Insurers are facing significant losses from the catastrophic Los Angeles wildfires—given the high value of homes and businesses in the affected communities. However, those losses are likely to be manageable for both insurers and their reinsurers, with preliminary estimates ranging from $10 billion to $15 billion, according to S&P Global Ratings, quoting reports from third parties.

“Significant wildfire losses in the first two weeks of 2025 could rapidly deplete the catastrophe budgets of U.S. primary insurers. This early strain may lead to earnings pressure later in the year, especially if 2025 proves to be above-average for catastrophes,” S&P said in its report, titled “Insurers Can Absorb Losses Amid Escalating Los Angeles Wildfires.”

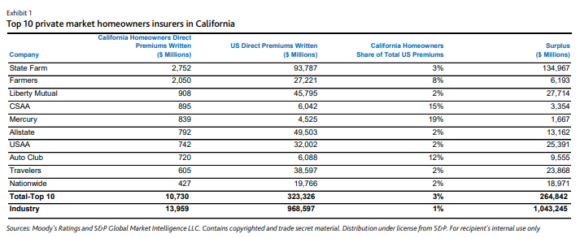

“Although expected losses are steep, we believe many of our rated insurers have the capital resilience to absorb them, after strong results in the first nine months of 2024 (and likely for the year),” S&P continued. “Moreover, many major primary insurers in the admitted market, such as State Farm Mutual, Automobile Insurance Co., Allstate Corp., and Hartford Financial Services Group Inc., have either reduced exposure to or exited the California homeowners insurance market over the past two years.”

Update: Hartford subsequently issued a comment about the S&P report: “California is and continues to be an important market to The Hartford. We stopped offering new homeowners, renters and condo policies on Feb. 1, 2024, in consideration, and after analysis, of the unique challenges and dynamics at play in the state. We need to be able to price our homeowners, renters and condo insurance appropriately for the risks we are protecting against. Lastly, we continue to write all our other existing products in California, such as business insurance and personal auto, and will continue to renew existing homeowners’, renters’ and condo policies consistent with our underwriting guidelines.”

In its report on the LA wildfires, Moody’s Ratings explained that after the major wildfires of 2017-2018, many California homeowners insurers nonrenewed policies, “particularly in wildland-urban interface (WUI) regions, while enhancing underwriting standards, conducting inspections, requiring homeowners to take steps to reduce wildfire risk and reducing geographic clustering.”

S&P does not expect the LA wildfires to trigger rating changes.

For the nonadmitted sector, S&P said, the $3.6 billion written in the excess and surplus (E&S) property market in California is relatively small. “These E&S specialty insurers are generally highly diversified and can quickly raise premiums to recuperate

losses.”

Moody’s noted that it will take weeks or months to determine the magnitude of the insured damages, but the Los Angeles wildfires are likely among the most costly wildfires in the state’s history.

J.P. Morgan doubled its forecast of insured losses to more than $20 billion, while Wells Fargo also expects similar insured losses and estimated that total economic costs would rise well above $60 billion, Reuters reports.

“Already the most destructive wildfire event in Los Angeles County history, certainly now in the top three deadliest fires in the state, and potentially the costliest in U.S. history, it is hard to keep up with the latest extent of the destruction from now six separate wildfires,” according to Firas Saleh, director-North American Wildfire Models, Moody’s, in a blog that summarizes the historic nature of the wildfires. (Editor’s note: The death toll from the wildfires has risen to 24).

Reinsurance Impact

At the same time, S&P said the impact on its rated global reinsurers will also be manageable “with no significant effect on earnings due to the event’s magnitude and timing.”

The wildfire represents the first major natural catastrophe loss in the year for the sector and losses are likely to will stay within reinsurers’ natural catastrophe budgets for the first quarter of 2025, S&P said. “However, it is still unclear how aggregate reinsurance coverage could be affected, given this will depend on developments over the remainder of the year.”

Reinsurers are entering 2025 with robust capitalization that is supported by strong earnings in 2023 and 2024, “which helped the industry’s returns to exceed its cost of capital,” S&P said.

“The reinsurance sector remains disciplined regarding its appetite for frequency losses, maintaining high attachment points for coverage,” the ratings agency said, noting that, despite selective price decreases during the January renewals, the sector remained committed to defending terms and conditions and those higher attachments.

Higher Attachments

There’s no question that this event will impact reinsurers – but at a manageable level, commented economist Robert Hartwig, a clinical associate professor of finance and insurance at the University of South Carolina, and head of the university’s Risk and Uncertainty Management Center, in an interview.

This wildfire event is highly concentrated, geographically, and is highly concentrated in terms of the timeframe, which is “precisely what reinsurance is designed for,” he said. “So it’s the type of event that’s likely to penetrate into reinsurance – even with higher retentions – although not as much as in the past when retentions were lower.”

Hartwig noted that there will be a greater effect on reinsurers from an event of this magnitude than from an entire summer’s worth of severe convective storm events, which add up to the same dollar amount. “And in each one of those cases, the impact on reinsurers would’ve been mitigated by the higher attachments.”

California Market in Brief

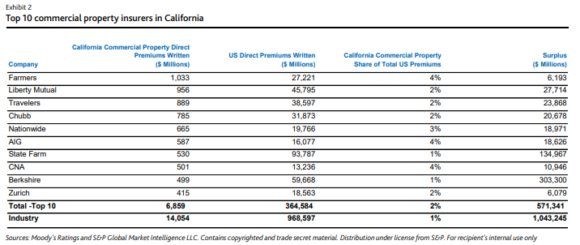

Moody’s Ratings said that losses will be shared among standard homeowners insurers, insurers specializing in high-value excess and surplus lines (E&S) homeowners policies, the California FAIR Plan and commercial property insurers. “Reinsurers will also assume losses through quota share, per-risk and excess of loss contracts,” Moody’s said in its report, titled “Insurers face large losses from devastating Los Angeles wildfires.”

“The allocation of losses among insurers will depend on their market share for the affected areas, which may differ from market share in the state,” Moody’s continued. “Insurers manage their wildfire exposures through geographic diversification, high quality reinsurance protection and solid capital bases.”

California’s FAIR Plan, the state’s insurer of last resort, has grown rapidly in recent years for homeowners and businesses that have been unable to obtain coverage in the private market. Moody’s said this was a situation that was exacerbated when California homeowners insurers nonrenewed policies after the major wildfires of 2017-2018.

Insurers still bear the costs from these policies, said Moody’s because the FAIR Plan “is a syndicated fire insurance pool comprising P&C insurers licensed to write business in California.”

“Insurers are required to participate in the FAIR Plan losses in direct proportion to a company’s market share. Pacific Palisades is California FAIR Plan’s fifth highest wildfire exposure concentration, with about $5.9 billion of exposure,” the Moody’s report continued.

New Regulatory Regime

In a separate report, AM Best noted that California recently implemented regulations that would allow the cost of reinsurance to be a factor in pricing, while also permitting the use of catastrophe models to account for mitigation efforts by homeowners, businesses, and communities. AM Best’s report is titled “Expanding California Wildfires Expected to Incur Large Insured Losses.”

“[T]he risk of wildfire is very high and very persistent and the effectiveness of the program in reducing insured losses will boil down to affordability and the availability of appropriate coverage,” AM Best said, noting that there may be challenges with respect to affordability, depending on the magnitude of the loss.

Previously, California was the only state to block the use of these factors in insurers’ pricing, but that changed in January 2025, said Hartwig. “Insurers now will be allowed to use forward-looking climate-based models and incorporate those in their rates. The quid pro quo is that insurers would begin to write again in the state, or would expand their writings.”

However, there is general concern that this event could potentially set back the intent of the new regulatory regime, Hartwig said, explaining that this is going to be one of the most costly fires in California history, and it’s just the second week of January.

Insurers may end up filing for rate increases for homeowners and commercial property renewals, effective in 2026, that are larger than what had been anticipated, he added.

Moody’s acknowledged that it will take time to determine how this legislation and the pending wildfire losses will affect the California homeowners insurance market.

S&P said the LA wildfires potentially compare with insured losses experienced in the North California wildfires of 2017 (Tubbs Fire) and in 2018 (Camp Fire), which cost the industry nearly $16 billion and $14 billion, respectively.

The conundrum for insurers is that the January fires are occurring during what should be the California’s rainy season, Hartwig said. “Essentially, the wildfire season of 2024 never ended.”

“Winter is generally the rainy season for Southern California, which makes wildfires in January relatively rare,” Moody’s said. “However, this winter has been unusually dry. Efforts to fight the Palisades wildfire have reportedly been stymied by limited water supply and low pressure for fire hydrants.”

(Editor’s note: Moody’s said its analysis comes from Moody’s Ratings credit rating agency, and does not represent Moody’s official estimates for insured losses, or for economic losses/property damage. Those estimates, which are not provided by the ratings agency, will be shared by Moody’s at a later date.)

Featured image: Water is dropped by helicopter on the burning Sunset Fire in the Hollywood Hills section of Los Angeles, Wednesday, Jan. 8, 2025. (AP Photo/Ethan Swope)

Related:

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster