Florida’s Hurricane Milton caused private insured losses of about $36 billion, estimated catastrophe modeler Karen Clark & Co.

The estimate includes losses from wind, storms surge, and inland flooding to personal, commercial and industrial properties and vehicles, as well as business interruption.

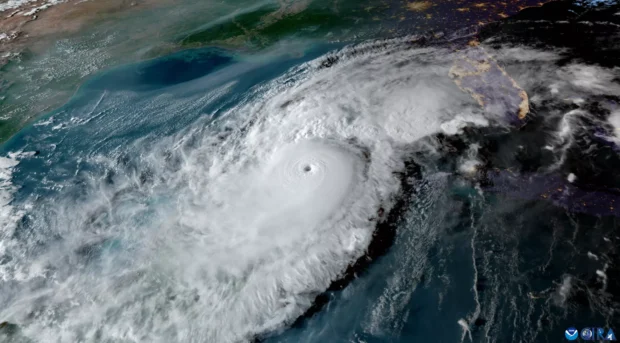

Unlike Hurricane Helene, which also affected the West Coast of Florida, much of Milton’s damage was caused by wind. Therefore, more loss will be covered by private insurers, said KCC. Both Milton and Helene were major hurricanes. Milton was at one point a Category 5 storm but its path was eventually affected by wind shear, weakening it to a Category 3 before hitting Florida on Oct. 9 near Sarasota.

An interesting distinction between Milton and most hurricanes was its winds, said KCC. Usually, a hurricane’s strongest winds are on the right side, but Milton generated winds just as strong on the left. In fact, in eastern Florida where Milton exited Oct. 10 as a Category 1, winds were higher on the left side than the right side.

“Both to the north and south of the track, Hurricane Milton brought tropical storm winds to an extensive region including the entire Florida peninsula and extended north along the coastline into Georgia,” KCC said.

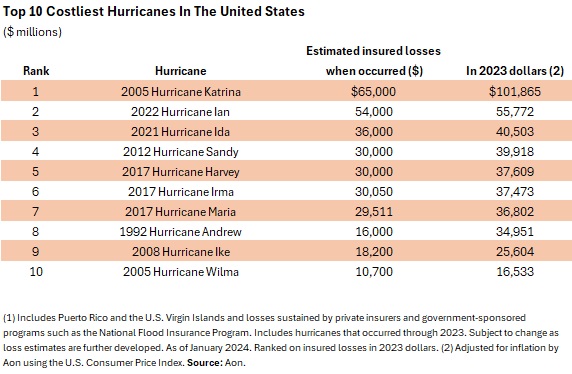

Insured losses of $36 billion would make Milton one of the costliest insured-loss hurricanes ever. KCC’s estimate is at the lower end of a range issued by Fitch Ratings. Hurricane Milton will cause between $30 billion and $50 billion in insured losses, said Fitch.

Moody’s RMS on Monday said private insured losses from both hurricanes Milton and Helene could be between $35 billion and $55 billion. The firm previously put a range of insured losses of between $8 billion and $14 billion on Helene.

Related: Experts Predict Impacts of $25B+ Milton Hit to Insurers, Reinsurers

Photo: Hurricane Milton, courtesy NOAA

This article was previously published by Insurance Journal. Reporter Chad Hemenway is the national editor of Insurance Journal.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation