Industry analysts’ early estimates of insurance industry losses for the January 2025 California wildfires have already grown from $8 billion to $40 billion-plus—with many noting that it’s too early for precision in the numbers.

In short, whether they were calculated with reference to insured loss totals from massive fires in past years, or based on preliminary exposures counts for this year’s fires, most loss forecasts will be wrong.

Will they ultimately prove to be too high or too low?

Andrew Siffert, senior meteorologist for specialist insurance and reinsurance broker BMS Group, provided a thoughtful analysis in a Wildfire Update posted on the group’s website earlier this week. (Source: BMS | BMS Wildfires Update 01/14/2025).

First he noted that simple base estimates are derived by multiplying the number of reported damaged or destroyed structures—roughly 7,000 from the Eaton fire and 5,000 from the Palisades Fire—by estimated average residential replacement values in each area—roughly $1 million for Eaton and over $2 million in the Malibu and Pacific Palisades areas.

The result is a back-of-the-envelope guess of $17 billion.

Going on to opine that insurance losses from these events will likely surpass $25 billion, Siffert pointed to these factors, among others, that could push losses higher:

- A high amount of additional living expense insurance payments could be associated with the fires.

- “Hyper-demand surges” in labor and materials are likely “in an already expensive area of the country.”

- Adjusters will be at a premium.

- Litigation from claim disputes could add to loss adjustment expenses.

- Smoke damage may impact structures outside the wildfire perimeters, adding to losses.

- Disaster recovery can take years, with required permits among items that take time. Also, there’s extra effort needed to understand designs—and replacement costs—of custom-built and high-value homes.

There has been some movement already to speed up recovery efforts. On Tuesday, the American Property Casualty Insurance Association praised an Executive Order signed by California Governor Gavin Newsom to suspend certain building requirements under the California Environmental Quality Act and the California Coastal Act, for homes destroyed by the Los Angeles wildfires.

The order applies to repair and replacement properties in “substantially the same location as, and do not exceed 110 percent of the footprint and height of, properties and facilities that were legally established and existed” before, according to the language of the order.

“Gov. Newsom’s decision is the kind of action that will need to take place in the coming weeks and months to bring Los Angeles back,” APCIA said, noting that the order will help impacted communities.

Working in the other direction, Siffert mentioned the upcoming FIFA World Cup 2026 and Olympics 2028 among the other potential loss-amplifying factors, noting a possible strain on the supply of skilled workers in advance of these events.

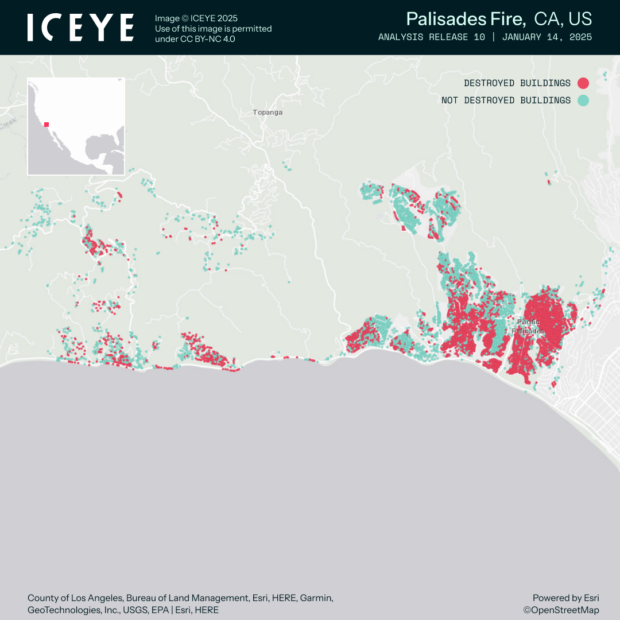

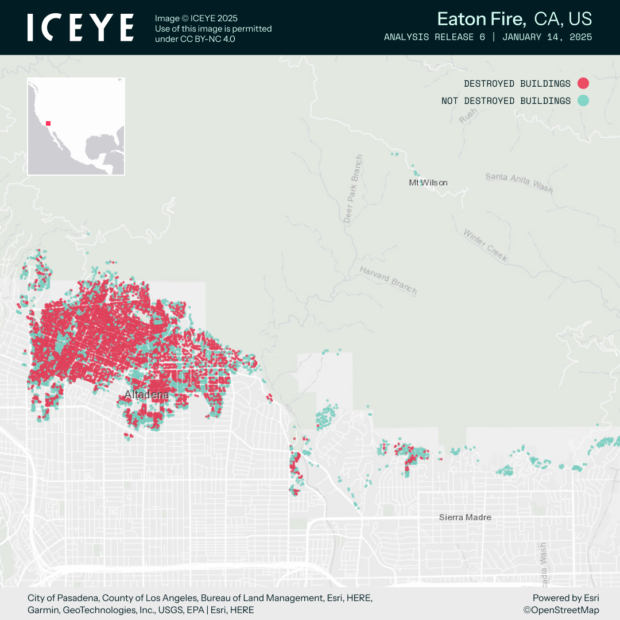

Supporting the components of Siffert’s base calculation, ICEYE, a provider of SAR (synthetic aperture radar) satellite data, shared this high-level analysis of damage with the media on Jan. 15, based on images from the day before:

- Palisades Fire: Likely more than 4,600 buildings destroyed. Fire less than 20 percent contained.

- Eaton Fire: Likely more than 6,700 buildings destroyed. Fire roughly 35 percent contained.

- Hurst Fire: Likely no buildings destroyed. Fire over 95 percent contained

Story continues below graphics. (Click to expand)

Most estimates reported so far have come from investment analysts covering the P/C insurance space, but on Monday, Jan. 13, catastrophe modeler Verisk estimated that there is more than $27 billion in total insurable exposure within the perimeters of the Palisades ($20 billion) and Eaton ($7 billion) fires. (Source: Verisk Event Alert: Southern California Fires – January 13 Update)

Related articles: Insured Losses From Los Angeles Wildfires Rising: $8B to $20B ; Update: LA Wildfire Insurance-Loss Estimates Approach $40 Billion

“While the definition of a ‘structure’ could mean several things, from a shed or outbuilding to a residence or a business, given high average property values in this area (Verisk estimates average residential replacement values in Altadena to be about $1 million, and exceeding $2 million in both Malibu and Pacific Palisades), these are likely to be among the costliest fires in U.S. history,” the publicly available alert states.

Another wrinkle: Vehicles may be included in some counts of damaged structures, a recent Associated Press article noted. (Related article: Are Cars ‘Structures’? Tallying the Damage from the Los Angeles Wildfires)

Verisk’s latest alert supersedes a very preliminary statement last week in which the cat modeler had indicated that there was at least $15 billion of insurable exposures lying within the perimeter of one of the fires—the Palisades fire—referencing perimeter information from the National Interagency Fire Center as of Thursday, Jan. 9. (Source: Verisk Event Alert: Southern California Fires – January 9 Update)

Separately, risk modeler CoreLogic, in a Jan. 14 update on the fires posted on its website, reported that as of Jan. 13, there were an estimated 16,636 properties within the fire perimeters of the Eaton and Palisades Fires, with a total reconstruction cost of $13.1 billion. (Source: “Devastating Wildfires Continue Burning in Southern California | CoreLogic®, Jan. 14 update)

“Note that not all properties within the fire perimeter are necessarily damaged by fire. Additionally, properties that are impacted may not have sustained damage equal to their full reconstruction cost value,” CoreLogic said.

There are other reasons that insured losses might ultimately turn out to be lower than some the estimates being reported this week, Siffert noted. Among them:

- Some structures may be paid off and self-insured.

- The California FAIR Plan only pays a maximum of $3 million on residential policies, which raised the question of how much loss is covered above this.

- There may be structures that were undervalued

“The event is still ongoing, and the fires are far from contained, with higher winds forecasted over the next couple of days,” Siffert added, underscoring the idea that it is still “too early to provide any credible loss estimate.”

Siffert’s report went beyond a discussion of potential deficiencies in early loss estimates, beginning with a detailed discussion of the role of the “katabatic,” or downhill-blowing, winds known as the Santa Ana winds in fueling Southern California wildfires.

Historical accounts trace their impact back to the earliest habitation of the region by the Native American peoples, he wrote. “While the winds are predictable up to a week in advance, their timing and frequency have shifted slightly, with recent research noting an increase in events during December and January,” he noted in a LinkedIn post about the report.

While investigations of ignition sources for the Palisades and Eaton fires are under investigation (with some reports pointing to a rekindling of an earlier fire from human causes sparking the Palisades conflagration and an electrical transmission tower as the Eaton fire source), the winds played a role in strengthening the fires. “If you’re a camper, you know if the fire is about to die and you blow on the flames, the fire often gets more intense as the wind fuels the fire beyond controllable levels,” Siffert wrote.

Featured image: Wildfire in Los Angeles area, using ICEYE’s wildfire analysis from January 14th, 2025.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market