Global reinsurers’ appetite rose for property catastrophe during the upcoming January renewals, which have seen risk-adjusted reinsurance rate reductions of 5-15 percent for loss-free accounts, according to a renewal report published by Guy Carpenter, the reinsurance business of Marsh McLennan.

Property catastrophe renewals were consistently oversubscribed as reinsurer appetite increased by 10-15 percent, while Guy Carpenter estimated that demand only increased by approximately 5 percent.

There was a range of pricing outcomes, which varied by region, attachment point and reinsurers’ views of price adequacy, said the report titled “Strong reinsurer appetite drives excess property catastrophe capacity at January 1.”

In contrast to the broader property catastrophe market, loss-affected layers saw adequate capacity with risk-adjusted rates from flat to 30 percent increases in regions such as the U.S., Europe and Canada, Guy Carpenter added.

Related article: Broker Exec Decodes Property Reinsurer Speak: ‘We Want to Grow’

Activity in the 144A catastrophe bond market remained robust at year end, with 67 different catastrophe bonds brought to the market for approximately $17 billion in limit placed in 2024, the report said.

Rate reductions and additional capacity reflect strong reinsurer appetite that has been driven by:

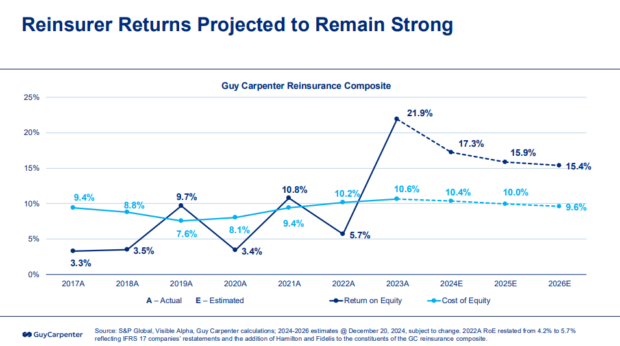

- Another profitable year in 2024, featuring projected average reinsurer returns on equity of 17.3 percent.

- Total dedicated reinsurance capital increasing by 6.9 percent to $607 billion.

- Continued reinsurer discipline around property catastrophe program attachment points and pricing.

- Meaningful cedent actions to improve underlying portfolio profitability (rate improvement, limit management and disciplined risk selection).

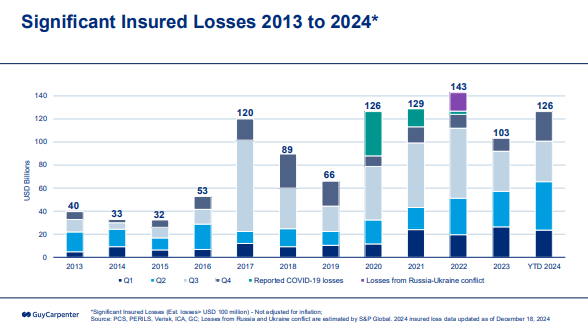

Guy Carpenter noted that higher attachment points have significantly benefited reinsurers’ results. “In 2024, global industry catastrophe losses reached nearly $130 billion, with the estimated reinsured share of these losses falling to 14 percent, down from the pre-2023 average of 20 percent,” the broker said.

“Given the increased catastrophe attachment points of recent renewals, supplemental purchases, such as frequency protection and other retention buydown options, play an important role in bringing balance to the market and ensuring reinsurance is impactful on cedent capital and volatility management,” it continued.

Casualty Reinsurance Renewals

Guy Carpenter noted that casualty reinsurance programs were an area of continuing market concern, and, as a result, year-end renewals were completed with varying outcomes.

Proportional casualty structures generally experienced ceding commissions that were flat to slightly down, the report said, noting, however, that excess of loss general liability and excess/umbrella placements continued to face pressure on treaty terms.

“Like with property catastrophe programs, cedents considered the value of casualty reinsurance by weighing cost and structure options,” Guy Carpenter said in the report.

By providing additional claims, rate, and exposure data, clients were able to increase transparency and distinguish their portfolios, which allowed reinsurers to gain comfort with treaty terms, Guy Carpenter said.

Addressing the cyber reinsurance market renewals, Guy Carpenter said, with buyers explored a range of blended solutions, from pro rata to event excess of loss and aggregate stop loss structures.

Source: Guy Carpenter

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes