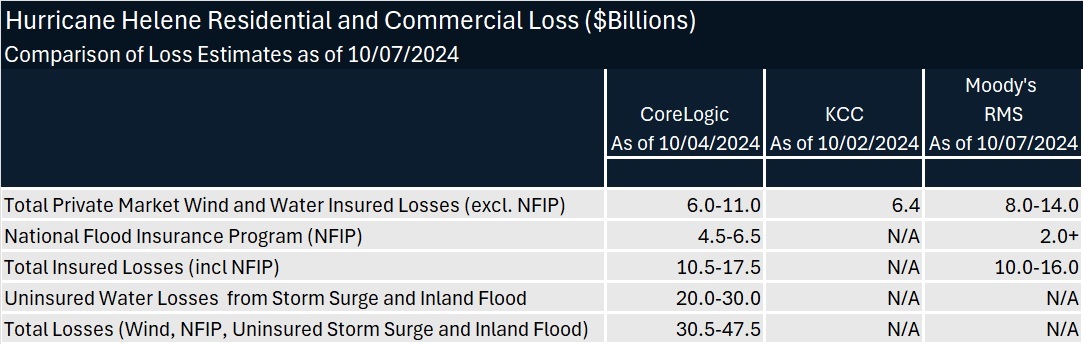

Early estimates of Hurricane Helene U.S. private insurance market losses in the $5 billion to $10 billion range have moved up higher in recent days, with Moody’s RMS offering the latest estimates of $8 billion to $14 billion.

The Moody’s RMS range of estimates, with a best estimate of $11 billion, encompass insured losses associated with wind, storm surge and precipitation-induced flooding.

Late last week, another risk modeler, CoreLogic, also published an updated range, now putting U.S. private insurance market losses at $6 billion to $11 billion, according to an estimate published on Oct. 4.

Earlier, on Sept. 27, CoreLogic had estimated insured private market property losses from hurricane Helene’s winds and storm surge for just the states of Florida and Georgia at between $3 billion and $5 billion. The new CoreLogic estimate includes inland flood losses covered by private insurers and includes impacts across 16 states.

Separately, preceding the Moody’s RMS and CoreLogic announcements, Karen Clark and Co. pegged losses for all three perils—wind, storm surge and inland flood—at about $6.4 billion across nine states.

Preceding that, a day after Hurricane Helene made landfall in Florida’s Big Bend region, rating agencies AM Best and Fitch Rating weighed in with estimates in the $5 billion to $10 billion range. Rating agency Standard & Poor’s joined the group last week, citing early insured loss estimates in the mid-single to low-double-digit billions of dollars. “We think the losses will be an earnings event, rather than a capital event, for the primary U.S. property/casualty insurers we rate,” S&P said, noting that an industry insured loss of $5 billion-$15 billion is not material relative to the industry’s capital and surplus base of $1.1 trillion as of June 30, 2024. The impact on individual insurers will vary, especially for small and regional carriers, S&P added.

The various estimates include provisions for damage to automobiles and well as residential and commercial property and provisions for business interruption, but only Moody’s RMS and CoreLogic have also expanded their analyses to give some indications of National Flood Insurance Program losses.

Adding $4.5 billion to $6.5 billion range for NFIP, CoreLogic’s totals for private and federal insured losses reach as high as $17.5 billion.

Moody’s RMS estimates that NFIP losses from Helene could exceed $2 billion.

“The worst impacts from this event are from inland flooding, where Helene completely devastated several towns in North Carolina, Tennessee and surrounding states with historical levels of precipitation,” said Firas Saleh, Director-U.S. Inland Flood Models, in a media statement, noting, however, that these are largely uninsured due to low levels of flood insurance penetration.

Related article: “Where Are the Private Insurers? Analyses Highlight U.S. Flood Insurance Gap“

CoreLogic also published a range of estimate on uninsured flood losses of $20 billion to $30 billion—nearly double CoreLogic’s insured loss estimates at both end of the range.

In terms of insured losses, Moody’s RMS Event Response expects the private market insured losses to be driven by wind, with a higher contribution coming from Georgia than Florida.

Raj Vojjala, Managing Director, Modeling and Analytics, Moody’s, noted that Florida has benefited from resilient building stock, adhering to improved code provisions and the requirement to “build back better” following previous hurricanes, such as Irma, Ian, Idalia. In contrast, in interior parts of Georgia and the Carolinas, building stock is older with less stringent enforcement of wind design provisions. “Many of these structures with aged roofs did not withstand damaging winds that extended far inland in Helene due to the fast forward speed of the storm,” Vojjala said.

“An unprecedented amount of treefall-related property damage, from high winds and saturated soils, further exacerbated wind losses in Georgia, making Helene potentially the worst hurricane loss in the state’s history,” he said, noting that even though Helene’s strongest winds blew in, wind losses in this event will come from the interior states.

Both insured wind and NFIP losses will be mainly in residential insurance lines, Moody’s said.

While storm surge in Florida and floods in North Carolina will also contribute notably to total private market insured losses, Moody’s expects the NFIP losses to be largely driven by storm surge in Florida, explaining that NFIP take-up in North Carolina is minimal.

For the private insurance market, the storm surge and inland flood losses will come principally from commercial, industrial and automobile insurance lines.

Noting that its latest loss estimate is isolated to Hurricane Helene-specific impacts, Moody’s also took note of impending damage from Hurricane Milton, expected to landfall on Florida’s west coast in the coming days. Where the two storms overlap, it may be difficult for claims adjusters to assign them to the event that caused the most damage, the statement from Moody’s RMS Event Response noted.

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Preparing for an AI Native Future

Preparing for an AI Native Future  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit