Regulators, insurance companies and attorneys at the Florida Chamber of Commerce Annual Insurance Summit this week sent a clear message to lawmakers about tinkering with Florida’s property insurance law, two years after major legislative reforms were adopted: “Don’t touch it. The 2022 and 2023 reforms are working. Let them continue.”

While many policyholders statewide have continued to see premium increases this year, putting pressure on lawmakers to take new action, others have seen slight decreases or rate stabilization, panelists said. And all signs point to a steadily improving market in a state that was in a full-blown crisis just 18 months ago: A real decline in the massive number of claims lawsuits; improving loss ratios for most carriers; a manageable hurricane season this year; billions of dollars in new capital in the state; and, yes, even a reduction in reinsurance prices in 2025.

“I think the Florida Office of Insurance Regulation would really like to see the status quo for now,” said Virginia Christy, deputy commissioner for property and casualty at OIR.

A number of Florida and national news reports in recent weeks have contended that some Florida insurers, including Citizens Property Insurance Corp., are failing to pay claims from recent storms. Those articles have not provided context, including the fact that many claims were below deductible levels or were the result of non-covered flooding, officials have said. Nonetheless, those reports will undoubtedly put pressure on lawmakers to take measures to protect policyholders or to penalize insurers – something legislators should resist, panel members at the summit said.

“The reforms are working well. To have a knee-jerk reaction in another direction would not be valuable,” said state Rep. Tom Fabricio, R-Miami Lakes.

That being said, others at the two-day conference in Orlando noted that some insurance-affecting legislation will be considered at the 2025 regular legislative session that begins in March:

Home elevation. State Sen. Blaise Ingoglia, the incoming chair of the Senate Banking and Insurance Committee, echoed others who said that more home strengthening measures are key to reducing insurance losses in the state. He plans to introduce legislation that would allow local governments to freeze property taxes rates for 15 to 20 years if homeowners elevate their homes above potential flood levels.

“We need to create incentives for people to build up and out of harm’s way – weather or not they have had damage to their homes currently,” said Ingoglia, R-Spring Hill, who happens to be a home builder by trade and whose district saw hundreds of homes flooded in the recent Hurricanes Helene and Milton.

Florida legislators last year renewed funding for the My Safe Florida Home program, which provides matching grants for wind mitigation. But the program proved so popular that it quickly ran out of available funding. New funding plans are likely to be in the hopper in the next legislative session. And the National Flood Insurance Program offers some community discounts when homes are rebuilt at elevation.

The property tax idea is new and would be another nudge in the right direction, Ingoglia said.

Litigation funding. Efforts to require more disclosure of third-party lawsuit investors failed to pass in the 2024 legislative session. But the idea will be back again in 2025.

“We’ll start where we ended last year and get this thing through the Senate,” said state Sen. Jay Collins, R-Tampa. “It could be an uphill battle in the House, though.”

Litigation funding by investment firms has been an issue in several states in recent years. Advocates say it allows plaintiffs to seek justice when attorneys may not want to risk the expense. But critics say the practice promotes frivolous suits and class actions that should not be pursued in the first place.

“Do we really want lawsuits to be based on whether they’re part of a good investment portfolio?” asked Alan Mirelman, a defense attorney with Beytin McLaughlin law firm in Orlando.

The National Council of Insurance Legislators last month published model legislation designed to bring transparency to and limits on referral fees to litigation funding, seen here.

PIP law. Florida’s personal injury protection, or no-fault auto insurance law, has seemingly been on the legislative agenda every year for almost two decades. Lawmakers approved some significant changes in 2021, but Gov. Ron DeSantis vetoed the bill. And when a similar measure is introduced again in the coming session, it will meet with opposition from some large insurance companies in Florida.

Data from regulators show that switching from a no-fault system to one that requires motorists to pay for bodily injury might initially reduce auto premiums for most drivers. But in just a few years, with higher limits on bodily injury coverage, rates would likely climb by more than 48 percent, said Roosevelt Mosley, managing principal at Pinnacle Actuarial Resources.

Attorney involvement and lawsuits also would probably increase, after declining in the last three years, said Michael Carlson, president of the Personal Insurance Federation of Florida, which represents some of the larger insurers.

Medical malpractice. Despite some limits on punitive damages in Florida, four Florida cities continue to lead the nation – far outpacing similar-sized U.S. cities – in medical malpractice insurance rates. And that threatens to hurt health care progress in Florida, panelists said.

Bills that would provide further limits on malpractice damages are likely to be introduced in the 2025 session.

Other takeaways from the summit:

Reinsurance rates for property insurers, globally, will drop by 5-10 percent for 2025 renewals, said Chris Spencer, executive director of the State Board of Administration. The board oversees the Florida Hurricane Catastrophe Fund as well as investments by the Florida Retirement System, so Spencer tracks reinsurance investments and costs.

He noted that Florida reforms are a big reason for reinsurance companies’ newfound confidence in property insurers. “All in all, the outlook for the market now is very positive,” Spencer said.

Should Florida encourage an end to asphalt roof shingles? Florida Insurance Commissioner Michael Yaworsky thinks so, noting that thousands of claims are the result of wind damage to shingles.

“Shingles are supposed to last 30 years. But they don’t. Not in Florida,” Yaworsky said. “It’s time to write asphalt shingles out of the plot in Florida.”

Other but often more expensive roof options include clay and polymer tiles, metal roofing, concrete shingles, and other systems. Yaworsky promised more information about an OIR effort on that front later this year.

Claims litigation, often considered the bane of Florida insurers’ existence from 2017 until recently, has declined significantly since the 2022 reforms that ended one-way attorney fees and assignments of benefits.

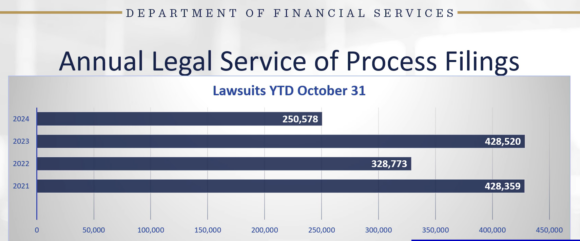

Service of process filings, required when lawsuits are filed, numbered just below 250,600 by Oct. 31 of this year. That’s about 42 percent below the volume recorded for the same period in 2021, at the height of the litigation flood, said Michael Dobson, general counsel at the Florida Department of Financial Services.

“That’s particularly remarkable when you consider the number of storms we’ve had in Florida this year,” Dobson said.

Public adjusters, often criticized by insurance interests for inflating damage claims, have dwindled after AOB limits were enacted in recent years. Claims involving public adjusters have dropped from as high as 20 percent after Hurricane Ian to about 5 percent today, one panelist noted.

Windshield repair suits also have dropped like a rock. Florida lawmakers in 2023 approved legislation that banned assignment-of-benefit agreements in auto-glass repair claims, and barred glass shops from offering gifts to insureds. Since the law took effect, auto-glass suits have dropped, from about 60,000 in 2023 to about 10,000 so far this year, and some plaintiffs’ lawyers who specialized in that have dropped that area of practice, said Ashley Kalifeh, a lobbyist and consultant with Capital City Consulting.

Florida insurers need a better soapbox. Carriers need to do a better job of promoting storm mitigation measures, said Tony Cotto of underwriting policy for the National Association of Mutual Insurance Companies.

Insurance companies, long an easy target for policyholders facing higher premiums, should also be united in their messaging to consumers, especially after plaintiff attorneys complained that the 2022 and 2023 reforms were a “giveaway” to insurers.

“The trial bar has been very united in its messaging. You need to be united, too,” said Spencer, of the State Board of Administration. “You need to tell people how you are protecting their nest egg, protecting their net worth. Tell the story of success in this state.”

Insureds also may not realize that part of the reason for higher rates lies with inflation and pandemic-fueled material shortages.

“Repair costs have doubled,” explained Don Matz, CEO of Orange Insurance Exchange. “Roof shingles cost more; drywall costs more,” he noted. Lumber prices have dropped recently, but only from a high seen in 2021.

This article was previously published by Insurance Journal. Reporter Will Rabb is the Southeast Editor of Insurance Journal.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit