue growth figures. Specifically, he pointed to exits from certain geographies and the fact that much of the recent revenue growth has been attributable to rate hikes rather than exposure growth over the last three years as additional explanations for the uncoupling of revenue and rate expectations.

He noted that the latest study shows 12 percent of carriers expecting to decrease staff—marking the fifth semi-annual study for which this percentage was at least 10 percent (dating back to January 2023).

Referring to the automation that companies have already put in place, and “major system changes” that occurred since roughly 2015, Rieder said, those changes have generated significant improvements in policy processing and data entry—and policyholder and billing inquiries can be handled through chatbots and other tools. Those may indeed still be impacting staffing plans, with companies, perhaps, expecting to still gain greater efficiency, he conjectured.

Turning his focus to the personal lines sector of the P/C insurance industry, he noted that companies have repositioned their underwriting portfolios. “Specifically, those companies that have exited or paused on their personal lines writings [may] now see that, with fewer policies, it means there are fewer claims [and] fewer calls” to answer—all trends that “still appear to be impacting their staffing levels.”

Rieder also noted that while there was an improvement in the general economy last year, storms like hurricanes Helene and Milton late last year and the wildfires in California this year highlight the fact that there is continued uncertainty around profitability for P/C carriers. While carrier results were generally strong, “a little bit of uncertainty in the overall financial situations” may be prompting carriers to pause any plans to significantly boost headcount.

Analyzing last year’s expected changes and the actual changes, the survey results reveal that P/C carriers, in particular, were spot on about increases. Fifty-three percent had expected to increase hirings in 2024, and 52 percent actually did. They missed the mark on decreases, however. While 37 percent had planned to maintain staff size, only 29 percent did keep headcount the same. Ten percent had anticipated staff cuts and, by year end, the actual percentage of P/C carriers that cut staff was 19 percent.

Giving some further insight on personal lines, Jeff Blair, Jacobson Group’s senior vice president of executive search and business development, noted that while 9 percent of all P/C companies surveyed (and 12 percent of all companies, P/C and life-health combined) plan to reduce staff over the next 12 months, 29 percent of P/C personal lines insurers are expecting workforce declines.

Expected increases in staff were highest among surveyed P/C commercial carriers and “balanced” carriers that write both commercial and personal lines, Blair said, adding that “the national carriers seem to have bigger plans for increasing staff.” Quantifying the differences in the segments, a note on one of Blair’s presentation slides during the webinar said that 67 percent of balanced P/C carriers are expecting to increase staff during the next 12 months, which is 43 and 4 percentage points higher than personal lines and commercial lines companies, respectively.

Doing the math, that means that less than one-quarter of personal lines insurers (24 percent) expect to increase staff in 2025.

Blair also noted that more personal lines carriers are expecting decreased revenue in 2025, compared to 2024 than carriers in other segments.

Personal lines carriers, as well as mixed carriers writing personal lines, also stood out when Jacobson and Aon asked about planned usage of temporary employees over the next year. Without sharing exact figures, Blair said the most significant increases in temporary staffing were planned for these two groups of carriers. “There does appear, potentially, to be a little bit of [activity aimed at] reducing permanent head count through decreases in staffing, but there may be an increase, as needed, for temps to fill in. And this can particularly be the case if some of these reductions are in the claims organization,” he said. “During catastrophes, you can increase with temps,” he said.

Related article: Future of Jobs: Claims Adjuster Among Fastest Declining Professions

Overall, across all segments included in the survey, 80 percent of insurers said they will maintain the use of temporary staff at current levels. Eight percent expect to increase their use of temps, and 12 percent expect to decrease the size of their temporary workforces.

The survey also asked participants about voluntary and involuntary turnover experienced over the last 12- and six-month periods. For carriers that provided the figures, the voluntary turnover rate over the past 12 months was 8.5 percent, and the involuntary rate was 4.1 percent. Blair noted that these rates are better than rates for broader professional services industries, where he said the voluntary turnover rate is “north of 13 percent,” and involuntary in the 6-8 percent range.

Again, a note on the presentation slide showing comparisons of overall turnover figures from the 2025 and 2024 surveys indicated that within the P/C sector, personal lines companies stood out from the rest of the respondents with the highest 12-month voluntary turnover rate at 11.3 percent, compared to commercial lines and balanced lines companies at 8.5 percent and 5.3 percent, respectively.

Overall, 12-month voluntary turnover was down from the prior-year survey which indicated a 9.3 percent rate vs. the 8.5 of the current report. “You tend to see voluntary turnover go down a bit, across industries and also in the insurance industry, when there are more unsure feelings about the market going forward from an employee standpoint,” Blair said, suggesting that uncertainty with respect to the economy is prompted people to stay put in their jobs.

As for employer-initiated job cuts, Rieder noted that the 4.1 percent 12-month involuntary turnover figure, which is stable compared to a 4.2 percent rate revealed in the prior survey, is actually double the more typical historical rates recorded in the survey back to 2005. “Normally, in most years that typically hovered around 1.5-2 percent,” Rieder said, offering two potential drivers. “One is more rigor around the performance management and expectations for employees. That has come up quite a bit, particularly in the virtual or hybrid work environments, [where] companies have seen certain employees perhaps not performing well in that environment.”

Rieder also noted that as companies have been making more improvements in their operational systems and processes, “they tend to find that that means [some] areas are candidly just overstaffed,” predicting that involuntary turnover will remain higher than the 20-year historical averages throughout 2025.

Blair added another possible driver: a surge of employment coming out of the pandemic. “It is only natural that we would find the new stasis point…There might have been some over-hiring, and that has led to some of this,” he said.

Rieder pointed to the huge spikes in revenue expectations in late 2021 and early 2022 to support the view. “Companies were expecting to grow and grow profitably,” he said. “That really probably hasn’t materialized to the way that they anticipated in 2021.”

Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut