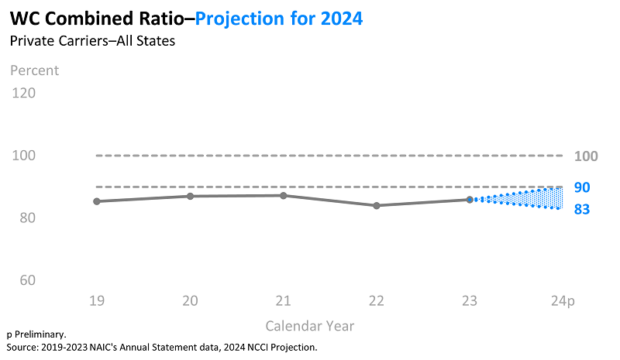

Preliminary analysis through the second quarter of 2024 by the National Council on Compensation Insurance indicates workers compensation continues to exhibits sign of strong performance and will likely close out the year with a net combined ratio similar to that of 2023, ranging between 83 to 90 percent.

In its latest State of the Line Report, analysis showed that calendar year (CY) 2024 private carrier direct written premium (DWP) decreased nearly 1 percent through the first half of 2024, compared with DWP through the first half of 2023.

CY 2024 private carrier direct loss ratio through the first half of 2024 is 48 percent, one point higher than that observed through the first half of 2023.

NCCI predicts the net loss ratio will be in close range of the 2023 result.

The line is expected to have another strong year with continued underwriting gains in 2024, comparable to recent years, and a net premium volume similar to that observed in CY 2023, according to the NCCI report.

The CY 2023 combined ratio marks the seventh consecutive year under 90 percent and a decade of underwriting gains for private carriers in the WC industry.

Nationwide, National Association of Insurance Commissioners (NAIC) private carrier direct written premium (DWP) decreased 0.9 percent through the first half of 2024, compared with DWP through the first half of 2023. This decrease has moderated compared to the –2.4 percent change observed through the first quarter of 2024.

When taking into account the 2024 results to date, the year-end private carrier net written premiums (NWP) change will likely be in the vicinity of zero, resulting in 2024 NWP close to the $43.0 billion figure observed in 2023.

This estimation is a reasonable possibility, according to the NCCI, assuming DWP develops similarly to historical patterns and the relationship between direct and net premium holds consistent.

Because premium is calculated as payroll times rate, the combined impact of the changes in those components drive the overall change in premium, the report explained.

The expectation on the impact of rate/loss cost level changes on premium is that it will decrease in 2024 by 9 percent, on average, as a result of recent rate/loss cost filings made in jurisdictions where NCCI provides ratemaking services.

Factors contributing to the decrease include the wage-sensitive exposure base (payroll) in WC as well as declines in lost-time claim frequency and moderate changes in claim severity.

Other factors contributing to a final rate change include changes in schedule rating, dividends, rate/loss cost departure, average experience rating modification, deductible credits or mix of policies.

The impact of these factors cannot yet be estimated, but over the last several years they have put upward pressure on premium, the NCCI said.

Further offsetting bureau premium level decreases, payroll through the first half of 2024 increased by an estimated 6.5 percent over the prior year (based on data from the following sources: U.S. Bureau of Labor Statistics; U.S. Bureau of Economic Analysis; NCCI). The increase is driven by a 1.5 percent increase in employment level paired with a 5 percent increase in wage rate.

NCCI expects that expense ratios (including dividends) for 2024 will be equal to those of 2023, and with CY2024 expected to return similar results as CY2023, it will result in 11 years of workers compensation calendar year combined ratios under 100 percent.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit