In initial commentaries released a day after Hurricane Helene made U.S. landfall, AM Best and Fitch Ratings both pegged insurance industry loss totals at at least $5 billion, indicating that primary insurers would bear those losses.

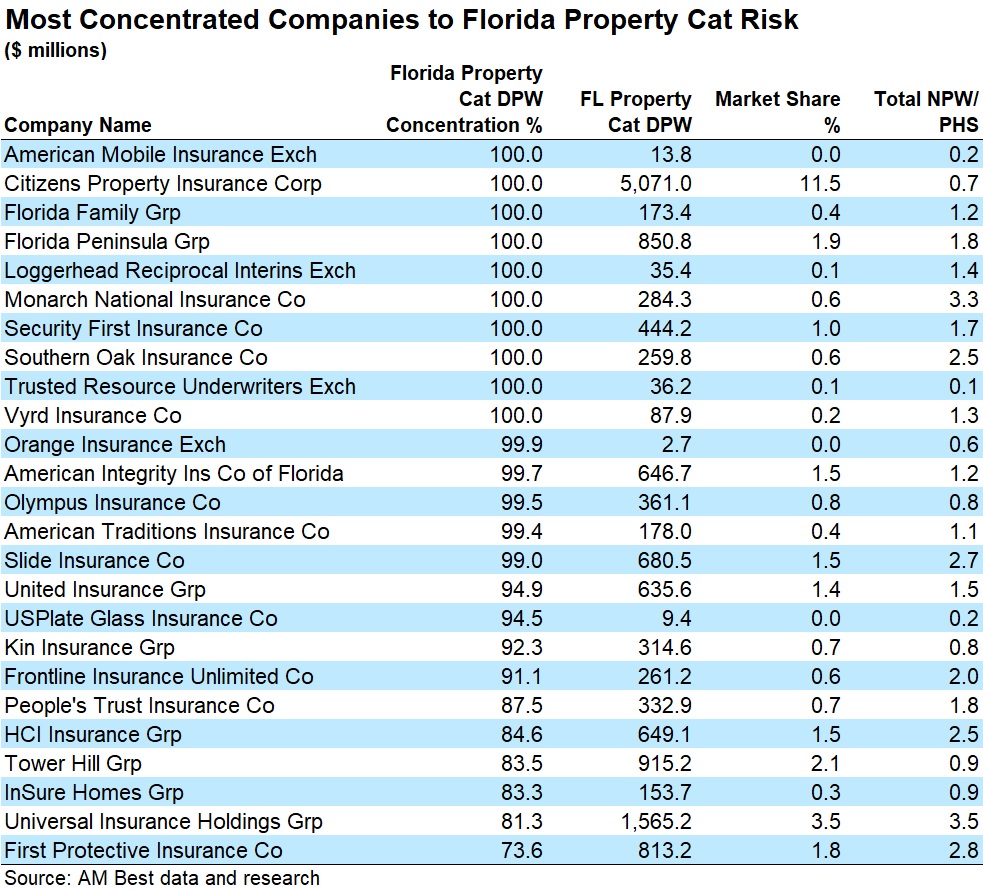

AM Best said that the storm, which landed as a Category 4 near Florida’s Big Bend, could “be a key financial test for Florida property-catastrophe specialist writers, some of which are thinly capitalized.”

Fitch, meanwhile, said that storm losses are not likely to affect credit ratings of property/casualty insurers or reinsurers, Citizens Property Insurance (AA) or the Florida Hurricane Catastrophe Fund (AA). Putting an insured loss range of $5-$10 billion on the event, Fitch said anticipated losses for individual carriers “should remain within ratings sensitivities, ample capital levels and insurers’ ability to increase premium rates.”

Breaking down potential exposure to various players, Fitch noted:

- Most large national underwriters do not have substantial market share in Florida.

- Florida’s state-owned property insurer Citizens, the insurer of last resort in Florida and market share leader for personal and commercial lines, has sufficient resources to meet current obligations.

- The same is true for the Florida Hurricane Catastrophe Fund.

“Florida homeowners’ insurance specialists will absorb losses, as Helene is likely not severe enough to trigger most excess of loss reinsurance coverages,” Fitch added.

Like Fitch, AM Best sees losses staying within the retention levels of primary insurers’ excess reinsurance programs “given the recent trend by reinsurers to impose higher attachment points on that coverage.”

Still, “losses could creep into reinsurance layers depending on the ultimate impact of the storm,” AM Best said.

“The storm will also be a test for newly formed reciprocals and the take-out companies that are absorbing policies from Citizens,” AM Best said.

According to AM Best, specialists other than Citizens—insurers with more than 70 percent of their premiums coming from coverage of Florida property catastrophes—have captured roughly 21-23 percent of the market over the last five years.

AM Best added that Florida specialists have been reporting higher loss ratios than the national property insurers writing coverage in Florida in each of the past five years, except for 2023. “While there was improvement in 2023, the market remains on the front end of this upswing with sustainability yet to be proven,” said Chris Draghi, director, AM Best.

Both rating agencies noted that the actual magnitude of insured losses will depend upon the determination of perils (i.e., flood versus wind), as well as potential business interruption losses. Fitch also noted that it wasn’t yet clear whether Florida, Georgia, the Carolinas or other states would see the most damage.

Before either rating agency published their commentaries, Guy Carpenter published a live event summary reporting that the industry likely escaped the possibility of insured losses exceeding $10 billion. That’s because the eye of Helene passed just east of Tallahassee, Fla. eliminating the highest insured loss scenarios (excluding NFIP).

Still, from a wind perspective, Helene was the strongest hurricane to make Landfall in the Big Bend region of Florida based on records dating back to 1850. Helene’s strength eclipsed an 1896 Cedar Key hurricane that landed in the same region, Guy Carpenter said.

The reinsurance broker said that the vast majority of wind losses will likely be retained by primary insurers rather than ceded to reinsurers.

As for water, Guy Carpenter said that during the earliest phase of the storm, locations south and east of Helene’s landfall near Perry, Fla. through the Tampa Bay metropolitan region saw coastal storm surge level that broke records by 2 to 3 feet. Guy Carpenter also described Helene as a “generational flood event in Southern Appalachian mountains,” with heavy rainfall spreading across the southeastern U.S. even before Helene’s landfall and continuing after.

Separately, Neptune Flood provided flood insurance statistics for states in Helene’s path, noting that only Florida saw and increase in flood insurance policies between June 2023 and June 2024. Still, according to Neptune, only 12 percent of Florida properties have flood insurance. In South Carolina, roughly 6.5 percent have flood insurance, while less than 2 percent of properties are covered for flood in Georgia and less than 3 percent in North Carolina.

In its commentary, Fitch noted that homeowners who purchase flood insurance usually do so through the National Flood Insurance Program (NFIP), adding that the levels of flooding and storm surges associated with Helene could trigger private market reinsurance coverage of the NFIP.

According to Fitch, 37 percent of the NFIP’s policies are underwritten in Florida, the highest percentage of any state. Fitch expects private reinsurers to continue pulling back from the market, noting that reinsurers would be most exposed to a loss from the NFIP’s catastrophe reinsurance from a major hurricane.

AM Best said that in addition to impacting NFIP, Helene’s flood losses may also affect the risk appetite of those insurers providing coverage within the fledgling private flood insurance market.

As for its overall $5 billion-plus insured loss estimate, AM Best explained that it was derived by making a comparison to Hurricane Idalia, which struck the sparsely populated area of Florida’s Big Bend region in August 2023, causing insured losses in the range of $2.5-4 billion (according to Verisk). “Helene’s strong wind fields stretched over a much wider area, accompanied by coastal storm surge and inland flooding,” said Jason Hopper, associate director, AM Best.

Featured Photo: Destruction is seen in the aftermath of Hurricane Helene, in Horseshoe Beach, Fla., Saturday, Sept. 28, 2024. (AP Photo/Stephen Smith)

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Five AI Trends Reshaping Insurance in 2026

Five AI Trends Reshaping Insurance in 2026  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut