Global non-life premiums are expected to hit a decade-high growth level of 4.3 percent in 2024, following the repricing of risk over the past several years in response to elevated claims, according to Swiss Re’s sigma.

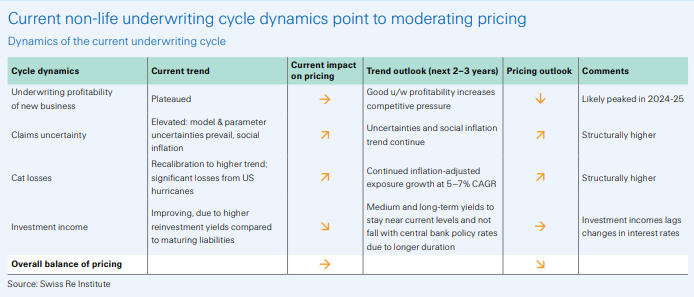

“Premium rates are now moderating, and we forecast softer global premium growth of 2.3 percent annually in real terms over 2025-26, below the 3.1 percent average of the last five years,” said the research report titled “Growth in the shadow of (geo-)politics,” which provides a global economic and insurance market outlook for 2025-2026.

Jérôme Jean Haegeli, Swiss Re’s group chief economist, said rates on the property/casualty side of the industry “are plateauing if you look at market indicators.”

But he indicated that inflation and inflation risk as well as the industry’s expected growth upside that still exists “probably is going to extend the rate cycle on the P/C side.”

Haegeli and Paul Murray, Swiss Re’s CEO Life & Health Reinsurance, spoke during a press briefing this week to discuss the report.

Another trend that could put downward pressure on rates is the fact that P/C business profitability is expected to improve significantly in 2024, primarily due to strong underwriting results and significant rate increases in personal lines insurance.

“We expect these trends to increase industry return on equity (ROE) for our sample of global markets to 9 percent, from 5 percent in 2023. For 2025 and 2026, we expect 10 percent ROE, meeting and exceeding the cost of capital,” the report said.

The Swiss Re report acknowledged that the rate hardening forces that followed the inflation surge in 2021 and 2022 are fading and the outlook for pricing is now more moderate, but trends such as social inflation and rising natural catastrophe losses “have the potential to counteract market softening in related portfolios. Geopolitical events also risk an inflation shock that could prolong the cycle transition.”

Indeed, U.S. hurricane losses in 2024 will likely push global natural catastrophe insured losses to well over $100 billion for the fifth consecutive year “and may delay the onset of softer property insurance pricing.”

Swiss Re said that commercial lines rates moderated during the third quarter – a trend (led by property rates) that is expected to continue.

“After 27 consecutive quarters of increases, the Marsh global commercial insurance rate index declined slightly (‒1 percent) in the third quarter of 2024 from flat in the prior quarter,” said Swiss Re, quoting Marsh’s Global Insurance Market Index, which was published in October.

“Property rates, which have driven the hardening cycle to date, saw a small decline. U.S. property rates declined by 1 percent in the third quarter, down from +2 percent in the second quarter of 2024, +8 percent growth in 1Q24 and a 11‒17 percent gain in 2023,” the report said, noting that Hurricanes Helene and Milton are unlikely to drive prices higher but may prevent rates from further declining in the U.S. and other affected regions.

In continental Europe, Q3 2024 property rates rose by 1 percent (after +7 percent in 2023), but in the UK and Asia Pacific, rates fell.

Other key points highlighted by the Swiss Re report include:

- Global total insurance premiums (life and non-life) are expected to increase by 2.6 percent on average in real terms in 2025 and 2026, after 4.6 percent estimated growth in 2024. Swiss Re’s forecast is well above the average of the past five years (2019‒2023: 1.6 percent).

- Growth will be primarily driven by the life sector, although saving business growth will moderate as interest rates decline. Non-life insurance will grow more slowly than in recent years as the boost from the hard market tapers down.

- The insurance industry will be supported by steady economic growth, resilient labor markets, rising real incomes as inflation moderates, and still-elevated long-term interest rates that support investment yields.

- The global cyber insurance market is expected to reach $16.6 billion by 2025.

- While the volume of malicious cyber attacks worldwide jumped by 75 percent, year-over-year, during the third quarter of 2024, pricing in the cyber insurance market is softening.

- Casualty pricing, principally for general and motor liability, reflects regional claims trends. In the U.S., social inflation, in the form of large jury verdicts, continues to have a strong impact.

- U.S. general liability and auto liability rates have increased by 14 percent in 3Q 2024, up from 7 percent increase in the first two quarters. In Continental Europe and the UK, rate increases are mostly driven by U.S. exposures.

- In financial and professional lines covers (largely D&O), rates are softening in all regions, a reaction to good results and capacity inflows in this line.

- Life and non-life (including health) premiums accounted for 43 percent and 57 percent of total premium in 2024, respectively.

- The global economy is poised to see further solid expansion with global real GDP growth forecasted at 2.8 percent in 2025 and 2.7 percent in 2026, which is roughly in line with 2024 but slower than the 3.1 percent average growth of the pre-pandemic decade.

- Real GDP growth in the U.S. is expected to moderate from 2.8 percent in 2024 to 2.2 percent in 2025 and 2.1 percent in 2026.

- The distribution of risks to the global economy is tilted to the downside, driven by geopolitics, the potential for disruptive policy changes, and financial market vulnerabilities.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation