Every year around this time, AM Best publishes a single list of the “World’s 50 Largest Reinsurers,” ranked based on unaffiliated gross premiums recorded in the prior year.

The latest installment, based on 2023 information, looks jarringly different.

The fact that some global reinsurers started to report results using a new accounting standard, IFRS 17, complicated AM Best’s typical analysis. Uneven adoption of IFRS 17 across the universe of global reinsurance prompted the rating agency to bifurcate its annual ranking into two sets of reinsurers.

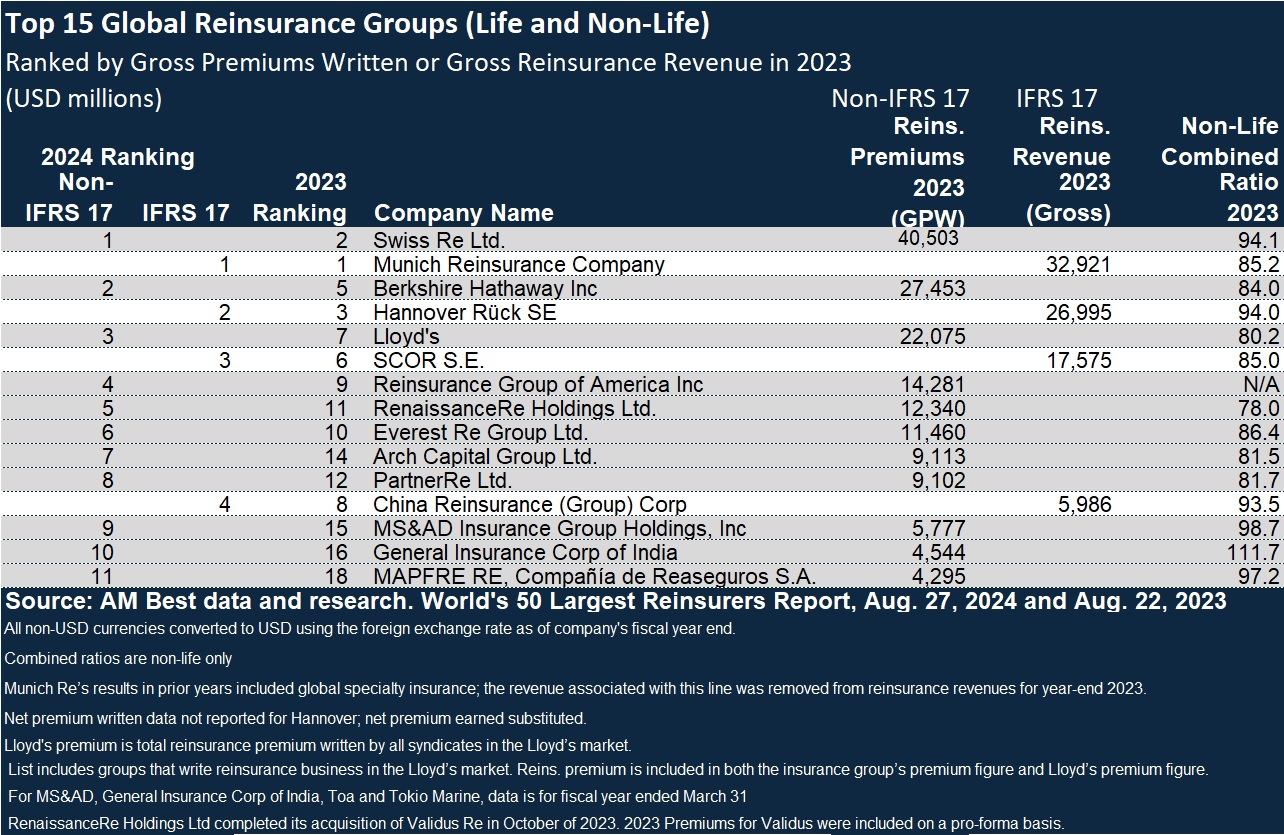

The excerpt of AM Best’s latest top 50 presented below, showing 15 of the largest reinsurers commingled on one chart, gives some sense of the level of complexity, which is fully appreciated by anyone in the U.S. who has tried to compare results of Asia and European insurers and reinsurers with North American counterparts.

The chart above doesn’t show the numbers 1 through 15 written down the first column. And the full chart in the AM Best report doesn’t display the numbers 1 through 50 in that column either. Instead, the rank order is displayed in two separate columns—a Non-IFRS 17 rank for those reinsurers that did not yet (or won’t) implement the new standard, and an IFRS 17 rank for those that did. (Bermuda-domiciled reinsurers, for example will continue to use U.S. GAAP accounting for their reports, Best notes.)

For the Non-IFRS 17 group, AM Best still sorts the list based on gross written reinsurance premiums. For IFRS filers, reinsurance revenue is used instead. According to AM Best, IFRS revenue is composed of different components from premium written and earned used in the prior standard, IFRS 4, and the revenue metric is no longer directly comparable to U.S. GAAP premium. The report notes that the reinsurance revenue recorded under IFRS 17 is meant to reflect “the expected amount earned for insurance service as it is rendered.”

“Ultimately, insurance revenue is different from premium received or written during the period,” AM Best states.

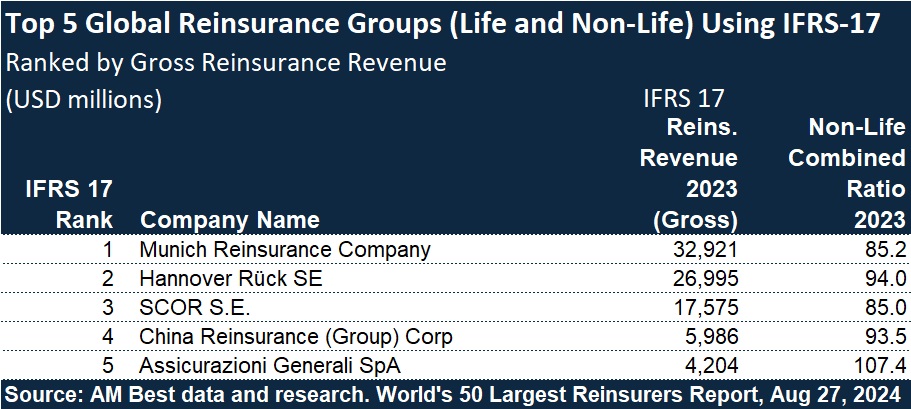

In this year’s AM Best “World’s 50 Largest Reinsurers” report, companies that adopted IFRS 17 for 2023 are ranked 1 to 15 based on gross reinsurance revenue; companies that report under non-IFRS 17 are ranked 1 to 35 based on the more-traditional gross written reinsurance premium measure.

Above, Carrier Management excerpted the top 4 from the IFRS 17 cohort, and the largest 11 non-IFRS 17 reinsurers to assemble a collection of 15.

Who’s the Biggest?

Under the bifurcated approach, AM Best ranks Munich Reinsurance Co. as the largest IFRS 17 reporting reinsurer based on nearly $32.9 billion in 2023 reinsurance revenue, followed by Hannover Rück SE ($27 billion) and SCOR SE ($17.6 billion).

Among non-IFRS 17 reinsurers, Swiss Re Ltd. is the largest, with $40.5 billion in 2023 gross premium written, followed by Berkshire Hathaway, Inc. ($27.5 billion) and Lloyd’s ( $22.1 billion).

For many years, Munich Re and Swiss Re have occupied the top two spots on AM Best rankings, and however you slice it, the two European giants remain the largest global reinsurers.

Last year’s less complicated ranking, based on 2022 data, showed Munich Re outranking Swiss Re with Munich Re’s 2022 gross written premiums totaling $51.3 billion and Swiss Re coming in at $39.7 billion. This year’s AM Best report notes, however, that the $51.3 billion for Munich Re included global specialty insurance, which was removed from gross reinsurance revenue for 2023.

The two reinsurers are using different accounting standards from one another this year, but this will change once Swiss Re adopts IFRS 17, the report notes.

(Editor’s Note: Swiss Re has now adopted IFRS 17. In a separate report, Fitch Ratings, displays financial information for the first-half of 2024, on a net of reinsurance basis, including IFRS 17 revenue figures for both reinsurers. Fitch’s analysis shows Munich Re’s first-half 2024 net reinsurance revenue at $20.6 billion—$14.2 billion for non-life business and $6.4 billion, life—while showing Swiss Re below that with $17.2 billion—$9.1 billion non-life and $8.1 billion life.)

In a sidebar to the AM Best report, which provides some more information about IFRS 17 accounting changes, AM Best analysts note an overall anticipated sharp decline in revenues reported under the new accounting standard. The sidebar indicates that the analysts did a comparison of gross premiums used in audited financial statements in 2022 and restated 2022 figures under IFRS 17 for 14 companies, finding that the IFRS 17 reported revenue, in the aggregate, was 31.3 percent lower than pre-IFRS 17 gross written premiums. “Non-life reinsurers with a large proportional treaty book tend to see a larger reduction,” the report says. (The report explains this by noting that under IFRS 17, part of the commission is considered an investment component—”an amount that will be paid to cedents regardless of whether an insured event occurs”—and that this is excluded from insurance revenue.)

The sidebar also gives a high-level overview of how reported equity and combined ratios are likely to change as reinsurers move from IFRS 4 to IFRS 17.

The Biggest Movers

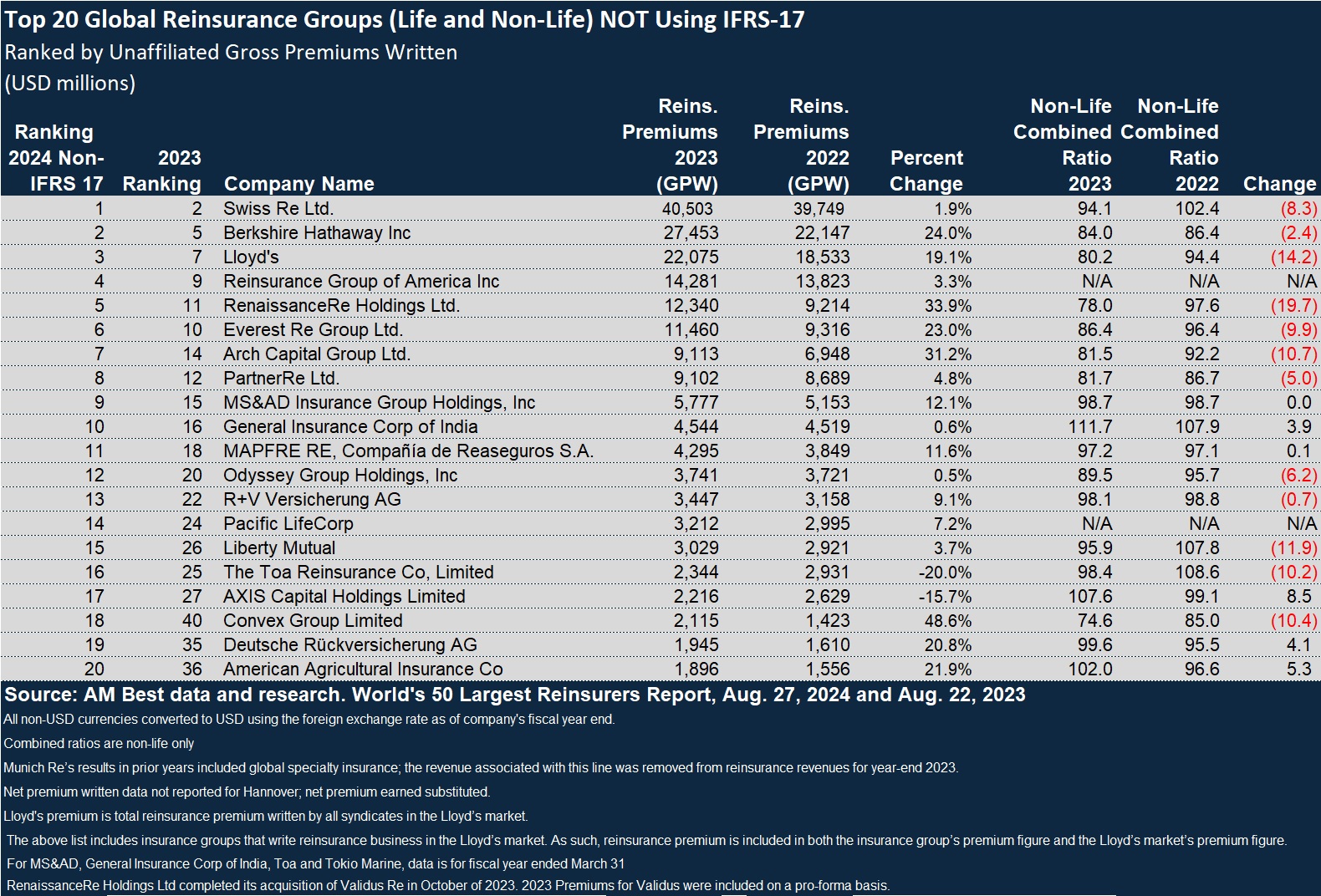

No matter how the horse race between Munich Re and Swiss Re plays out in future years, based on 2023 data for non-IFRS reporters, a handful of North American reinsurers outpaced everyone else in terms of premium growth.

- Everest Re, for example, saw gross premiums rising 23 percent to $11.5 billion from $9.3 billion.

- With $12.3 billion of gross premiums in 2023, RenaissanceRe displaced Everest in the overall ranking. RenRe’s recent acquisition of Validus Re contributed to a 33.9 percent jump in premius for the Bermuda reinsurer.

- With $9.1 billion in gross premiums, Arch Capital Group and PartnerRe rank below RenRe, but Arch Capital was the bigger sprinter of the two, vaulting over Partner Re with a 31.2 percent jump, compared to Partner’s lower 4.8 percent rate of growth.

Aggregating the results, the report notes that for the top 35 non-IFRS 17 companies, total reinsurance gross premiums written rose by more than 6 percent during 2023, driven primarily by strong rate increases rather than exposure growth.

Other reinsurers reporting larger-than-average premium jumps appear near the opposites ends of AM Best’s Top 50 list.

Berkshire Hathaway saw 24 percent growth in reinsurance premium, to $27.5 billion in 2023, while relative newcomer, Convex, with less than one-tenth of Berkshire’s volume, saw its premiums grow 48.6 percent to $2.1 billion in 2023.

Convex, founded in 2019, also reported one of the lowest combined ratios of the non-IFRS 17 cohort in 2023 at 74.6. Only the smallest company on AM Best’s list, Hamilton came in with a lower combined ratio of 68.4.

Most non-IFRS 17 reporters saw better combined ratios in 2023, with Everest, RenRe and Arch’s ratios improving by roughly 10 points or more based on figures presented in the latest AM Best ranking report and the prior one (published in August 2023).

AXIS Capital reported the largest deterioration in its combined ratio for the non-IFRS 17 grouping, and also saw its premium decline.

How Else is IFRS 17 Different?

In the AM Best report sidebar about IFRS 17, the authors noted that the comparison of 14 2022 balance sheets under IFRS 4 vs. IFRS 17 revealed variations in reinsurers’ equity, with equity declines more concentrated among companies with larger life insurance portfolios, while P/C equity positions typically benefitted somewhat.

Turning to underwriting KPIs, the analysts said that combined ratios are generally lower under IFRS 17, with a requirement for discounting of claims reserves contributing to the difference.

In addition to the discussion of IFRS 17 in the “World’s 50 Largest Reinsurers” report, AM Best also published a separate report, “IFRS 17 — Economic View Adds Complexity to Reinsurers’ Financial Statements,” to explain what’s changing in more detail.

In general, the report notes that the change in the accounting standard is more radical for life reinsurers than P/C reinsurers. “For the life business specifically, the standard allows for a more meaningful and accurate representation of earnings. The move will also impact some longer-tailed lines of property/casualty business, albeit to a smaller extent.”

More specifically, the report says:

- A key difference between IFRS 17 and IFRS 4 is the focus of IFRS 17 on recognition of an insurance contract’s profit over the duration of the insurance coverage.

- Under IFRS 17, discounting is now normally required for all insurance contract liabilities.

- The discount requirement is somewhat offset by a requirement for an explicit risk margin.

- Under IFRS 17, reinsurers have typically seen a greater overall impact on combined ratios than the direct market has.

- IFRS 17 introduced new elements to account for the liability components of insurance contracts: risk adjustment and contractual service margins for longer duration policies.

- Insurance service revenue replaces premium written as the revenue line in income statements.

With respect to discounting, AM Best notes that significantly lower discounted loss reserves—now called insurance contract liabilities—has driven equity positions up. The discounting impact, however, could be partly dampened with a Risk Adjustment (RA), an adjustment for the level of uncertainty about the timing and amount of cash flows.

According to the report, the effect of unwinding the discount and the effect of changes in discounting and yield curve assumptions over time are presented in the insurance finance result, which is separate from insurance service result.

The report also describes new concept introduced by IFRS 17, the contractual service margin (CSM), which represents the present value of unearned profit an entity expects to earn on a insurance contracts as insurance services are provided. CSM is set up as a liability on the balance sheet.

The report goes into more detail on profit trends and unfamiliar metrics under IFRS 17.

A full copy of the IFRS 17 report is available at http://www3.ambest.com/bestweek/purchase.asp?record_code=346066

The World’s 50 Largest Reinsurers report is available at http://www3.ambest.com/bestweek/purchase.asp?record_code=346088

Both reports are part of AM Best’s overall look at the global reinsurance industry ahead of the Rendez-Vous de Septembre in Monte Carlo. Other reports, including AM Best’s in-depth looks at the insurance-linked securities, Lloyd’s, health and regional reinsurance markets, will be available in September.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage