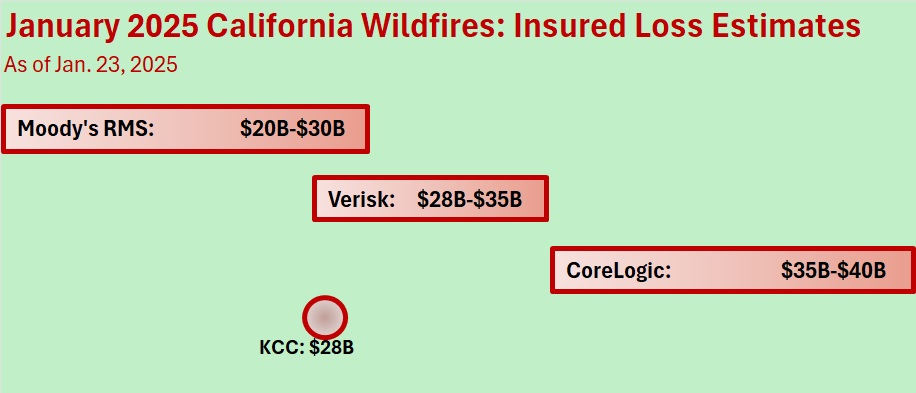

Risk modeler KCC has estimated that insured losses to residential, commercial and industrial properties, and autos from the Palisades and Eaton Fires will be close to $28 billion.

KCC’s estimate, which includes estimated losses to the California FAIR Plan, falls between previous ranges announced by Verisk, Moody’s RMS and CoreLogic.

Related articles:The Latest LA Wildfire Loss Estimates: Verisk’s Range Is $28B-$35B; Moody’s RMS Adds to LA Fires Insured Loss Estimates With Range of $20B-$30B ; Smoke, Coverage Issues Cloud Wildfire Forecast: $35-$45B Losses Insured

KCC’s estimate came as another fire, the Hughes fire, which started on Jan. 22, doubled in size—expanding to more than 10,000 acres. As of Thursday night, Cal Fire’s website reported that the Hughes fire was 36 percent contained. California government officials appearing on the Weather Channel said that the latest fire stood in contrast to the earlier fires because water and resources were more readily available for fire-fighting efforts.

The KCC, Verisk and Moody’s RMS estimates are for the two largest fires that started on Jan. 7 but also continued to burn on Thursday, although the Eaton Fire was 95 percent contained at that point. CoreLogic’s estimate encompasses five fires that started in early January.

The KCC flash estimate, based on the high-resolution KCC U.S. Wildfire Reference Model, includes estimates of losses for both private insurance and California FAIR plan policies, and covers damage from the fires, smoke, time-element losses for residents in evacuation zones whose homes were not damaged by the fire, guaranteed replacement cost coverage, and demand surge.

The KCC announcement noted that all these types of losses should be covered by typical insurance policies.

In a statement about the estimate, KCC called out the question of whether homeowners and business owners in the impacted areas had insurance coverage as a primary area of uncertainty. KCC has assumed that the majority of properties in the area are insured either privately or through the FAIR plan, but the $28 billion estimate contemplates a small percentage that are likely uninsured.

In explanatory notes about its range of estimates, Verisk also referred to the question of insurance take-up, noting that in recent months, multiple insurers have dropped policyholder coverage for wildfires or outright dropped customers altogether with significant fire risk, including many in Los Angeles County, leading to an increase in exposure covered by the California FAIR plan.

“In the Pacific Palisades, for example, about 15 percent of homeowners are on the FAIR plan, [and] this proportion is four times higher than it was in 2020.”

Commenting on another factor that impacting the ultimate loss values vs. modeled estimates, Verisk said that losses could exceed stated insured limits due to guaranteed replacement cost coverage. “Given rapidly increasing property values as well as the potential for increases in labor and material costs in the coming months, these coverages could kick in to further exacerbate insured losses. Likewise, if older structures requiring rebuilding will have to be brought up to current building codes, Ordinance or Law coverage will kick in and could again drive losses higher,” Verisk said, noting that these factors are not explicitly included in the Verisk loss estimates.

In its estimate summary, Verisk also addressed a questions that been raised several times in recent weeks: Are the Palisades and Eaton fires a single event, or two distinct events?

Verisk Property Claims Services (PCS) has designated each of the Palisades and Eaton fires as separate catastrophe events, the summary stated. “This opens the possibility for insurers and other market participants to follow suit,” Verisk said, going on to note that Mercury General (not named by Verisk but instead identified as a California insurer) is considering this for the purposes of calculating reinsurance recoveries from the fires.

Related article: Mercury General Gives Reinsurance Update: One or Two Events Still TBD

“[M]ore generally speaking, the way these fires get defined as an event could have a notable impact on the split of losses between private insurers and the reinsurance market,” Verisk said.

Preparing for an AI Native Future

Preparing for an AI Native Future  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation