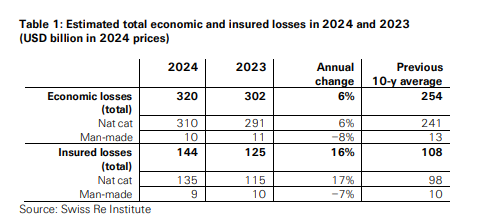

Estimated insured losses from natural catastrophes are on track to surpass US$100 billion in 2024 – for the fifth consecutive year — and are even likely to hit US$135 billion-plus, according to Swiss Re Institute.

Natural disasters are driving an expected 17 percent increase in losses for the insurance industry this year (from 2023) — a trend that is being exacerbated by a warming climate, the report indicated. (See related graphic below.) Swiss Re noted that 2024 is set to become the hottest year on record – at 1.54°C above the pre-industrial average.

“Losses are likely to increase as climate change intensifies extreme weather events while asset values increase in high-risk areas due to urban sprawl,” the Swiss Re report explained.

“Economic development continues to be the main driver of the rise in insured losses resulting from floods, but also other perils, seen over many decades,” said Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist, in a statement. “However, with natural catastrophe risks rising and higher price levels, the annual increase of 5-7 percent in insured losses will continue, and protection gaps could remain high.”

Rising Flood Risk

Indeed, flood risk is rising across the globe in the third-costliest year for this peril. Europe, in particular, experienced intense flooding in September and October, which resulted in the second-highest insured losses from floods in the region of approximately US$10 billion, Swiss Re estimated. October’s flash floods in eastern and southern Spain saw one year’s average precipitation dumped in less than eight hours in many locations, the report said.

The Gulf region also experienced record floods in April, Swiss Re added, when “intense precipitation” hit Dubai in the United Arab Emirates, bringing insured losses of close to $3 billion.

U.S. Losses Dominate

At least two-thirds of this year’s total insured losses (of $135 billion-plus) are attributable to the U.S., which saw two major hurricanes in September and October as well as a high frequency of severe thunderstorms (also known as severe convective storms).

Insured losses from Hurricanes Helene and Milton are approaching US$50 billion, while SCS (which mostly affect the U.S.) are expected to add more than US$51 billion globally for 2024. This marks the second-highest SCS loss after a record high of approximately US$70 billion in 2023, Swiss Re added.

Other highlights from the Swiss Re report include:

- Manmade insured losses averaged $9 billion across the globe in 2024,

- Economic losses totaled $320 billion for the year – or $310 billion for nat cats and $10 billion for manmade catastrophes. (Economic losses include insured and uninsured losses.)

For the fifth consecutive year, insured losses from natural catastrophes are breaking the US$100-billion mark, said Balz Grollimund, Swiss Re’s Head Catastrophe Perils. “Much of this increasing loss burden results from value concentration in urban areas, economic growth, and increasing rebuilding costs. By favoring the conditions leading to many of this year’s catastrophes, climate change is also playing an increasing role. This is why investing in mitigation and adaptation measures must become a priority.”

Source: Swiss Re

Photograph: Emergency services remove cars in an area affected by floods in Catarroja, Spain, on Sunday, Nov. 3, 2024. (AP Photo/Manu Fernandez)

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford