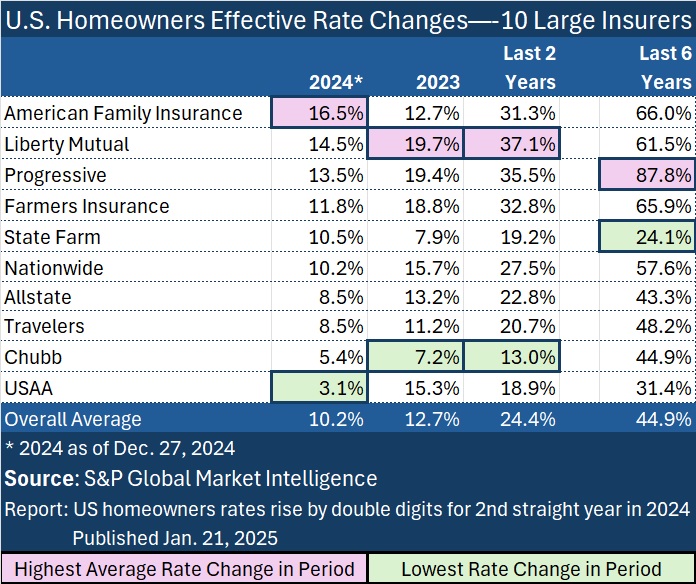

According to a new analysis of homeowners insurance rates, some Midwest states saw the biggest jumps in premiums last year—and American Family Insurance topped a list of 10 insurers ranked by average rate change.

The analysis published by S&P Global Market Intelligence this week is based on homeowners rate filings approved through Dec. 27, 2024—so not quite the whole year last year.

According to S&P GMI, the calculated weighted national average effective rate increase for homeowners insurance was 10.4 percent last year through late December. In 2023, the comparable figure was 12.7 percent, putting the two-year average increase at roughly 24 percent. (Source: “U.S. homeowners rates rise by double digits for 2nd straight year in 2024,” published Jan. 21, 2025 by S&P GMI)

The state for which S&P GMI calculated the biggest effective rate increases for 2024 was Nebraska with 22.7 percent. In total, 33 states had double-digit calculated effective rate increases last year, with rates in Montana, Iowa, Minnesota, Utah and Washington also rising more than 20 percent by S&P GMI’s calculations.

Minnesota and Iowa were also among the states with the highest direct loss ratios in 2023 (including defense costs), although Hawaii, Kentucky and Arkansas were worse.

On the other end of the spectrum, Florida had the lowest—at 1.0 percent—but the text of the report notes that Florida’s calculation does not include any changes by Citizens Property Insurance Corp., the state-backed insurer of last resort.

Related articles: State Farm Posts Worst HO Loss Ratio Since 2011; Peers Recover: S&P GMI ; Who’s Raising Homeowners Rates? S&P GMI’s Q2 2024 Analysis

For American Family, which raised rates in 42 states last year, the carrier’s three largest weighted-average rate increases occurred in Missouri (30.1 percent), Illinois (27.5 percent) and Nebraska (27.1 percent), the S&P GMI report says.

About the Analysis

Rating filing information for S&P GMI’s analysis was sourced from System for Electronic Rate and Form Filing documents. Loss ratio information is from the Exhibit of Premiums and losses of the NAIC P/C regulatory statements.

The S&P GMI analysis is limited to Owner Occupied Homeowners rate filings of each state’s 10 largest homeowner underwriters based on 2023 direct premiums written plus any of the country’s 10 largest homeowner underwriters outside the state’s top 10, excluding state-backed insurers of last resort like Citizens Property Insurance Corp. of Florida.

Mobile homes, rental and condo lines of business are also excluded.

The effective rate change is the average of the cumulative changes by renewal business effective date for each insurer weighted against respective calendar year direct premiums written reported within the NAIC P/C insurance regulatory statements.

The calculations are based on rate filings entered into the database through Dec. 27, 2024, for 49 states plus the District of Columbia. Wyoming was excluded because a limited number of rate filings were available within the database.

While the Wisconsin-based mutual insurer pushed rates up more than 31 percent, on average, countrywide in the last two years, the largest homeowner insurer, State Farm, ranks in the middle of the pack in terms of rate hikes with a two-year average increase of less than 20 percent across all states.

In fact, while the 10 insurers analyzed by S&P GMI increased homeowners rates by about 45 percent over the six-year period from 2019-2024, State Farm scored the lowest six-year jump at 24 percent.

Another mutual, Liberty Mutual, implemented the second-highest weighted-average rate change calculated by S&P GMI across the country, at 14.5 percent in 2024, and the largest two-year jump (of about 37 percent).

The text of the S&P GMI report, “U.S. homeowners rates rise by double digits for 2nd straight year in 2024, provides more information about the states in which Liberty Mutual, Progressive and Farmers boosted rates the most, and includes a state-by-state chart listing overall average rate changes for the 10 insurers combined for each of the years 2019-2024. Maps included in the report give a sense of relative rate changes and loss ratios for each of the states (excluding Wyoming for the rate changes due to limited data available).

Profitability Improves

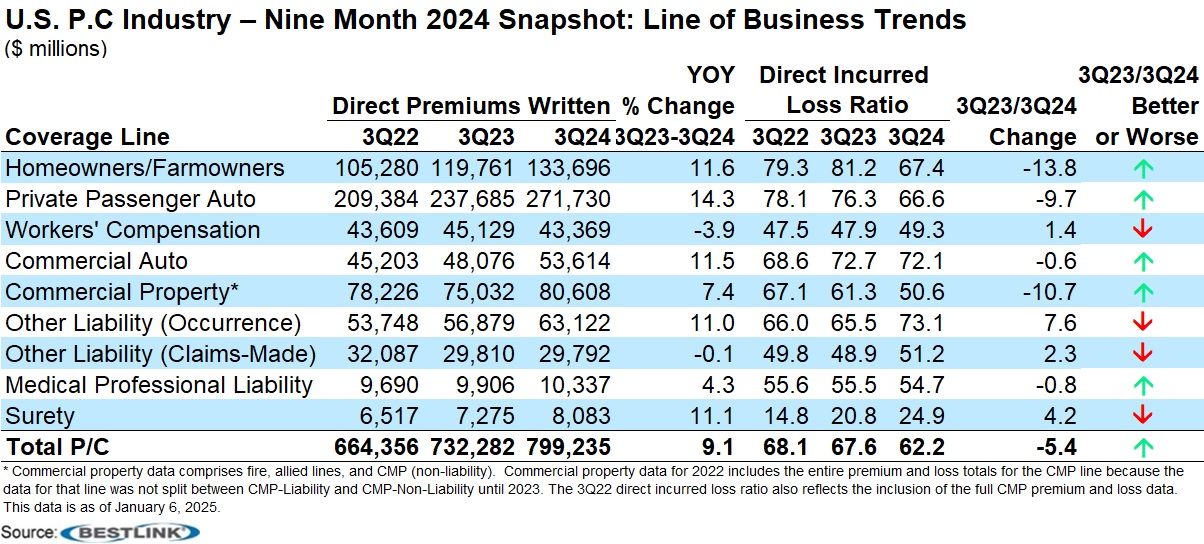

Separately, rating agency AM Best published an analysis of loss ratio changes by line through the first nine months of 2024, finding that homeowners was the most improved line, driven by an aggressive push for rates.

Overall, the homeowners loss ratio experienced a 13.8-point improvement during the first nine months of 2024, compared to the same period in 2023, according to the report titled “3Q24 Snapshot: Personal Lines Propels Improvement in Direct P/C Industry Underwriting Results, which summarizes data derived from U.S. P/C carriers’ third-quarter statutory statements (received and aggregated as of Jan. 6, 2025).

Across all lines, the loss ratio dropped 5.4 points, and AM Best said the significantly improved direct underwriting results were driven by increased earned premiums, which have outpaced the rise in incurred loss and loss adjustment expenses, and other underwriting expenses.

“The personal lines segment saw the most notable improvement, benefiting from an aggressive push for more adequate rates, pricing segmentation in personal auto, the impact of underwriting initiatives and improved catastrophe risk management practices,” AM Best said, noting that the improvement for the homeowners line came in spite of Hurricane Helene, which impacted third-quarter results.

David Blades, associate director, Industry Research and Analytics, AM Best, noted that although the nine-month results provide “optimism for full-year direct and net results, Hurricane Milton, which occurred in the fourth quarter, is expected to have a greater impact on homeowners and commercial property results than Helene.”

Commercial property was the second-most improved line in terms of underwriting profit, with the loss ratio for that line dropping 10.7 points.

Close behind, the personal auto segment’s direct loss ratio through third-quarter 2024 improved by nearly 10 percentage points and experienced an industry-leading 14 percent increase in direct premiums written.

Direct premiums written across the property/casualty industry were up by 9.1 percent compared with the same period in 2023, slightly below the 10.2 percent increase through third-quarter 2023.

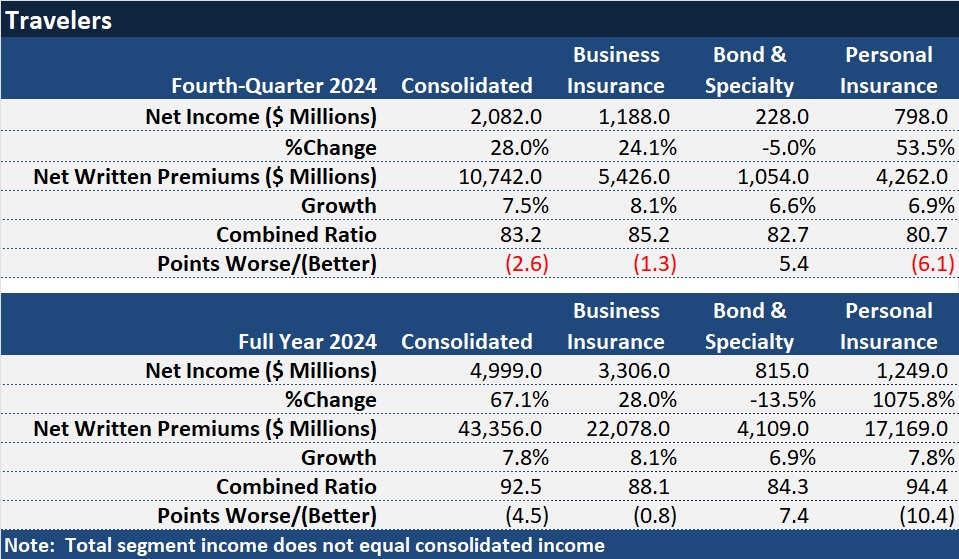

Earlier this week, Travelers, the first publicly traded insurer to announce full-year earnings, reported increased underwriting profits for the company overall, but the biggest combined ratio improvement was a 10.4 point year-over-year drop for its personal insurance segment (10.7 points for homeowners and 10.0 points for personal auto).

Travelers full-year combined ratio for the homeowners line landed at 93.9, in spite of more than 24 points of catastrophe losses. The carrier reported renewal premium changes averaging 14.1 percent in the fourth quarter of 2024.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs