There has been some question about whether California’s insurer of last resort – the FAIR Plan – has enough cash on hand to pay for its share of wildfire claims. As surplus is inadequate and reinsurance has a deductible that exceeds available cash, an industry assessment is inevitable, a Fitch analyst confirms.

FAIR Plan doesn’t have enough surplus for this level of fire loss — the biggest California wildfire loss to date, said Gerald Glombicki, senior director at Fitch Ratings in an interview with Insurance Journal.

This means that insurers writing business in California ultimately will have to bolster FAIR Plan’s financial position, as will homeowners across the state.

Nearly a year ago, FAIR Plan had $336 billion of property exposure with surplus of just $200 million, and $700 million of cash on hand, said Victoria Roach, who testified before the California Assembly Insurance Oversight Committee on March 13. (Editor’s note: Current figures for this year cannot be confirmed).

According to FAIR Plan statistics, it has $5.9 billion of exposure to the Pacific Palisades (where the fires are raging) — its fifth highest wildfire exposure concentration.

By September, FAIR had listed its property exposure as $458 billion, a 61% increase from the previous year. While the total amount of claims the FAIR Plan will face are still undetermined, the overall industry insured price tag could hit $30 billion-$40 billion with economic losses of $150 billion to $275 billion, analysts estimate.

Los Angeles Fires Become Existential Test for California’s Stopgap Insurer

“As of September 30, 2024, California FAIR Plan exposure in Los Angeles County was US$112.2 billion with a year-over-year growth of 53%. Los Angeles County exposure represents approximately 23.1% of the entire California FAIR plan portfolio,” according to a blog written by Firas Saleh, director of product management at Moody’s.

In March of 2024, FAIR Plan — known formally as Fair Access to Insurance Requirements (FAIR) Plan — had a surplus of only $200 million and it likely hasn’t risen to sufficient levels in the subsequent year.

“You can never go below your surplus level. If you do, you need an assessment or you’re bankrupt,” according to Glombicki.

How does the assessment work? Glombicki explained that the insurance companies would get assessed a certain figure. If the assessment is $1 billion or less, insurance companies can only pass on 50% to their clients, he said. “However, 100% of the first dollar (and up) after $1 billion can be passed along.”

He pointed to a problem with the assessments, which all California homeowners insurers must pay. “You won’t be necessarily in a fire zone, but you can be paying for that risk of being in the fire zone.”

Another problem for the FAIR Plan is that there could be a reinsurance protection gap.

“FAIR Plan’s $2.5 billion reinsurance has a deductible of $900 million, higher than the $700 million cash on hand, which is quite crazy when one thinks about it,” said one analyst who didn’t want to be identified.

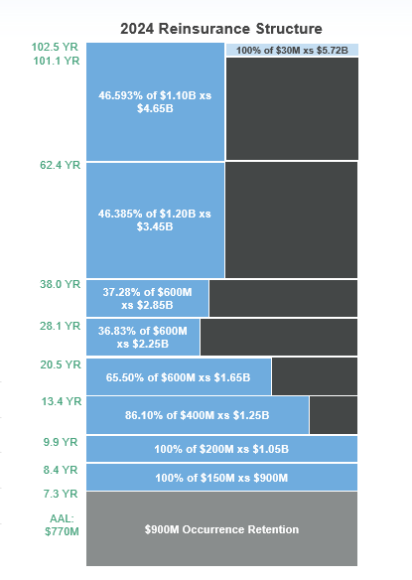

According to Gallagher Re, FAIR Plan’s reinsurance structure details follow:

- $900 million per occurrence retention,

- Total reinsurance limit is $2.6 billion,

- Tower exhausts at $5.75 billion, which is the 102-year modeled return period.

Glombicki explained that as a result of the structure of the reinsurance tower (see graphic above), FAIR Plan pays co-insurance throughout the $4.85 billion limit. External coverage comes to $2.63 billion. In other words, FAIR Plan shares the loss in the tower as well. (Editor’s note: the co-pays are shown in the graphic as the dark gray boxes on the right-hand side).

Exponential Growth

The FAIR Plan policy count has increased by 35% in the 12 months ending Sept. 30 to over 450,000. Why has there been such a large level of growth? Higher losses and regulatory pricing restrictions led many primary insurers to reduce their exposure to the California homeowners’ market or exit the state altogether.

Insurers that operate in the state will contribute to the FAIR Plan based on market share, which helps spread the risk of high-loss events, said Fitch Ratings in its commentary titled “Property Casualty (Re)Insurance Ratings Not Affected by California Fires,” published on Jan. 13. “Large catastrophic losses can strain the financial resources of the FAIR Plan, potentially leading to assessments or surcharges on participating insurers to cover deficits.”

Such large losses can lead to increased premiums or reduced coverage in the private market “as insurers adjust to offset their increased liabilities from FAIR Plan contributions,” the Fitch report continued.

“The long-term goal is to reduce the FAIR Plan’s market share, where policies are underwritten due to high-risk factors, such as wildfires. Coverage is capped at $3 million per policy, which can be inadequate to cover replacement costs,” Fitch continued. “Reduction of FAIR market share will only be successful if private insurers are not restricted from adequately pricing for wildfire risk.”

Recent regulation in the state aims to increase participation within the admitted market.

“Per recently issued regulation, major insurance companies must increase the writing of comprehensive policies in wildfire-distressed areas equivalent to no less than 85% of their statewide market share, whereas there had not been legal requirement for insurers to commit to providing any coverage in high-risk areas,” Fitch explained, noting that smaller and regional insurance companies must also increase their writing.

Further, the California insurance commissioner issued a mandatory one-year moratorium, effective Jan. 7, 2025, on insurance non-renewals and cancellations for homeowners’ insurance within or adjoining the ZIP Codes of the Palisades and Eaton fires in Los Angeles County regardless of loss, said Fitch.

“In exchange for increasing coverage, the state will let insurance companies pass on the costs of reinsurance to policyholders. Previously, California was the only state that didn’t allow the cost of reinsurance to be borne by policyholders.”

There may be some relief ahead for homeowners as well as the state’s insurers. On Jan. 9, a bill was introduced that aims to assist in issuing catastrophe bonds and help finance the costs of insurance claims, increasing the claims-paying capacity of the FAIR Plan.

The FAIR Plan Stabilization Act (Assembly Bill 226) authorizes the FAIR Plan to request the California Infrastructure and Economic Development Bank “to issue bonds if the FAIR Plan faces liquidity challenges in the event of a major catastrophe such as a wildfire.”

Glombicki said the bond scheme might work in terms of delaying the assessment on insurers. The question is the timing and how quickly can FAIR Plan get those funds if a bond is issued. “I’m not saying it’s impossible; it’s just the timing of doing that becomes more problematic, whereas an assessment is immediate.”

However, even the assessments take time because they would occur when homeowners renew their policies, he explained.

Photograph: A home burns in the Eaton Fire in Altadena, Calif., Jan. 8, 2025. (AP Photo/Nic Coury, File)

Related:

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash