The U.S. property/casualty mutual segment has leaned on investment income to maintain strong overall financial performance and grow surplus in the face of underwriting volatility and severe weather-related activity, according to an AM Best report.

To combat underwriting losses and rising reinsurance costs, mutual insurers have pursued rate adequacy, with additional rate increases expected in the second half of 2024 and continuing into 2025, AM Best said.

AM Best’s report, “US Property/Casualty Mutual Insurers Resilient Despite Perpetual Volatility,” found that premiums written rose about 13 percent in 2023, which is the mutual segment’s highest growth in premium over the past decade.

AM Best found that rated mutuals reported $9.3 billion of net income through the first half of 2024, compared to an $11.7 billion net loss in the first half of 2023.

While mutual insurers have had success at obtaining more premium to cover additional losses, the solution of seeking more rate to offset costs has come with pushback, said Lauren Magro, financial analyst, AM Best.

“Insurance regulatory regimes differ by state, with some more conservative than others, leading to approval and implementation delays,” said Magro.

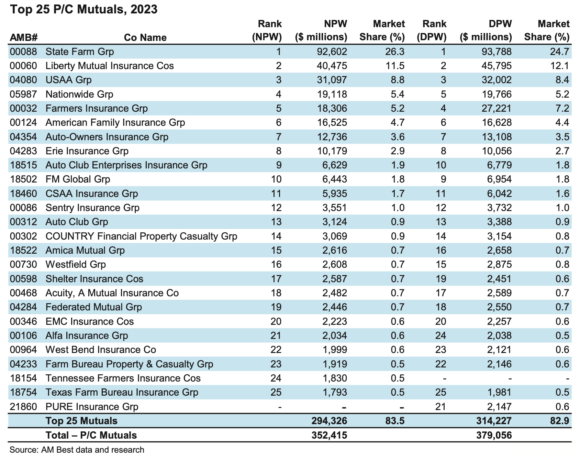

The top 10 largest rated mutual insurers account for 72 percent of net premium written, as well as 72 percent of direct premium written.

State Farm Group leads the group with a market share of approximately 25 percent, more than double that of Liberty Mutual, the next largest rated mutual.

Approximately two-thirds of mutual insurers’ products are comprised of three lines: private passenger auto liability, homeowners multiperil and private passenger auto physical damage. It’s in these lines that mutuals have applied sizable pricing adjustments, AM Best reported.

NPW in private passenger auto physical damage increased in 2023 by over 22 percent to about $12.9 billion, while private passenger auto liability and homeowners multiperil grew by by over 12 percent.

The industry rating agency said mutuals are refining their underwriting standards, with many implementing higher minimum deductibles. Some mutuals have tightened eligibility requirements by excluding dwellings or roofs that have passed a certain age. Others are diversifying exposures by tapping more into commercial lines, which are considered less volatile to severe weather events. Still, nearly two-thirds of mutuals are geographically concentrated in one state.

Many mutuals were subject to a higher degree of weather-related losses in 2023 than in 2022, AM Best said. The segment reported a combined ratio of 109.7 in 2023, driven by an increase in the pure loss ratio and partly offset by a lower underwriting expense ratio.

Meanwhile, mutuals have had a tougher time securing reinsurance coverage, and have had to pay higher reinsurance costs with tighter terms and conditions. Reinsures have cut back on some coverages, such as unlimited aggregate reinsurance.

“As catastrophe retentions rise, many mutuals are relying more on their own capital in the case of a severe event and taking these losses directly to the bottom line,” AM Best said.

Rising surplus

Policyholders’ surplus at the end of 2023 was just under $400 billion for the mutual sector—an improvement from 2022 but still lower than in 2021. AM Best said the change in surplus was mostly driven by a bounce-back in unrealized capital gains.

Bonds account for roughly 60 percent of mutuals’ portfolios, with stocks making up around 20 percent of investment allocations.

The significant increase in interest rates has led mutuals to pursue strategies to provide a more stable, definitive cash flow. More than 36 percent of rated mutuals maintain a “Strongest” balance sheet, the rating agency said, while 52 percent have a “Very Strong” assessment. The majority of surplus is found in mutuals with the highest financial rating.

“Mutuals assessed as ‘Strongest’ recorded total policyholders’ surplus of over $300 billion in 2023, significantly exceeding all other assessment levels, which cumulatively hold less than $100 billion,” AM Best noted.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk