There’s been a rise in AI -driven insurance fraud in the UK, as observed by claims handlers, according to fraud-prevention platform Sprout.ai and a survey conducted by Censuswide in July 2024.

The survey of 200 UK-based claims handlers (50 claims handlers from each of four different insurance sectors: pet, travel, health/dental, and home insurance) found that 19 percent believe that up to one in four claims now involve fake supporting documents created or altered using artificial intelligence and digital tools.

Another 64 percent estimate a 65 percent uptick in fraudulent claims since 2021.

Of those surveyed, 64 percent suspect AI has been used to create or alter documents in 5-10 percent of all claims.

“AI plays a dual role in the battle against insurance fraud. On one hand, it is a tool that fraudsters increasingly use to create fake documents, images, and data that can deceive insurers,” Roi Amir, CEO of Sprout.ai stated. “On the other hand, AI is also the most effective weapon to combat this type of fraud. Only sophisticated AI can effectively combat the fraud facilitated by other AI technologies, which the research in this report shows is on the rise.”

Some examples of AI-created supporting documentation for a claim might include altered images or receipts.

Inflation is one reason cited for the rise in insurance fraud across the globe.

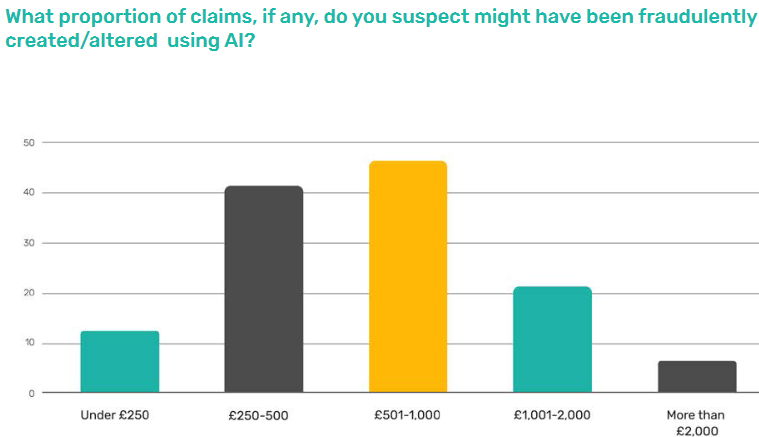

In the UK, it appears those committing insurance fraud are doing so on lower value claims, according to the survey.

Of the claims handlers surveyed, 3 percent believing that fraudsters are focusing on smaller value claims worth less than £2000.

The survey found that claims valued between £501-£1000 are particularly likely to involve AI-generated our altered evidence.

Of those surveyed, 47 percent of claims handlers report seeing documents they suspect have been altered in this value range. The documents can include photographs, maps, medical reports or valuation certificates.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes