Nuclear verdicts in the United States are breaking records with 27 court cases each awarding compensation of more than $100 million during 2023, according to a compilation published this year.

Swiss Re executives shared the figure, first published by Marathon Strategies in May, during a press briefing at the reinsurance Rendez-Vous de Septembre in Monaco, as they introduced attendees to a newer data point—a 7 percent jump in Swiss Re Institute’s new social inflation index for the U.S. in 2023.

The 7 percent figure represents a 20-year high, said Dr. Jérôme Jean Haegeli, group chief economist for Swiss Re, pointing to litigation costs from mega-jury awards as a driver of the figure. (Online bonus article: “Quantifying Social Inflation: How Swiss Re Developed an Index“)

Joining Haegeli at the briefing to discuss a Swiss Re report on social inflation and litigation trends was Gianfranco Lot, chief underwriting officer, property/casualty reinsurance.

“Social inflation is super costly for consumers, corporations and insurance companies as well,” Haegeli said, noting that social inflation now exceeds economic inflation as the main casualty-claims driver, leading to underwriting losses, higher premiums and reduced insurance capacity.

Swiss Re defines social inflation as the increasing severity of liability claims beyond that explained by economic factors.

“U.S. commercial casualty insurance losses grew by an average annual rate of 11 percent over the last five years, reaching $143 billion in 2023,” said Swiss Re Institute’s sigma report, titled “Litigation costs drive claims inflation: indexing liability loss trends.”

The U.S. casualty claims total was 33 percent more than global insured losses from natural catastrophes of $108 billion in 2023.

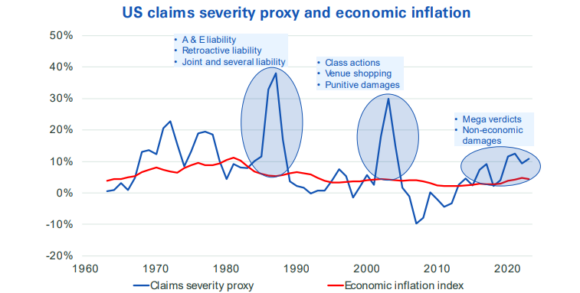

To put this number into context, the U.S. casualty claims total was 33 percent more than last year’s global insured losses from natural catastrophes of $108 billion in 2023, the report said, noting that the current cycle of social inflation has existed in the U.S. since around 2015. (Other social inflation cycles have occurred in the mid-1980s and the late 1990s. See accompanying graphic.)

Source: S&P Capital IQ, Swiss Re Institute; Note: A&E refers to asbestos and environmental.

Claims severity proxy is on a calendar year basis.When insurers and reinsurers began incurring losses and saw these negative trends during the current cycle, they started to re-underwrite their books and cut limits, which has had an impact on the supply of insurance and reinsurance, Lot explained during the press briefing.

The report noted median limits purchased for liability towers (or stacked liability insurance programs) declined by an average of nearly 25 percent in nominal terms and 46 percent in inflation-adjusted terms between 2014 and 2023, which was a period of increasing loss costs.

Lot pointed to industry sectors that have seen casualty limits drop precipitously over the past decade, such as the construction industry, which has seen limits drop by approximately 60 percent, manufacturing by 39 percent and the chemical industry by 50 percent (referencing a June 2024 report published by Chubb Limited, “Liability Limit Benchmark & Large Loss Profile by Industry Sector 2024”).

In addition, the number of insurance panel participants has risen by 25 percent over the past 10 years, Lot said.

Social inflation “is leading to reduced capacity in the insurance market,” said a Swiss Re representative in an emailed statement. “The rate environment has not kept up with loss trends, which means that insurance companies need to find ways of reducing exposure. One way is to limit the shares that insurers are willing to sign in the programs. The need for insurance is still there, so to be able to place the risk in insurance programs, more panelists are needed.”

At the same time, insurers responded by raising premiums. “[B]y the first half of 2024, U.S. liability premium rate increases had re-accelerated to 7 percent year-on-year, from 3-5 percent in the preceding six quarters, defying a broader deceleration of commercial insurance rates,” Swiss Re said in the report, referencing information from Marsh’s Global Insurance Market Index (2Q24: U.S. casualty excluding workers compensation).

“Insurance rate increases have not compensated for rising loss costs, raising combined ratios for bodily injury-exposed liability lines and delivering cumulative underwriting losses of $43 billion between 2019-2023,” said Haegeli and Lot in their presentation.

The report explained that the five-year average (2019-2023) direct combined ratios (via exposure to bodily injury claims) have been 105 for other liability occurrence, 109 for commercial auto liability, and 106 for medical malpractice, with cumulative underwriting losses for these three lines over the same period totaling $43 billion.

Haegeli noted the 7 percent rise in social inflation in the U.S. in 2023 is “double the size of what has been seen in the last 10 years, but it’s not reflected if you look at the insurance rates.”

The report cautioned that social inflation ultimately can lead to insolvency for insurers, reinsurers and their customers. “Persistent and underpriced social inflation can ultimately affect the insurance industry’s ability to provide risk transfer, the lack of which causes significant disruption at local and national level,” the authors said. “For example, one of the main causes of the collapse of Australian insurer HIH in 2001 was persistent under-reserving of long tail-lines, specifically on account of an under-estimation of the effects of social inflation.”

Haegeli said the trucking industry is one of the sectors most affected by mega verdicts and, as a result, could be at risk of insolvency if they can’t buy adequate insurance coverage.

“If you don’t have the capacity for the right price to provide to the insureds, then the real economy is always going to be exposed more to bankruptcies,” he said during the press briefing. “So, it’s not just the cost of insurance which matters here. If [insurance is] less available because the price is not right, then you are exposing companies to more insolvencies. So, corporate America is also exposed.”

The report noted some trucking companies are reducing excess coverage to manage costs, as these covers are seeing rate increases of more than 75 percent.

“According to a 2023 report by the U.S. Chamber for Commerce Institute for Legal Reform, there are fewer insurers in the trucking market today, and many of the ones left now offer reduced coverage,” the report added. “This means trucking companies are finding it increasingly difficult to secure adequate insurance cover and are being forced to assume more risk than they have in the past.”

Drivers of Social Inflation

The Swiss Re report attributed the outsized jury awards in the U.S. principally to bodily injury cases, which can generate outsized awards. “Driving factors include the trial bar’s use of psychology-based strategies and litigation funding, as well as jurors’ attitudes to issues like social injustice and negative sentiment toward corporations,” Swiss Re suggested.

The five-year average (2019-2023) direct combined ratios have been 105 for other liability occurrence, 109 for commercial auto liability, and 106 for medical malpractice, with cumulative underwriting losses for these three lines over the period totaling $43 billion.

While the U.S. is the epicenter of social inflation and it is a predominantly U.S. phenomenon, other countries such as Australia, UK and Canada show signs of social inflation and share some of the driving forces such as the expansion of mass tort, but these countries are “not as exposed to runaway awards,” said the report.

“Tort law in continental Europe differs significantly from the U.S., primarily due to the absence of juries and the influence of civil law traditions. In most European countries, tort cases are adjudicated by professional judges rather than juries,” the report said, acknowledging, however, that class actions and litigation funding are growing rapidly in Europe.

The report went on to discuss the impact of third-party litigation funding (TPLF)—a process through which commercial or consumer litigants and law firms finance their case and other legal costs with the help of third-party investors.

“TPLF is correlated with higher awards, longer cases and greater legal expense. Litigation funding is also inefficient as more than half of the awards remain within the professional litigation industry,” the report said. (Source: The latest sigma report references an earlier 2021 Swiss Re Institutes report, “U.S. litigation funding and social inflation: the rising costs of legal liability,” which cites an October 2018 report from the U.S. Chamber Institute for Legal Reform, “Costs and Compensation of the U.S. Tort System,” for the inefficiency statistic and 2019 and 2020 data from Morning Investments for the insights on the length of cases.)

“We expect social inflation in the U.S. to continue for the foreseeable future, and that it will remain mostly a U.S. phenomenon,” said Swiss Re in a commentary accompanying the report. “While economic inflation is abating, there are no signs of a let up in social inflation pressures. And in our view, the current rate of increase is unsustainable: We estimate the impact on casualty business in the U.S. will outweigh the earnings benefit of higher interest rates within one to two years.”

Based on current trends, Swiss Re estimates that the impact of social inflation will outweigh the benefit of higher interest rates on casualty lines in one to two years.

It cited several steps that could help resolve the growing problem such as “tort reform, regulation of the use of third-party litigation funding, in particular around disclosure rules, risk mitigation at the corporate level and, in the insurance industry, use of new technology and data analytics to improve underwriting discipline and claims management, and more proactive preparation of defense cases insurance.”

The first significant wave (cycle) of runaway social inflation occurred during the U.S. liability crisis of the 1980s when changes to legislation and case law significantly expanded the scope of tort liability, the report explained. “Corporations and their insurers were retroactively held liable for environmental damage and huge asbestos-related claims.”

The market eventually returned to balance when tort reform measures slowed rapidly rising liability costs, while insurers and reinsurers moved to re-underwrite their asbestos and environmental risks. “A subsequent focus on insurability and alternative risk transfer restored market balance.”

***

Beyond Tort Reform

Beyond Tort Reform

External fixes like tort reform and third-party litigation funding disclosures are some often-cited methods for reining in escalating jury verdicts and settlement values that continue to worry liability claims professionals and insurance industry executives. But Carrier Management asked several executives and a defense lawyer to look inward instead—at adversarial claims handling tactics in place now that some say are working to inflate social inflation—and to identify industry best practices that will stem the tide of rising claims severity. Read their viewpoints in these articles:

- Unite and Conquer: How the Insurance Industry Can Deflate Social Inflation

- A New Claims Playbook: United and Street Smart on Litigation Demands

- Defense Lawyer’s Perspective: Connecting Insurers, Promoting Plaintiff-Style Solidarity

Those articles are featured in CM’s fourth-quarter magazine, “Unite and Conquer: Industry Battles Social Inflation.” (Download a PDF for free access to all articles in the magazine or become a Carrier Management member to unlock every feature article we publish.)

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Preparing for an AI Native Future

Preparing for an AI Native Future  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford