State-sponsored residual property markets have seen an influx of risks come in since 2018, with some states growing by more than 200 percent.

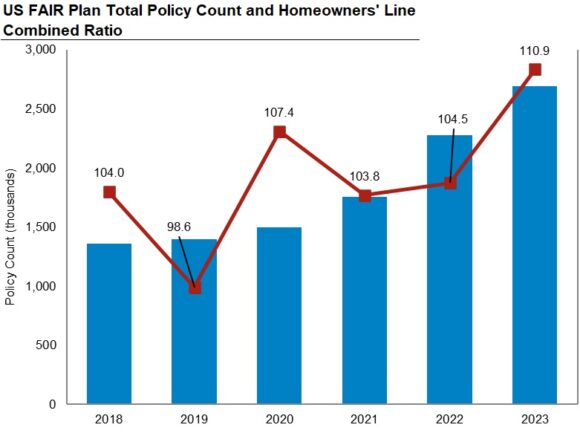

According to insurance industry ratings firm AM Best, the policy counts of personal and commercial property Fair Access to Insurance Requirements (FAIR) Plans overall have nearly doubled since 2018, with most of the growth occurring after 2020.

The underwriting profitability ratios for the primary market have worsened due to weather-related losses, inflationary pressures and increased reinsurance costs, leading many admitted insurers to reconsider their property exposures. The combined ratio for private homeowners insurers nearly reached 111 in 2023. This has driven the rapid increase of risk into the residual market, particularly for personal lines, AM Best said in a recent report.

Driving the overall doubling in policy counts for state-sponsored plans is Georgia, Louisiana, Florida, California, Washington and North Carolina — the only states that have seen policies go up since 2018. The policy count in the residual markets in Georgia, Louisiana and Florida shot up more than 200 percent. Meanwhile, policy counts in many other FAIR Plan states declined at least 10 percent since 2018.

“Further storms, such as hurricanes Helene and Milton, that cause widespread destruction will likely dampen the risk appetite of insurers providing homeowners coverage in affected states such as Florida, Georgia, and North Carolina,” AM Best said.

Thirty-three states and the District of Columbia offer some kind of FAIR Plan for homeowners and business that qualify. Each state plan has different eligibility requirements. Seven states—Alabama, Florida, Mississippi, New York, North Carolina, South Carolina and Texas—also have counterpart “Beach and Windstorm Plans” to provide coverage against hurricanes and other sever storms.

Preparing for an AI Native Future

Preparing for an AI Native Future  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook