Carriers are on the hunt for quality agencies to make new appointments, according to a new report, which also found that the top way they’re finding them is at industry tradeshows and events.

While face-to-face connectivity still works to corral them, agents are looking for digital connections, including fast quoting and real-time appetite guides, according to the annual Agency-Carrier Connectivity Trends Report from Ivans.

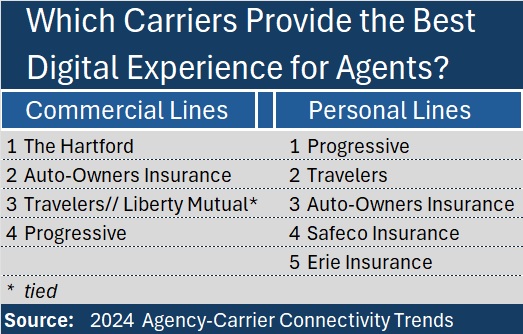

The report, based on an online survey of 1,456 industry professionals—agents, carriers, MGAs/wholesalers and technology providers—offered rankings of top carriers based on digital experience (congrats to The Hartford and Progressive for earning top spots in commercial and personal lines) and insights, including the following:

- 76 percent of carrier respondents are looking to appoint new agencies.

- While tradeshows were the top-ranked method to find them, carriers also cited third-party partners (media outlets and industry associations) and online search engines (Google and Bing) among top search tools.

- 87 percent of agents say they would write more business with carriers if they provided real-time appetite and quoting within their agency management systems to make it easier to find markets.

- Commissions ranked behind three other carrier attributes that agencies consider in deciding whether to place business with carriers. Superior product offerings (#1), ease of business enabled by technology (#2) and great customer service (#3) ranked higher on agency checklists.

- Asked what drives them to place more business with a particular carrier, again commissions was an afterthought. Agent respondents said the top two reasons they give more business to carriers is their ability to quote the fastest and ability to connect to integrated quoting in an AMS.

- Revealing other higher-rated reasons, the Ivans survey found that agents favor carriers that provide indications with the least amount of questions (ranked #3), and those that provide binding and issuing within the quoting system (#4).

- Nearly 76 percent of agencies said they often lose opportunities because they cannot find a market to quote.

- For commercial lines, just under one-third of agents prefer to quote using carrier portals, but 55 percent said the use them—up from 50 percent in the prior year’s survey.

Other carrier survey responses presented in the report included information on methods carriers use to market commercial risks, and lines of business for which they use third-party data when quoting.

Additional agency perspective questions summarized the average number of carriers contacted for small and mid-market commercial submissions, declination percentages for small and mid-market commercial, dealings with the excess and surplus lines market, and lines of business that agencies want supported by policy download.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut