Although Chubb, AIG, Amica and Erie outranked peers in the U.S. homeowners insurance market on measures of customer satisfaction, the compiler of satisfaction scores—J.D. Power—believes customers aren’t at all satisfied with many other insurers.

They’re just stuck, a media statement about the recently released J.D. Power 2024 U.S. Home Insurance Study suggested without using exactly that word to describe an availability problem faced by shoppers seeking replacement carriers.

“The average shopping rate among home insurance customers has climbed to a record high of 6.8 percent through the second quarter of 2024, up from 5.9 percent two years ago,” said Breanne Armstrong, director of insurance intelligence at J.D. Power. “Many shoppers have ended up staying put because there are so few alternatives available, but carriers need to recognize that steady rate increases put policy retention at risk and has a negative effect on customer satisfaction.”

In fact, only 2.2 percent of homeowners switched coverage, J.D. Power said, reporting that the figure is down from 2.5 percent two years ago.

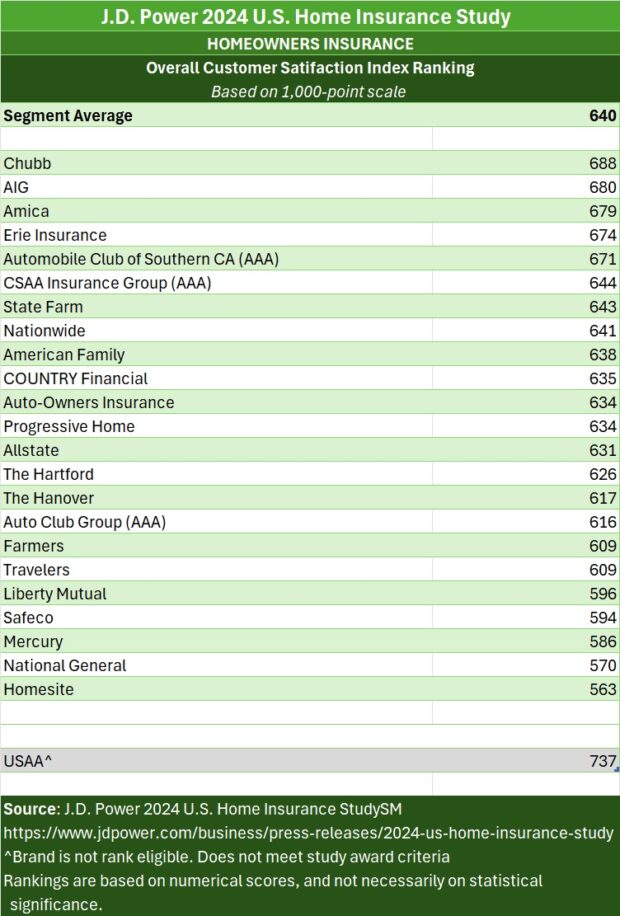

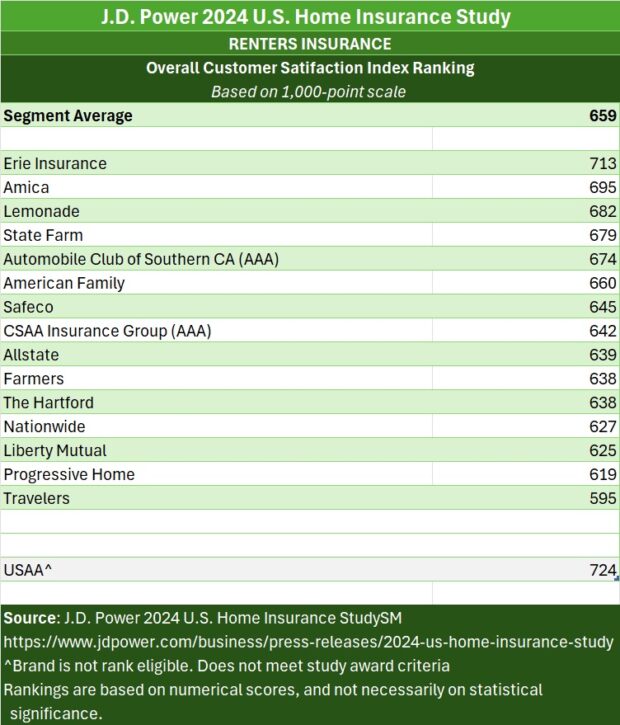

Overall, the average customer satisfaction score landed at 640 (on a 1,000-point scale) for homeowners insurance carriers studied. It was 659 for providers of renters insurance. Determining how the average satisfaction level compares with prior years is no longer possible because J.D. Power redesigned its scoring methodology this year.

This year’s analysis, however, does provide a comparison of satisfaction scores for customers who were faced with rate hikes against those who were not. Those having to deal with insurer-initiated rate jumps gave their carriers marks that translated to a score of 594, on average, while the overall satisfaction score for those seeing flat or declining rates came in at 686.

While J.D. Power’s media statement suggests that rising prices are a key driver of decreased satisfaction with homeowners carriers this year, only a slim majority—56 percent of the customers responding for the study—faced insurer-initiated rate increases, J.D. Power told Carrier Management.

For those that did face the prospect of higher premiums, survey results revealed that clear communication from insurer to customer could greatly reduce the likelihood that the customer would shop for a new carrier. According to the J.D. Power announcement, customers who understood the reason for the increase were 14 percentage points less likely to shop for a new policy than those who do not understand the reason for the rate increase.

How Insurers Rank

Among individual carriers, Chubb ranked highest in the homeowners insurance segment, with a score of 688. In 2023, Chubb, which focuses on serving high-net-worth customers in its personal lines business, ranked close to the bottom, coming in 15th among 21 carriers back then.

Related article: GEICO Tops Progressive With Higher J.D. Power Scores

Addressing questions about double-digit premium growth in its North American personal lines business this year during a second-quarter earnings conference call, Chubb Chief Executive Officer Evan Greenberg noted that the carrier experienced broad-based growth across the nation—not simply growing in catastrophe-exposed areas—and he attributed the growth to differentiated coverage and service.

“We are not the cheap guys on the street. And in fact, there are many [people] who I personally will tell ….if you’re looking for a cheaper price, let me give you the name of three other insurance companies. But no, they want Chubb. And the renewal retention rate and the growth in new business [is] very gratifying that way,” he said.

Greenberg reported that Chubb’s high net-worth personal lines division is almost a $7 billion business, and that Chubb’s homeowners pricing was up 14.6 percent in the quarter, while the loss-cost trend remained steady at 10.5 percent.

“We’re getting improved rate to exposure….We’ve worked on it for years now, [and] our ability to price the business is far more sophisticated. And our by-peril pricing is very sophisticated,” he said.

“If you are a customer whose profile meets our product, we are who you want because the richness of the coverage and the way we administer it,” he said, referring to services that command high prices. “That’s what our brand is well known [for]. And there is a real increase in demand for Chubb,” he stated.

He continued: “We’re improving constantly improving our services, and [improving] the way we communicate with our customer. And that is in front of us,” he said, promising continued improvement.

Behind Chubb in this year’s J.D. Power ranking this year were AIG, ranked second with a score of 680, followed by Amica (679) and Erie Insurance (674). While Amica has previously ranked first or second in every study dating back to 2013 (the first year that CM covered the reports), and Erie has regularly ranked in the top five (garnering the top spot in 2023), AIG is a newcomer to the top ranks. AIG first broke into the top 10 in 2021 and ranked fourth in 2023.

For the renters insurance, Erie Insurance ranks highest for a second consecutive year, with a score of 713. Amica (695) ranks second and Lemonade (682) ranks third.

To Bundle or Not

Another aspect of the homeowners insurance buying experience that J.D. Power regularly investigates is the incidence of bundling home and car insurance. According to the 2024 study, bundling home and auto policies declined sharply in 2024 compared with 2023.

J.D. Power reports there is growing intent to switch auto insurance without switching home insurance.

According to the latest study, only 21 percent of customers say that if they switch their auto insurance, then they “definitely will” also switch their home insurance. That frequency of that response is down from 24 percent a year ago.

The J.D. Power U.S. Home Insurance Study is based on responses from 14,122 homeowners and renters via online interview conducted from November 2023 through July 2024.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Preparing for an AI Native Future

Preparing for an AI Native Future