Two new analyses—one from a risk modeler estimating insured damages from Hurricane Helene, and the other from a rating agency about flood insurance penetration and profitability—highlight the staggering gap in coverage for flooded U.S. properties.

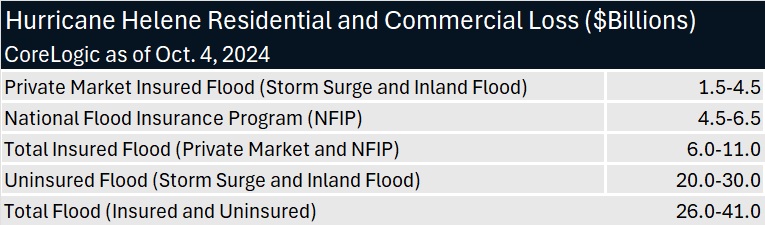

Late last week, CoreLogic published estimates of insured and uninsured Helene flood losses. The risk modeler put the combined total of water losses covered by private insurers together with those covered by the National Flood Insurance Program in the range of $6.0 billion to $11.0 billion—likely $20.0-$30.0 billion short of the full amount of Helene flood damage.

Proportionately, that comes out to roughly three-quarters of the damage that is not insured.

See related article, “The Latest Hurricane Helene Insured Loss Estimates: Totals Move Higher”

Partly explaining the gap and focusing on devastated areas of North Carolina, CoreLogic noted that flood insurance is not a requirement unless a home has a federally backed mortgage and built within the Special Flood Hazard Area (SFHA), also known as the 100-year flood zone. But areas other than SFHAs are also at risk to flooding, as seen across western North Carolina and other states in the southeastern U.S. during Helene.

Breaking down the insured flood losses from Helene into those covered by the private market vs. those covered by NFIP, the CoreLogic estimates suggest that NFIP will be covering somewhere between 60 and 75 percent of the insured flood damage. (Low-end estimates are $4.5 billion NFIP losses, roughly 75 percent of a low-end total of $6.0 billion in total private market and NFIP insured flood losses. CoreLogic’s high-end estimates have NFIP picking up $6.5 billion of the insured flood total. The high-end of the range for private market insured flood losses $4.5 billion, bringing the high estimate total insured flood losses to $11.0 billion.)

Why don’t private insurers have more of the flood insurance pie?

AM Best analysts tackled the question of the persistent gap between private and NFIP coverage in a separate report yesterday. Best’s Market Segment Report, “Temporary Extension Protects NFIP Through Hurricane Season, Longer-Term View Is More Clouded,” reveals that while private insurers have seen their share of direct premiums for flood insurance more than double to 25 percent in 2021 from just under 13 percent in 2016, the private market share has since stalled.

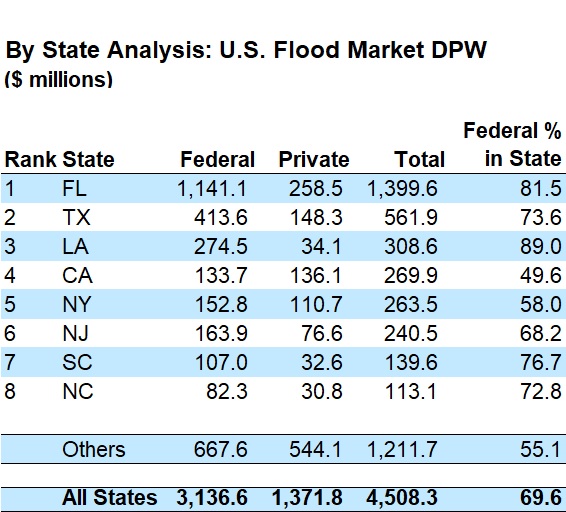

Private insurers commanded less than one-third of the overall U.S. flood insurance market in 2022 and 2023, with the federal NFIP accounting for the bulk of the premiums and claims payouts, the AM Best report shows. The situation looks even more unbalanced in the nation’s most flood-prone states.

Below, we summarize NFIP direct written premiums for flood insurance compared to private market premiums for the eight states with the most flood insurance premium, taken from the AM Best report. The chart reveals private insurers write less than 25 percent of the flood premiums in states like Florida and North Carolina, which were impacted by Hurricane Helene.

The report advances possible reasons:

- Private insurers are wary because of the growing unpredictability of the weather.

- Insureds are hesitant to switch out of the federal program.

- Where there isn’t buyer inertia, private insurance rates are still higher than NFIP

Problems plaguing the program have included underpricing, an issue that NFIP’s Risk Rating 2.0 was designed to correct that. The new pricing of Risk Rating 2.0 hasn’t yet been fully realized, however. As a result, NFIP premiums may still be lower than what is available in the private market, the report says, supporting the third possible reason.

NFIP’s risk-adjusted pricing went into effect for new policies in October 2022 and for renewals in April 2023, but hikes on renewal policies are capped at 18 percent annually, the report explains.

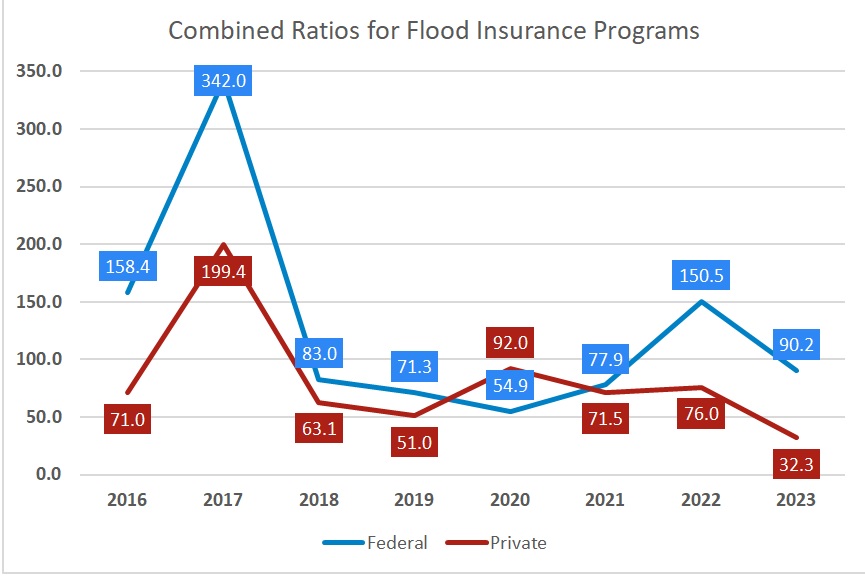

As for the uncertainty of unstable weather, the report shows that in spite of volatile weather, private market insurers have generated less volatile flood insurance results than federal flood program insurers. And the private insurers have generally been profitable.

In fact, private insurers recorded combined ratios of 76.0 or lower in aggregate for six of the last eight years, with the 2023 combined ratio landing at 32.3, the report shows.

Providing a history of the NFIP program, and reporting that the program debt now stands at nearly $21 billion, the report notes that Hurricane’s Helene and Milton will likely increase that burden.

Even though the U.S. Congress agreed to a short-term NFIP extension as Helene approached, “any long-term solution to the troubled federal program likely would need private flood insurers to take on more risk,” AM Best states.

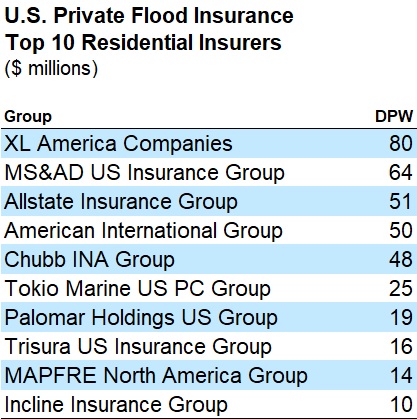

The report provides lists of the top 10 residential writers of U.S. private flood insurance and the top 10 commercial writers. The top 10 residential writers, accounting for more than 80 percent of the private market, are republished below.

According to the report, the commercial share of the market has accounted for roughly two-thirds of the private flood insurance market for the last three years. Top commercial writers include Zurich U.S., Berkshire and Assurant.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Preparing for an AI Native Future

Preparing for an AI Native Future