Fitch Ratings published midyear underwriting results for 19 non-life reinsurers last week, finding that the group’s average first-half 2024 combined ratio was 84.2, and forecasting continued profits for the rest of 2024 and 2025 also.

But while reinsurers will continue to maintain underwriting discipline and achieve favorable returns in 2025, “margins will peak in 2024,” Fitch Ratings analysts stated in their midyear 2024 report.

“Fitch anticipates that market conditions will continue to support attractive returns for reinsurers into 2025, as rates are generally adequate with supply and demand having reached a balance,” says the report, in which Fitch analysts also estimate that non-life reinsurance net written premiums increased by 6 percent in first-half 2024 from first-half 2023.

The premium growth reflects “strong performance during the reinsurance renewals, as market conditions remained favorable,” the report says.

While premium growth is likely to continue, it will happen “at a reduced pace as the market becomes more competitive,” the report says.

The report refers to a point of equilibrium that the reinsurance market has reached “with increased capital supply from accumulated earnings meeting higher demand for reinsurance protection from cedents.”

Having already met this equilibrium, “Fitch expects market rates to be mostly flat in 2025 and terms and conditions to broadly hold steady,” the report says, supporting the forecast for a profit margin peak in 2024.

Still discipline remains a feature of the 2024 and 2025 reinsurance markets, the report suggests pointing to limited new capacity entering the market, deteriorating U.S. casualty loss cost trends from social inflation, as well as heightened catastrophe and climate change risk.

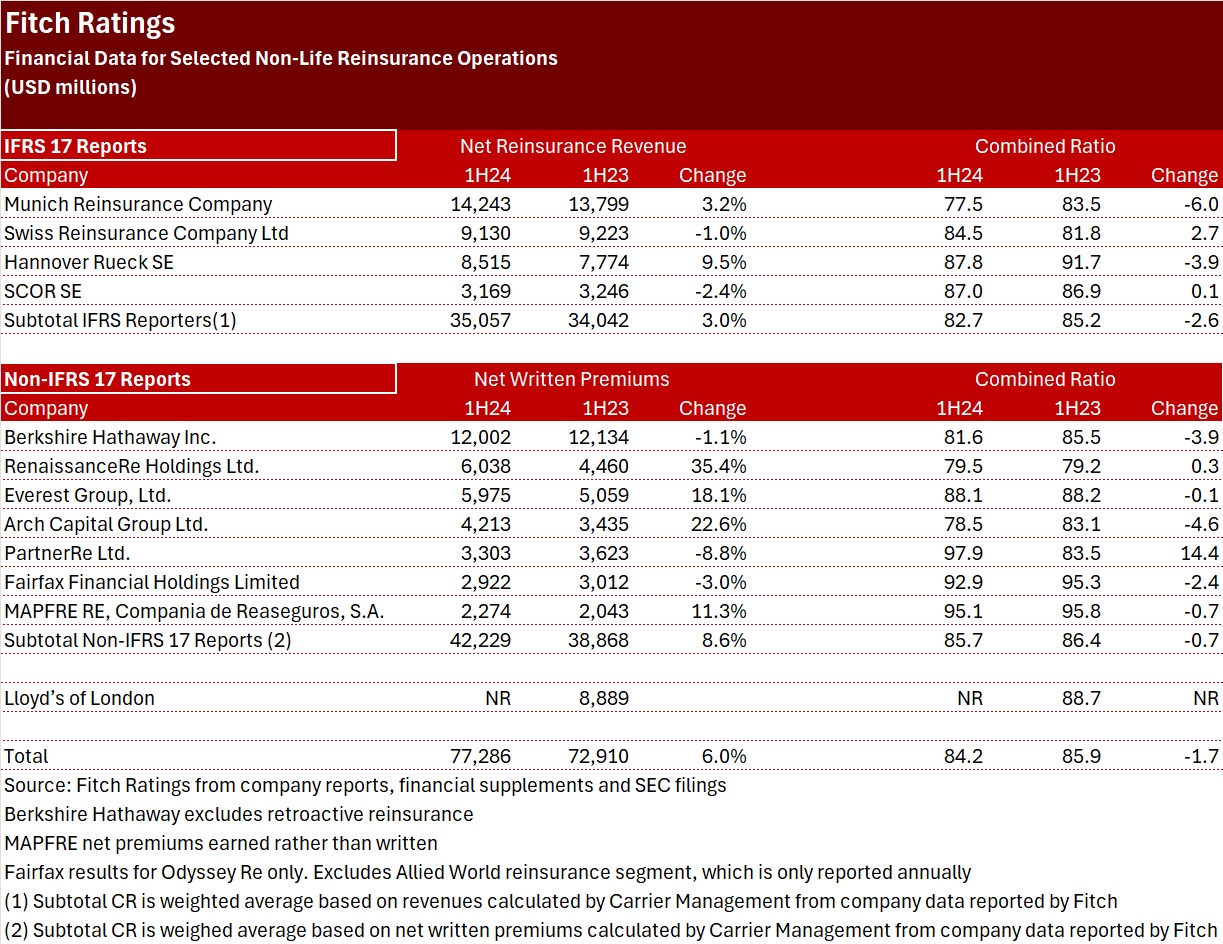

The report includes charts of revenues, combined ratios and shareholders equity for four reinsurers, which are reporting results using a new accounting standard, IFRS 17, and for 15 additional reinsurers. Below, we have excerpted some of the results to show all four of the IFRS 17 filers and seven of the others—those with net written premiums $2 billion or more.

For those reinsurers using IFRS 17 as their accounting standard, the report shows reported non-life reinsurance revenue rather than net written premiums, and the IFRS 17 reporters combined ratios include the impact of discounting.

Overall, the aggregate combined ratio for the 19 reinsurers, at 84.2, improved from 85.9 in first-half 2023. For the first-half 2024 period, the combined ratio included roughly 5.9 points attributable to catastrophe losses—down from 6.9 points in the same period last year. And loss reserve development was about 0.5 points less favorable—shaving 2.8 points off the combined ratio for the 19-company group this year, compared to 3.3 points last year.

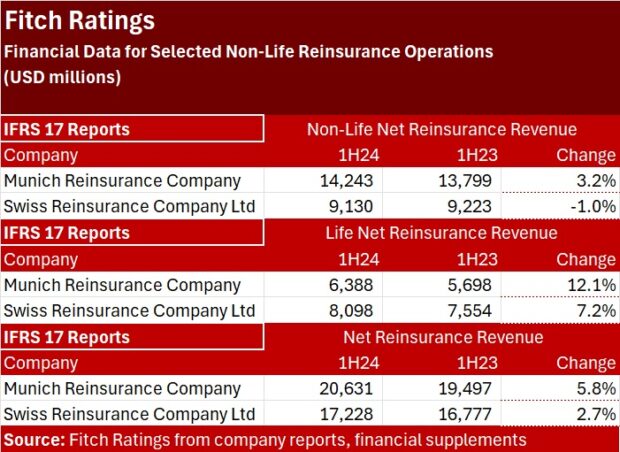

An appendix to the report also shows life reinsurance results for eight of the reinsurers, including all four of the IFRS 17 reporters.

Adding together the non-life and life reinsurance revenues for the two biggest—Munich Re and Swiss Re—produces a bigger total for Munich Re through the first six months of the year. Fitch’s analysis shows Munich Re’s first-half 2024 net reinsurance revenue at $20.6 billion—$14.2 billion for non-life business and $6.4 billion, life. Swiss Re’s first-half total revenue comes in at $17.2 billion—adding its $9.1 billion of non-life premiums and $8.1 billion in life premiums for the period.

Varying Results

While Fitch calculated a 6 percent overall growth rate for the 19 non-life reinsurers and a 1.7-point improvement in the combined ratio during the first-half of 2024, a handful reported outsized premium growth and nearly half saw their combined ratios rise.

On the growth front, RenaissanceRe’s net written premiums soared 35 percent in first-half 2024 compared to first-half 2023. Fitch reported that this was driven by the renewal of business acquired in its acquisition of Validus Holdings, Ltd. from American International Group, Inc. in November 2023.

Among the larger reinsurers, Everest and Arch Capital each reported premium growth near 20 percent. Smaller players, Hamilton Insurance Group and Aspen Insurance Holdings posted first-half jumps of 38 percent and 30 percent to $788 million and $571 million, respectively.

Reinsurers recording premium declines included PartnerRe (-8.8 percent), AXIS Capital Holdings (-6.3 percent) and SiriusPoint (-3.9 percent). According to Fitch, AXIS increased premiums ceded to a quota share retrocession agreement, while SiriusPoint had lower net premiums in U.S. casualty and Bermuda specialty.

While nine of the 19 reinsurers saw their combined ratios deteriorate anywhere from 0.1 point to more than 14 points, PartnerRe was on the high end of the group, with its first-half 2024 combined ratio rising 14.4 points to 97.9. SiriusPoint’s combined ratio rose 13.9 points to 87.3 in first-half 2024.

The Fitch report also includes discussions of potential merger and acquisition activity in the global reinsurance sector and the impact of alternative capital.

- Reinsurance M&A deals could return as organic opportunities slow and the market inevitably turns soft again.

- Fitch expects continued strong supply growth in the alternative reinsurance capital market into 2025, barring substantial ILS catastrophe losses in second-half 2024.

On the bottom line, Fitch said that the 19 reinsurers analyzed in the report generated net income return on equity of 19.9 percent in first-half 2024—right in line with a 20.1 percent ROE result for first-half 2023.

SCOR SE was the only company to report a net loss driven by a charge in its life-health business, Fitch said.

Otherwise, “underwriting gains remained solid and investment results remained positive, with strong equity market returns and higher reinvestment yields.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs