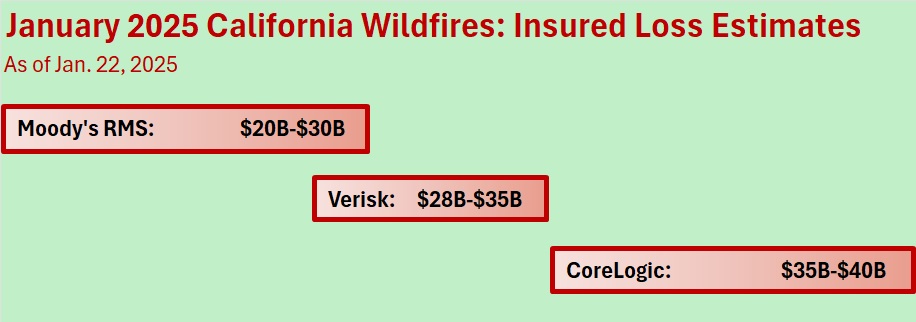

The Extreme Event Solutions group at Verisk has estimated that insured industry losses to property for the Palisades and Eaton fires together will fall between $28 billion and $35 billion.

Verisk’s estimate, which includes estimated losses to the California FAIR Plan, falls between previous ranges announced by Moody’s RMS and CoreLogic last week.

Related articles: Moody’s RMS Adds to LA Fires Insured Loss Estimates With Range of $20B-$30B ; Smoke, Coverage Issues Cloud Wildfire Forecast: $35-$45B Losses Insured

Verisk’s estimates came in as the two major fires, which started on Jan. 7, 2025, continued to burn. Cal Fire’s website reported that the Palisades Fire was 68 percent contained and the Eaton Fire, 91 percent, at the time Verisk’s estimates were being announced on Jan. 22.

Verisk said the estimated range encompasses losses to residential, commercial and industrial properties and automobiles for their building, contents and time element coverages, and accounts for demand surge, debris removal and estimated insured take-up rates.

Given the large number of structures destroyed by the Paradise and Eaton fires, necessitating complete rebuilding, “it is likely that losses stemming from debris removal coverage will be non-trivial,” Verisk said in a media statement.

For the demand surge analysis, Verisk used historical construction cost data for the Los Angeles area (Los Angeles County and Santa Barbara County), accessing Verisk’s 360Value Quarterly Residential Replacement Cost Index (seasonally adjusted).

Unlike the earlier estimates announced by CoreLogic and Moody’s RMS, Verisk’s loss estimates do not include losses from smoke damage.

Also contrasting the Moody’s RMS estimate, Verisk’s estimate is for the Palisades and Eaton fires only—between $20 billion and $25 billion for the Palisades fire, between $8 billion and $10 billion for the Eaton fire—not for the Hurst or other fires occurring in January 2025

Most of the estimated losses are to residential risks, Verisk said.

Verisk also specified that its estimates do not include allowances for the impacts of social inflation, losses from guaranteed replacement cost coverage, losses to infrastructure, extra-contractual obligations, law and ordinance expenses, or losses from hazardous waste cleanup, vandalism or civil commotion, whether directly or indirectly caused by the event. Loss adjustment expenses are also excluded.

Moody’s RMS said that its estimates contemplate “a wide range of complex factors around reconstruction costs after the wildfires including cleanup, costs associated with permit fees, code improvements, and potential law and ordinance expenses.”

Separately, on Wednesday morning, executives of Travelers, the first publicly traded insurer to report fourth-quarter 2024 earnings, said it was too early to provide estimates of the impact of the wildfires on the carrier during a conference call. “We’d like to take more time to refine our analysis before providing an estimate,” Chief Financial Officer Dan Frey told analysts, adding that the impact would be “material” for the industry, and that the wildfire losses “will have a material impact on our first-quarter earnings.”

Several analysts tried to get some better sense of the magnitude of that first-quarter impact with questions about the value of properties Travelers wrote in the affected area and the breadth of policies (full coverage for wildfires or difference in conditions coverage). One finally asked directly whether using Travelers’ statewide market share could get her close to a number.

That is a “pretty blunt instrument,” said Chief Executive Officer Alan Schnitzer, noting first that any estimate derived by applied Travelers California market share to an estimate of insured losses for the industry overall is “obviously pretty sensitive” to the latter. Industrywide estimates are “going to develop over time,” he noted.

In addition, “when it comes to market share, the publicly available market share is dated information,” he stressed. “It doesn’t reflect actions we or others have taken to manage exposure, and it doesn’t reflect any differences that might exist between local market share and statewide market share.”

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market