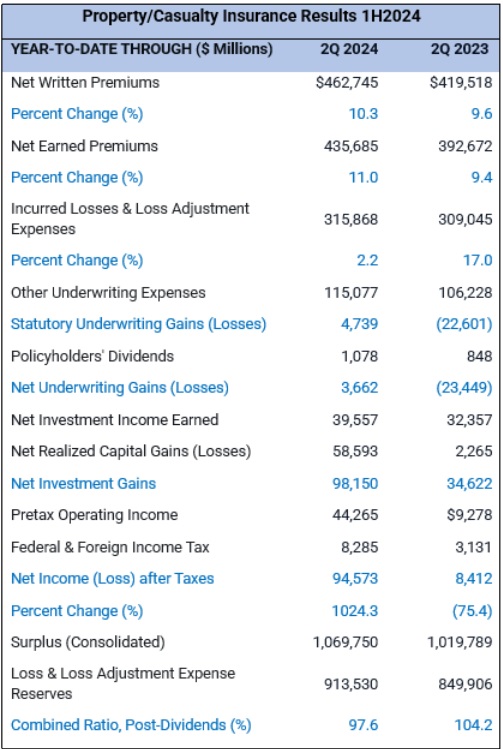

The U.S. property/casualty insurance industry recorded a net underwriting gain of $3.7 billion and net income of $94.6 billion for the first-half of 2024, according to a new report.

“After years of consistent losses, premium growth is helping the overall industry move towards stabilization, with positive first-half underwriting gains for the first time since 2021,” said Saurabh Khemka, co-president of underwriting solutions at Verisk, in a media statement announcing the figures released by jointly by Verisk and The American Property Casualty Insurance Association yesterday.

Basing their estimates on information from annual statements submitted to insurance regulators by insurers representing roughly 91 percent private U.S. property/casualty market, insurers, Verisk and APCIA reported that net written premiums grew just over 10 percent to $462.7 billion.

The 10.3 percent jump was similar to a 9.6 percent increase in net written premiums recorded for first-half 2023 over the prior-year six-month period.

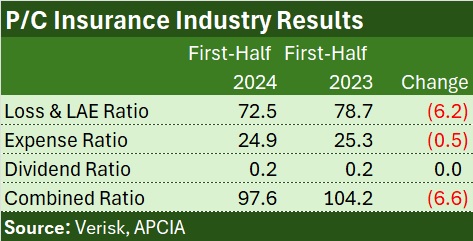

Incurred losses, however, rose only 2.2 percent for first-half 2024, fueling a 6.2 point drop in the industry loss ratio.

With the expense ratio dropping a half-point as well, the combined ratio for the first half of this year is estimated to be 97.6, compared to 104.2 for last year’s first half.

Robert Gordon, senior vice president of policy, research, and international at APCIA, said “it remains to be seen if insurers can finish the year with an underwriting profit after two straight years of underwriting losses,” noting that while commercial lines have been profitable, personal lines insurers are “still struggling to keep up with rising losses”—with wildfire season continuing and an expected spike in hurricane season activity looming ahead.

For another view, read, “Personal Auto Driving P/C Insurers to 2024 Underwriting Profit”

“Insurers’ surplus is continuing to recover from the catastrophic losses in 2022, although it has not kept pace with inflation or the economic demands for insurance coverage,” Gordon added.

In the first half of 2024, the industry’s trillion-plus policyholders surplus figure increased only slightly—to $1,070 billion from $1,014 billion at the end of 2023.

Still, insurers’ rate of return on average policyholders surplus rose to 9.1 percent in the first half of 2024, up from 3.6 percent at the end of 2023.

According to the Verisk/APCIA report, investment income grew 22.2 percent to $39.6 billion, but the biggest factor contributing to the $94.6 billion net income on the bottom line, after taxes, was $58.6 billion in net realized gains. Adjusting for over $50 billion in capital gains realized by one insurer, first-half 2024 gains are estimated to be approximately $45 billion.

Source: Verisk, APCIA

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford