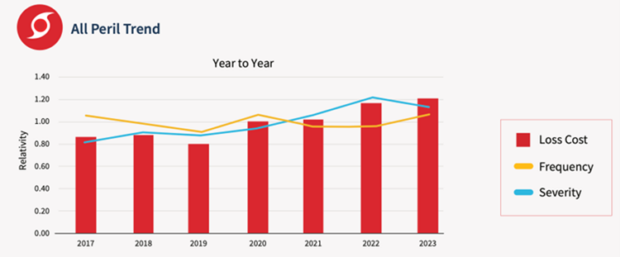

The U.S. home insurance industry has experienced an upward trend in all-peril loss costs over the past seven years, according to a new report released by LexisNexis Risk Solutions.

The ninth annual LexisNexis U.S. Home Trends Report found that all-perils lost costs and all-perils frequency increased by 4.1 percent and 11 percent, respectively, from 2022 to 2023. Since 2019, all-perils loss costs rose 52 percent, with frequency climbing 16.9 percent.

Although severity has declined 6.3 percent since 2022, it remains 29.8 percent higher than 2019 figures, the data showed.

For the purposes of the report, the all-perils figures combine data for hail, wind, water, fire and lightning weather perils, as well as non-weather related claims such as water leaks, thefts or liability.

Catastrophe claims represented 46 percent of claims across all perils combined in 2023, the highest in seven years.

By peril, some of the data breaks down as follows:

- Hail loss costs increased 57.9 percent from 2022 to 2023, along with frequency (up 53.6 percent) and severity rising 2.8 percent year over year from 2022. States with the highest impact of hail-related perils include Colorado, Nebraska and Wyoming.

- Loss costs for other weather-related perils declined from 2022 to 2023, with fire and lightning costs down 11.1 percent, and weather-related water down 51.4 percent.

- Non-weather-related water loss costs decreased by 11.2 percent in the same period but remained on an upward trend over the past seven years.

“In the last year, the U.S. saw several historic-level weather disaster events and the highest level of catastrophic claims across all perils we’ve seen in the past seven years, which contributes to rising premiums that consumers across the country face right now,” said Cole Winans, vice president, home insurance, LexisNexis Risk Solutions.

“As home insurance carriers continue to contend with seasonal and geographic variabilities related to climate— in addition to rising inflation, material and labor cost—understanding by-peril and macro level home insurance trends, coupled with maintaining extensive data and imagery on current house conditions over an extended period of time is imperative to remain nimble in today’s volatile and dynamic market,” he added.

“Even as more insurers are likely to see rate increases approved in certain states in the coming months, they will need to be discerning in writing new business only in those pockets where they can do so profitably and that will be on a carrier-by-carrier and state-by-state basis.”

Despite the all-perils severity reduction in 2023 (6.3 percent down from 2022), the elevation in severity above 2019 (up 29.8 percent) points to the importance of long-term trend data when evaluating risk and pricing, the report stated.

Colorado ranks highest in loss costs from catastrophic claims (274 percent above 2023 U.S. average catastrophic loss cost), while the severity of claims (dollars lost, on average, per claim paid) was highest in the state of Hawaii in 2023 (63 percent above 2023 U.S. average severity).

U.S. states with the highest combined catastrophe and non-catastrophe loss costs include Colorado, Minnesota, Nebraska, Louisiana and Iowa. Lowest ranking states include Massachusetts., New Hampshire, West Virginia, Vermont and Maine.

In 2023, the data indicated the U.S. experienced 6,962 hail events, up 57.3 percent from 2022, with 71 percent of hail claims deemed catastrophic.

With 28 weather and climate disasters in 2023, each surpassing the billion-dollar damage threshold, 17 were attributed to severe weather or hail events.

Hail peril seasonality over the past seven years continues, with April, May and June observing the highest frequency and loss cost in 2023.

Wind peril frequency rose 14.8 percent, along with a loss cost increasing 0.7 percent from 2022-2023. Severity, by comparison, fell 12.3 percent year-over-year, the report found. Despite seasonal loss cost averages peaking in August and September over the past seven years, 2023 loss cost and frequency were highest in March.

In 2023, 62 percent of wind claims were deemed catastrophic claims, up from 52 percent the year prior.

Fire and lightning perils in 2023 saw decreases in loss costs (-11.1 percent), frequency (-8.6 percent) and severity (-2.7 percent) from 2022. However, catastrophic claims rose 7 percent from 2023, with the Maui, Hawaii, wildfire considered one of the most damaging and deadly events in 2023.

Weather-related water perils declined in 2023 with a reduction in loss cost (-51.4 percent), frequency (-25.5 percent) and severity (-34.8 percent). In 2023, 61 percent of weather-related water claims were catastrophic.

Addressing claims related to water damage, such as leaking pipes and appliances, non-weather-related Water perils decreased across loss cost (-11.2 percent), frequency (-10.3 percent) and severity (-1.1 percent) in 2023.

While theft loss cost and frequency decreased by 14.2 percent and 15.8 percent, respectively, in 2023, severity rose by 1.9 percent, partially attributed to the rising cost of consumer goods such as high-end kitchenware.

Liability saw a marginal increase in severity (0.2 percent) in 2023, with an 18.3 percent drop in frequency driving down overall loss costs (down 18.2 percent).

Other perils, including physical damage claims not included elsewhere, extended coverage, damage to property of others, etc., saw a frequency increase of 9.3 percent year-over-year. Loss costs, along with severity, both declined 10.7 percent and 18.3 percent, respectively, from 2022 to 2023.

“When we look at peril data over a seven-year span, it’s increasingly clear that home insurers cannot rely on short-term trends alone to make fully informed decisions about their books of business and operational strategies,” said George Hosfield, associate vice president, home insurance, LexisNexis Risk Solutions. “For example, while hail loss cost surged by 57.9 percent in a one-year observance, the longer-term trend shows consistent increases across all perils year-over-year. This emphasizes the need for carriers to consider broader historical data when evaluating risk and adjusting pricing strategies to help support their long-term profitability.”

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Preparing for an AI Native Future

Preparing for an AI Native Future  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll