WTW characterized commercial insurance rates as balanced and stable in a report last week. But as Hurricane Milton approached, the broker warned of upcoming disruption.

“The current state of affairs might only be one major hurricane away from being upended, and with Milton knocking on the door, the probability of disruption is growing,” said Jon Drummond, head of broking in North America, in a statement released hours before Milton made landfall in Florida as a Category 3 hurricane.

In its Marketplace Realities report published on Oct. 4, which offers 2024 price predictions on 30 commercial lines of business, WTW said rates have thus far been balanced and stable.

“The industry has not categorically rewritten its position on any one line of business, but rather has taken micro-actions reacting to emerging trends.” said Drummond.

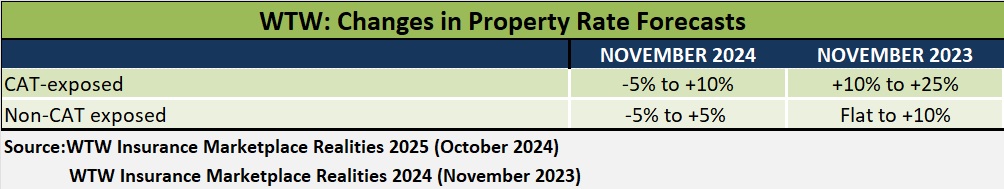

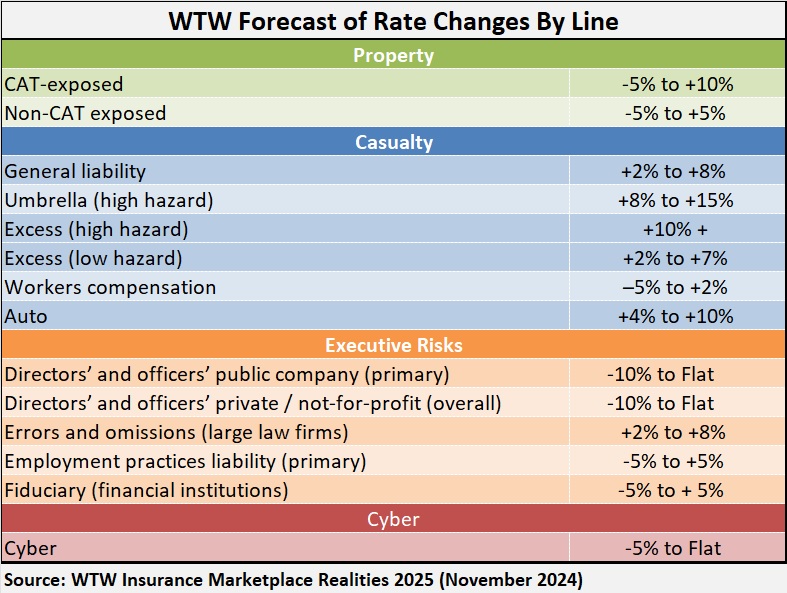

Reinsurers continue to bring back capital to first-party property risk—with some expanded appetite via insurance linked securities for catastrophe-exposed risk. Rates on catastrophe-exposed property are expected to go down 5 percent to up 10 percent.

Cyber and financial markets remain relatively soft with plenty of capital and capacity. Cyber rates are expected to stay at least flat for the rest of 2024, WTW said. However, there is some focus in rate adequacy in mid-excess directors & officers liability.

“After several years of rate deterioration, historic and new markets are beginning to cite an inability to support further reduction, particularly in excess layers,” WTW said of D&O. The broker expects prices here land in the range of -10 percent to flat for both primary public and private D&O.

The most disruption is in umbrella & excess thanks to rising litigation costs and growing concerns such as PFAS, the broker noted.

This article was previously published by Insurance Journal. Reporter Chad Hemenway is the National Editor of Insurance Journal.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage