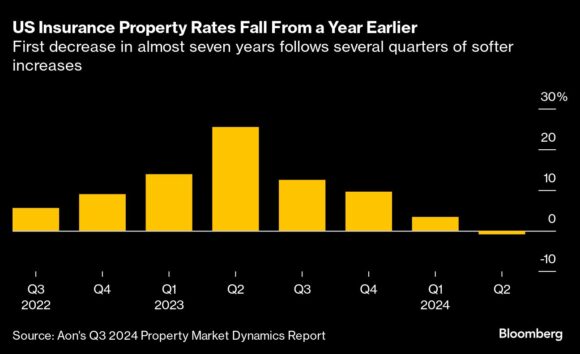

U.S. property insurance rates are decreasing for the first time in almost seven years, after insurers returned to profitability amid lower losses tied to catastrophes.

The average U.S. property insurance rate decreased 0.94 percent in the second quarter from a year earlier, following several periods of softening increases over the past year, according to a property market report from Aon Plc. It’s the first time rates have decreased since the third quarter of 2017.

“We, along with our clients, are excited that rates are finally decreasing,” Vincent Flood, Aon’s U.S. property practice leader, said in an interview. “Clients definitely had rate fatigue.”

In recent years, more frequent losses weighed on U.S. insurers’ profitability, leading rate increases to surge past 30 percent in the third quarter of 2020. Then, rising interest rates put further pressure on the sector as investors left the reinsurance market in search of alternative investments, Flood said.

Last year, lower losses from catastrophes meant insurers returned to profitability, allowing them to allocate more capital to their property insurance businesses, boost their growth ambitions and adopt aggressive pricing strategies.

Rate moderation is expected to continue in the current quarter and could persist if losses tied to catastrophes remain low during the last months of the year, according to Flood.

“If we were to have a significant event, then I would see the market stabilizing again,” he said. “But absent of that, I think we’ll continue to see rates decline in 2025.”

Photo: Daniel Acker/Bloomberg

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster