State Farm was the only one of 10 major players in the homeowners insurance market reporting a worse second-quarter loss ratio for the line than it did in 2023, according to a new analysis.

The outlier result came even as State Farm, like its competitors in the space, recorded a double-digit jump in premiums, according to S&P Global Market Intelligence.

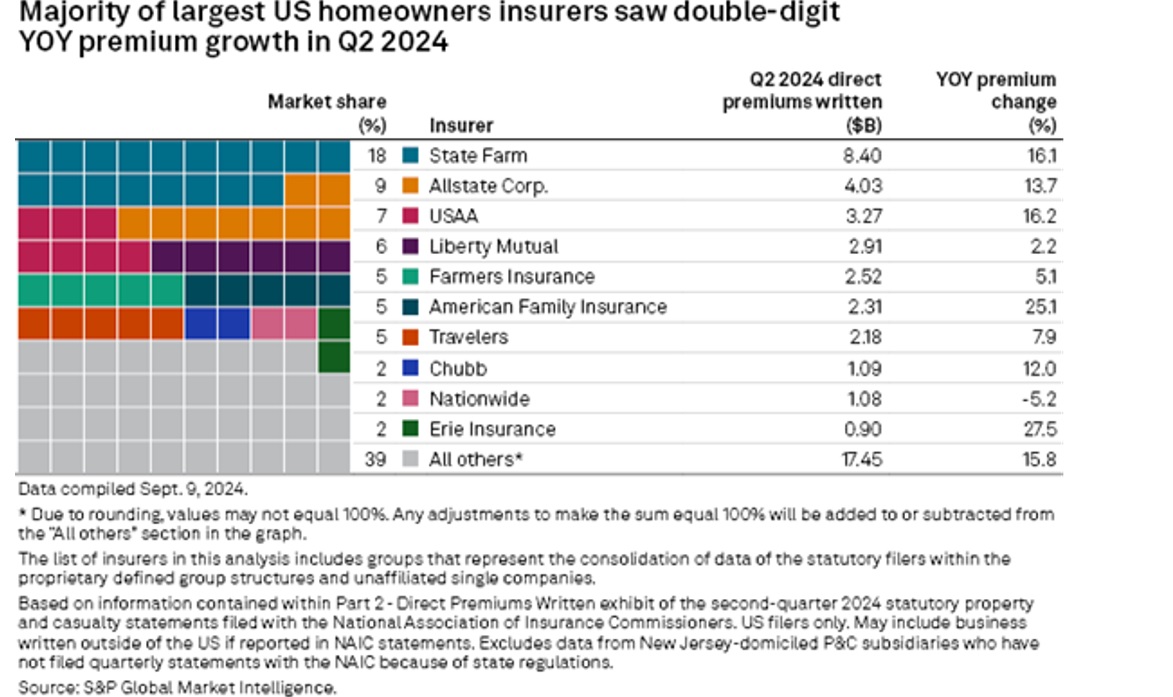

S&P GMI provided second-quarter loss ratio, premium growth and market share information for 10 large homeowners insurers and for the U.S. property/casualty industry in a new analysis this week (“Rising premiums, shrinking ratios fuel solid Q2 for US homeowners insurers” | S&P Global Market Intelligence), reporting that the industrywide second-quarter direct loss ratio dropped 12 points to 79.1 while industry direct premiums written rose 13.6 percent to $46.2 billion.

State Farm’s direct second-quarter written premiums jumped 16.1 percent year over year to $8.4 billion, solidifying the carrier’s position as the nation’s largest homeowners insurer with an 18 percent market share. But State Farm’s loss ratio went in the wrong direction, rising nearly 12 points to 94.8 in second-quarter 2024, S&P GMI reported.

In contrast, Allstate, with a market share of 9 percent, recorded a 28.1 point drop in its loss ratio—which landed at 72.8 in the second quarter of 2024 compared to 100.9 in second-quarter 2023. Allstate’s direct premiums rose 13.7 percent to just over $4 billion in the quarter.

S&P GMI’s principal research analyst Tim Zawacki said State Farm’s sharp increase in homeowners losses is mainly attributable to severe weather in the quarter, and further noted that the storm losses fueled State Farm’s worst underwriting results in a second quarter in 13 years.

State Farm had consolidated underwriting losses totaling $4.4 billion compared with $3.9 billion in the second quarter of 2023, according to Zawacki, its largest underwriting loss in a second quarter since 2011 after adjusting for inflation.

In spite of several severe weather outbreaks in the quarter, particularly in the Midwest and South, the other nine insurers analyzed by S&P GMI saw their loss ratios improve anywhere from 5.1 points (from Chubb) to 28.1 points (for Allstate).

Including Allstate, six companies experienced double-digit percentage point improvements compared to the second quarter of 2023. Among them were USAA, with a 19.5 point improvement to 93, down from 112.5 in second-quarter 2023. Travelers’ loss ratio improved 17.8-point to 86.1. compared to 103.9 in second-quarter 2023.

None of the 10 large insurers reported a loss ratio above 100 for second-quarter 2014, while half did in second-quarter 2023.

Focusing on the top line, nine of 10 companies in the analysis saw year-over-year improvement in direct written premiums, six by double-digits. Erie Insurance Exchange, a subsidiary of Erie Indemnity Co., and American Family Insurance Co. had the highest increases at 27.5 percent and 25.1 percent, respectively, followed by USAA at 16.2 percent.

Featured image: AI generated (Adobe Firefly)

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit