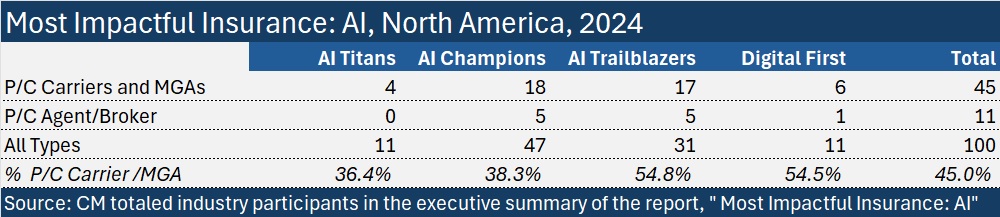

A research firm has identified 100 insurance industry participants that are making a difference with artificial intelligence, including four insurance carriers with property/casualty insurance operations that the firm characterizes as “AI Titans.”

Most Impactful, a proprietary research initiative measuring business effectiveness of firms in the financial services ecosystem, has named Allstate, Nationwide, Travelers and USAA among 11 insurance companies and distributors whose investments in AI technology and talent outpace peers.

“These insurance firms make substantial AI/ML investments in absolute dollar terms. AI Titans file AI/ML patents, offer a comprehensive range of products, and have strong partnerships with global tech giants at the forefront of AI/ML,” says the report, “Most Impactful Insurance: AI.” In addition, Titans employ large workforces “with relevant expertise in AI/ML, build multiple products themselves and experiment with leading-edge use cases.”

Rather than relying on companies to nominate themselves, Most Impactful set out to objectively measure the AI impact of individual insurance industry participants, using a combination of publicly available metrics and proprietary algorithms to identify 100 companies using traditional AI or generative AI impactfully, and then to group the 100 leaders into four categories: AI Titans, AI Champions, AI Trailblazers and Digital First companies.

More specifically, an executive summary of the report notes that the researchers started with a group of 500 selected through a broad screening from all North American insurance firms and then cut those down to 100 honorees by evaluating the 500 across six key dimensions:

- Spending.

- Initiatives in Production.

- Vendor Relationships.

- Patents Filed.

- Executive Commitment.

- Human Capital.

In comparison to AI Titans, AI Champions, making up almost half of the 100 honorees, spend more modestly in absolute terms on AI/ML. But they devote a relatively high amount of their technology spend to AI. Products like fraud detection, claims processing automation, and chatbots are seen among these champions, 18 of which are P/C carriers (by Carrier Management’s count of the companies displayed across categories in the summary report). Champions advance AI initiatives by forming partnerships with established AI tech companies, and “lacking the bulk of the AI Titans,” their AI/ML workforces are moderately sized, the text of the executive summary notes.

Flipping through the pages of the summary, Carrier Management noted that P/C insurance carriers make up more than 50 percent of the two remaining categories: AI Trailblazers, described as smaller carriers “punching above their weight actively hiring C-level leaders to drive technology strategy” and to innovate; and the Digital First InsurTechs, where technology is the key ingredient in the people-process-technology trio of AI impact factors.

P/C insurers, however, are underrepresented among Titans and Champions.

“Health companies were particularly well represented in the Titans and Champions categories, largely due to their size and ability to realize the benefits of AI investment across a vast number of individual use cases,” Dan Latimore, Chief Research Officer of Most Impactful, confirmed when CM asked about the differences via email. Health insurers, he wrote, “deal with a significant amount of ever-changing data at a considerably higher velocity than life or P/C insurers. Moreover, health companies have more opportunities to make recommendations for customers, such as producing first drafts of patient care plans or driving operational efficiencies.”

Latimore also noted that for P/C carriers, the focus is not necessarily on improving AI itself. They do, however, focus on three characteristics common to high-impact implementations:

- Freeing up knowledge workers from repetitive tasks. Think data formatting or document cross-referencing, for example. This allow knowledge workers to focus on higher-value work like analysis or insights.

- Generating content, whether it’s internal reports or new code.

- Enabling customers and employees “to use natural language to easily access the vast amounts of data that carriers hold, rather than constructing complex queries or navigating through difficult menus.”

Like Titans, Champions include some of the nation’s largest insurers by premium volume, such as Berkshire Hathaway, Liberty Mutual, American Family Insurance, AIG, Erie Insurance, and CNA.

Trailblazers include a range of smaller regional and specialty carriers, including Donegal Group, Heritage Insurance, ProAssurance and the State Compensation Insurance Fund.

Asked to highlight initiatives that earned some of the Trailblazers their distinctions, Latimore called out Amica and Safety Insurance Group. “While neither of these carriers is particularly large, both have fully embraced the opportunities presented by AI, realizing tangible benefits in their operations,” he wrote in an email to Carrier Management.

“Amica is collaborating with ZestyAI to leverage its property and climate risk analytics platform, which includes risk models that assess both the hazard and vulnerability of hail and wind damage using predictive analytics,” he said. “Additionally, Amica has been a longstanding user of Shift Technology’s AI-driven solutions, utilizing them for claims fraud detection, subrogation detection, and underwriting fraud detection.”

“Similarly, Safety Insurance Group has embraced AI to enhance fraud detection, improve responses to customer inquiries, and streamline underwriting turnaround times.”

Most Impactful issued its free research report earlier this month, offering a high-level overview of the findings. The free summary report,which Carrier Management reviewed for this article, includes examples of insurance firms leveraging robotic process automation, AI chatbots, AI fraud detection, AI claims process and underwriting. The free report also offers some advice for non-Titans, including these tips:

- Focus on talent. “Even with outside help, you’ll need someone inside to ensure” projects run smoothly.

- Focus on efficiency and risk mitigation in claims and fraud. “Downplay revenue increases as you begin your AI journey.”

- Build partnering muscles. “Ignore patents,” instead putting the “focus on finding the right partners for both technology and implementation.”

- “Don’t hide your light under a bushel.” By announcing AI intentions, insurers can attract talent.

- “Set clear goals and measure relentlessly with an eye to being able to nimbly make mid-course corrections.”

- Pay attention to data. “Put your house in order to provide a solid foundation for your AI initiatives

In a media statement, Most Impactful noted that there is also be a paid version of the report available online, which details the most popular AI features and provides a detailed assessment of how insurance companies have dedicated time and resources to innovations in AI.

Most Impactful is the research arm of The Financial Revolutionist, a destination for fintech insights, analysis, and data.

Feature photo AI-Generated (Adobe Firefly)

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb