Data and technology leaders at insurance organizations are gung ho about using GenAI to increase customers satisfaction, reduce operating costs and improve risk management, but few are fully ready to comply with regulations or to monitor AI results.

More than one-quarter are even using “synthetic data” to train AI models in order to overcome what SAS, a provider of data analytics and AI solutions, described as a “data drought.”

Those are some of the findings from a survey of over 200 leaders of technology, data, digital and analytics teams of insurance enterprises published by SAS and Coleman Parks Research in a report titled, “Your journey to a GenAI future: An insurer’s strategic path to success.”

The report digests insurance industry responses to questions about implementation plans, budgets, governance frameworks, regulatory compliance and concerns from a broader survey of 1,600 companies in industries that also included banking, health care, life sciences and government.

Specific to the insurance sector, the report revealed that 89 percent of insurance industry respondents plan to invest in GenAI in 2025—and 92 percent have a dedicated GenAI budget in the works.

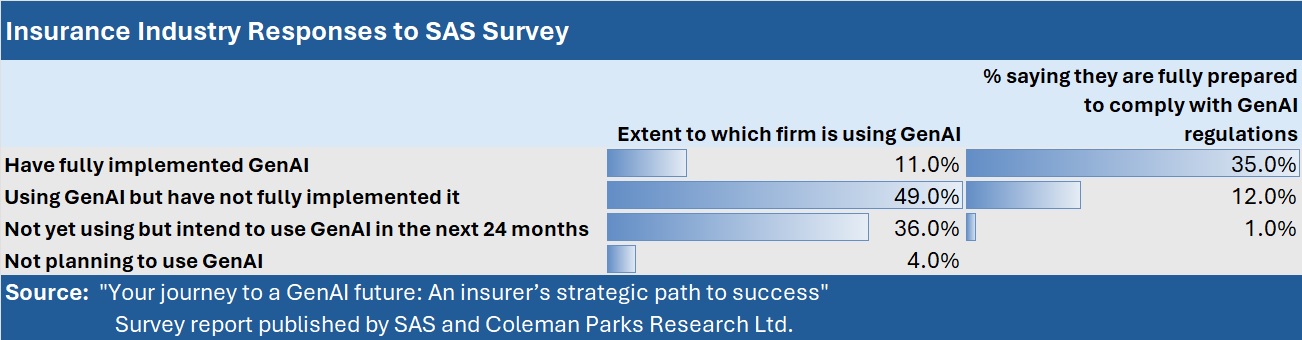

Yet, only 1 in 10, or 11 percent, of the insurance respondents reported that their organizations are fully prepared to comply with current and upcoming GenAI regulations.

That average figure is heavily weighted by respondents who said they have started using GenAI tools but have not fully implemented them. Representing 49 percent of the 236 total respondents, only 12 percent of this group feels sure that their organizations are “fully prepared” to comply with GenAI regulations. (See chart below)

Sixty-two percent of these GenAI users feel at least “moderately prepared” to comply.

Among those who said their firms have fully implemented GenAI—roughly 11 percent—only about a third (35 percent) feel confident that they are “fully prepared” to comply with GenAI regulations. Another 15 percent of these companies, who have fully implemented GenAI tools, admitted they are only “slightly prepared” to comply with regulations.

Related articles: Regulators Run Alongside Speeding AI Train: What the NAIC Model Bulletin Means for Insurers; Ready or Not, 80% of P/C Insurers Aim to Use AI for Biz Decisions This Year

Ethics and Governance

According to the report, insurance industry respondents, like respondents from other industries are concerned about data privacy and data security issues that may arise when using GenAI—with about three-quarters of those surveyed ranking these issues as top concerns, whether they were from the insurance industry or not.

But insurance industry participants pulled away from the pack on a third issue of concern—the ethical implications of using GenAI. While 59 percent of insurance respondents cited this concern, the cross-industry average was lower, at 52 percent.

Still, despite insurers’ deeper ethics worries, “their plans for governance and monitoring—efforts that would include the creation, implementation and maintenance of ethical frameworks–remain works in progress,” SAS said in a media statement.

In fact, even though 92 percent of the insurers have budgeted for GenAI implementations for 2025, half have only between 1 and 10 percent of the budget earmarked for governance and monitoring—and 9 percent haven’t set aside any budget at all for these activities.

More in line with their level of concern, 57 percent said a governance framework is in development. But 27 percent described their framework as “ad hoc and informal”; 11 percent said their ethical frameworks are “nonexistent.”

Insurers say that their firms currently don’t have sufficient training on GenAI governance and GenAI monitoring—”which includes everything an organization does to check the results the technology is producing, and how effectively and efficiently it’s achieving its purpose,” the SAS report said.

While 68 percent of the insurance professionals said they personally use GenAI at work at least once a week, 54 percent described the training they receive on governance and monitoring as “minimal.” While 35 percent thought their training was “adequate,” 4 percent had none at all.

“We’re not looking at an AI bubble set to burst, and that’s a good thing. But it’s clear that the insurance sector, like other industries, has obstacles to overcome,” said Franklin Manchester, Principal Global Insurance Advisor at SAS, in a statement about the findings.

A Data Drought?

In an industry typically described as awash in data, insurers may probably don’t have the right kind of data to train GenAI and other AI models, SAS said in a statement about the survey report.

“The quality and quantity of data used to train GenAI and other AI models can make or break the accuracy, fairness and equity of the model’s results in claims and policy decisions,” the statement said.

“There’s a serious lack of large datasets, combed for bias and checked for data quality, in insurance—a veritable data drought,” SAS said.

In addition to quality issues, there may be gaps, SAS noted. Giving the example of large language models, SAS said LLMs require huge amounts of data, “which may not be available in existing productions systems to properly treat edge cases.”

Edge cases?

Manchester explained to Carrier Management via email that an edge use case is something that happens unexpectedly. “In a programming or software context, it’s something that happens infrequently or to a small subset of users.”

“For insurance, an edge use case might be a particular risk, or a particular group of customers, that an insurer cannot price or underwrite because they lack the loss experience or underwriting knowledge to understand the risk.”

“In this instance, the insurer could use synthetic data (a form of generative AI) to enrich the pricing model to ensure there is a robust enough data to handle the infrequent risks presented.”

Asked specifically about their potential use of synthetic data—”artificial data manufactured to realistically mimic real-world data, used to enrich existing datasets without compromising customer privacy”—27 percent of insurance decision makers responding to the survey said they were already using it, and 30 percent said they were actively considering it.

While the report doesn’t indicate specific use cases for which the synthetic data is currently helping insurers, the report highlights the need for insurers to safeguard their customers’ sensitive personal information and stresses that models require tremendous amounts of data.

“Synthetic data is generated by algorithms or rules rather than collected from the real world. Because it mimics the characteristics of the real-world data that it’s trained on, synthetic data can help insurers preserve privacy and overcome the time, cost and complexity of collecting and managing real-world data. Synthetic data can even help insurers fight bias,” the report adds.

Manchester provided some further context around the idea of filling in data gaps related to edge cases. “Consider a digital portal, where customers can buy insurance. Say a potential customer is attempting to buy insurance for their small business, a flower shop. The shop owner applies for a policy online. That business is a pretty vanilla risk, and the carrier will likely have the ability to price a policy without any trouble.”

“But what if the businessowner seeking insurance is an aerial space manufacturer who is big into metal or energy providing aerospace parts to the likes of Boeing?” he said, recounting an actual situation he faced when he worked as an agent. “We had no idea how to price that risk. We didn’t even understand the questions to ask,” he said. “If you’re running a pricing model, you have to feed information into it in order to understand the expected loss cost associated with that particular risk. This is a time when I would’ve loved to have GenAI capabilities to inform our modeling,” he stated.

Goals for GenAI

The leaders responding to the survey in the insurance industry carry titles including data manager, head of IT, chief information officer, and analytics manager, among others. These leaders most commonly identified three goals for their firms’ GenAI investments:

- Improvement in customer satisfaction and retention, was identified by 81 percent—the highest percentage for this goal across any of the industry segments.

- Reduction in operational costs and time savings, identified by 76 percent.

- Enhanced risk management and compliance measures, 72 percent.

On a personal level, over two-thirds of the insurance respondents reported using some form of GenAI in their professional roles at least once a week—and 22 percent said they used it daily.

To drill down on the responses from the insurance industry data and technology leaders, and to compare them with responses of peers across other sectors, visit the SAS interactive GenAI survey data dashboard.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Preparing for an AI Native Future

Preparing for an AI Native Future