While writing primary casualty insurance is more appealing than writing casualty reinsurance, the chief executive of Arch Capital said casualty reinsurance business remains attractive for his company.

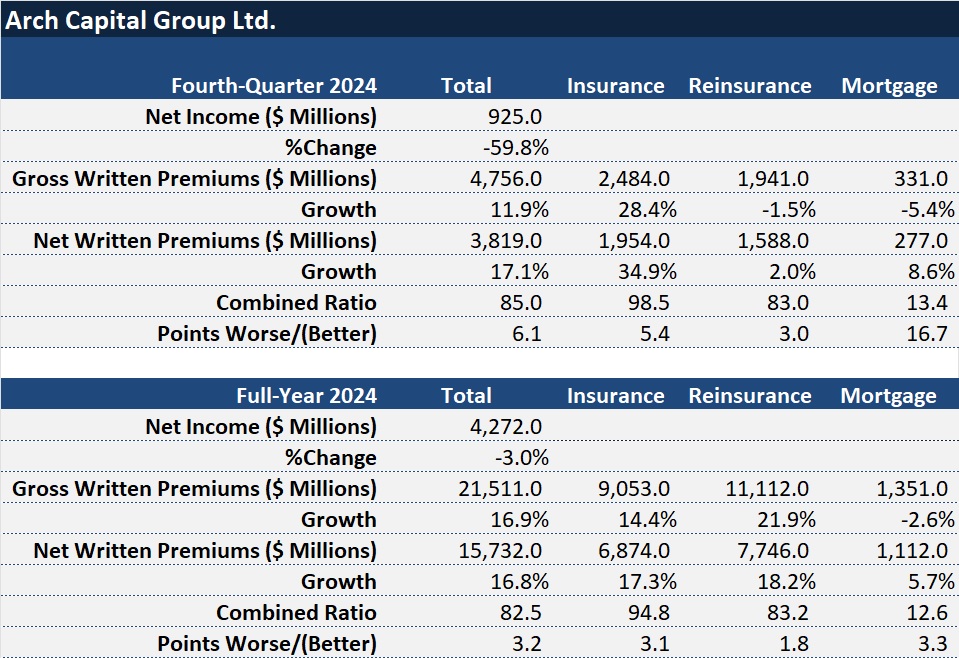

Speaking during an earnings conference call this week, after reporting $3.5 billion of after-tax operating income and an operating return of 18.9 percent for 2024, Nicolas Papadopoulo, Arch Capital’s chief executive officer responded to a question about his preference and about the state of the casualty reinsurance market in 2025.

Specifically, an analyst, following up on some opening remarks by Papadopoulo flagging liability business as a growth opportunity for Arch, asked whether the incremental supply of casualty reinsurance at 1/1 was higher than he might have expected. The analyst also asked whether ceding commissions to primary carriers for quota-share casualty reinsurance were too high.

“We’re hearing bubbles of people on the [earnings conference] calls saying that they don’t think it’s attractive,” he said, referring to casualty treaty reinsurance. “So hopefully they withdraw. But right now, I think there’s plenty of people willing to write the business,” with supply meeting demand, Papadopoulo said.

Among executives who expressed a negative view of the casualty reinsurance market recently was W. Robert Berkley, Jr., president and CEO of W.R. Berkley Corp.

“One of the things that’s been both surprising and, quite frankly, a bit disappointing to me has been how slow or sluggish the reinsurance market has been to respond to social inflation and some of the challenges. It is our suspicion that you are seeing a gradual groundswell that is building and we will see discipline coming to the casualty reinsurance market, hopefully over the coming months and years,” Berkley said, during his company’s earnings call in late January.

“We, as an organization, are unapologetic in the fact that we’re in business to make good risk-adjusted returns. We will write the business and lean into it when we think the margin is there. And we will have no qualms taking a more defensive posture when we don’t think the margin is there….We just don’t think that the [casualty reinsurance] market is exercising the discipline, and quite frankly is expecting an appropriate risk-adjusted return,” said Berkley explaining fourth-quarter and full-year premium declines for casualty reinsurance—the only line of business showing a decline on the specialty company’s books.

At Arch, where net premiums grew 17 percent in both the final quarter and the full year last year across all of its underwriting segments (insurance, reinsurance and mortgage) combined, casualty reinsurance and insurance grew faster. For the full year last year, casualty reinsurance net premiums grew 22 percent to $1.2 billion, while property-catastrophe reinsurance premiums grew just over 10 percent to $958 million. Reinsurance for other specialty and other property lines grew by just about the same amount at Arch—roughly 18 percent—although specialty reinsurance was the largest line of business with $2.8 billion in net premiums, about $600 million than non-cat property reinsurance.

On the primary insurance side, Arch Capital reported a 48.2 percent jump in premiums for the other liability occurrence line, with premiums landing at just over $1 billion for the year. While commercial multiple peril and commercial auto insurance net premiums were both under $0.5 billion, these lines too showed significant growth last year—with CMP premiums more than double the amount written in 2023 and commercial auto up 24 percent.

Much of the growth in these insurance lines is attributable to the $450 million acquisition of the MidCorp and Entertainment insurance businesses from Allianz Global Corporate & Specialty SE, announced in April last year but completed in August. Arch Capital reported that a 35 percent jump in net written insurance premiums reported for the fourth quarter would have been 7.7 percent, excluding the MCE acquisition premiums. When Arch first announced the acquisition last year, the company said the deal would expand its ability to “participate in underwriting-intensive middle-market lines.”

Related article: Arch to Buy Allianz’s Mid-Market, Entertainment Insurance Units for $450M

As for the question or reinsurance vs. insurance, during the Arch Capital earnings call this week, Papadopoulo said: “We are more bullish on the primary side today, on the E&S [insurance] side because we have a true expertise there. We underwrite the business one-by-one.”

So, if he were to compile a list of business opportunities, E&S casualty, he said, would be No. 1.

But casualty reinsurance isn’t all that far behind, he suggested. “There are good competitors of ours, people we admire or we hire underwriters from. Being able to support those people through our reinsurance team I think makes sense to me.”

As for ceding commissions, they will go down the day when reinsurers start “putting their foot on the ground and say, listen, I’m not going to write it unless the ceding commission is down 2 percent or 3 percent. We haven’t seen that. Even on the business that we place ourselves,” we haven’t seen that,” he said, seemingly referring to reinsurance Arch Capital buys for its own book. Getting higher rates and lower ceding commission will help reinsurers to justify writing casualty reinsurance business, he said.

In summary, “Yes, I think the commission may be a little high, but I think if you pick [cedents] that can outperform on the loss ratio, you may still be alright,” he said.

During his introductory remarks, Papadopoulo referenced differing appetites in the insurance and reinsurance markets, and flagged the areas of opportunity for Arch.

“Market conditions within our segments remained favorable with a number of select growth opportunities ahead of us,” he said. “As you may have heard from our peers this quarter, rate and loss trends vary by line of business and broadly offset each other.”

“All hands do not point to the same hour on the underwriting clock. For example, we are selectively deploying capital to the area producing attractive risk-adjusted returns, such as insurance and reinsurance liability lines, specialty business at Lloyd’s and property-cat reinsurance.”

“Alternatively, in lines of business where competitive pressures have eroded margin to levels [that are] below adequate, our underwriting teams are focused on improving our business mix within each of those lines to ensure our minimum profitability targets are met,” he said.

What are those lines where margins are eroding?

“The most visible one I would say is public D&O where I think we’ve seen a significant rate decrease in the last two years, in double-digits. That seems to be tempering, but… it reach[ed] a level that you really have to ask yourself account by account, is the overall line still profitable?”

The second area that Arch is watching is cyber, “where also, on the excess side, we’ve seen double-digit rate decreases,” he said, adding that the supply of capacity in both lines isn’t waning.

At Arch, premiums for other liability-claims made were relatively flat at $858 million for full-year 2024.

“Looking ahead, our primary goal is to maintain attractive margin[s] despite expected heightened competition,” Papadopoulo said in opening remarks. He also commented briefly on the Jan. 1 reinsurance renewal date. “We grew the reinsurance business by selectively increasing our writings in property, liability and specialty lines.”

“Arch Re’s status as a leading global reinsurer is a result of its focus on addressing broker and clients’ needs, combined with its underwriting vigilance and high degree of scrutiny on the performance of its business. Throughout the hard market, our teams [have] had the conviction to increase [Arch’s] support and relevance with brokers and clients, making Arch a more valuable collaborative partner when other reinsurers wavered, and in some cases even withdrew capacity,” he said.

Addressing the potential impact of the January 2025 California wildfires on Arch, the CEO led off the earnings call noting that the company expects a net loss between $450 million and $550 million based on an industry loss estimate of $35 billion to $45 billion.

Will there be a market impact from the fires at midyear, an analyst asked.

“We believe that a significant part of that [$45 billion of industry] losses will go to the reinsurance market….Most reinsurers, including ourselves, we start the year with a loss ratio in the 20s or the 30s or depending on your luck, maybe higher than that. So, [the wildfires] should damper the enthusiasm of a many markets trying to be heroes and writing the business. I would think that it will have an effect on the rates for the rest of the year,” Papadopoulo concluded.

Separately, offering the perspective of reinsurance buyers, executives speaking on a Mercury Insurance earning conference call this week said they had been expecting a flat-to-down 7/1 renewal before the wildfires ignited last month. But now a premium increase is likely, they said.

Related articles: Property-Cat Reinsurance Rates Will Stop Dropping Post-Wildfires: Execs; Mercury Sees Subro, Re Recoveries Cutting Most of $1.6B+ Wildfire Losses ;

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster