The national auto insurance shopping and quoting rate reached a new high between April and June, but many insurers appear to have achieved or are approaching rate adequacy, “which should lead to less rate activity and perhaps less shopping in the future,” according to a new J.D. Power report.

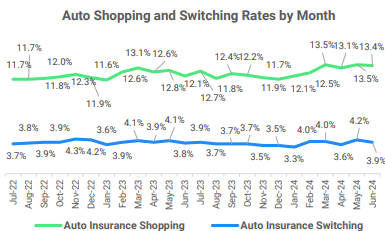

The consumer intelligence company’s data shows that May matched the ongoing study’s all-time high monthly shopping rate, which was set two months earlier at 13.5 percent of U.S. drivers. Also in May, 4.2 percent of drivers switched insurers — setting the study’s all-time monthly high. The data dates to September 2020.

“Rate filings showed a multi-decade high in February and filings through the rest of 2024 show lower increases than what were filed earlier in the year,” the report said. “Shopping for auto insurance could moderate as rate increases calm.”

Overall, the national quarterly quote rate increased to 13.3 percent during the second quarter of 2024. This marked the highest rate seen in the study’s nearly four-year history. Meanwhile, the national quarterly switch rate remained even at 3.9 percent.

All regions of the country saw double-digit quote rates in the second quarter. The Southeast and South-Central United States led the way, with 14.6 percent of drivers shopping during the three-month period. The West and Midwest each experienced rates of 13.2 percent, and 10.7 percent of drivers in the East shopped during the quarter.

J.D. Power reported that two-car, two-driver homeowners made up 18.7 percent of households with auto insurance last quarter. This was followed by homeowners with one car and one driver (9.1 percent), three-plus cars and two drivers (8.1 percent), three-plus cars and three-plus drivers (8.1 percent) and one car and two drivers (5.7 percent). One-car, one-driver renters accounted for 8.8 percent of households with auto insurance.

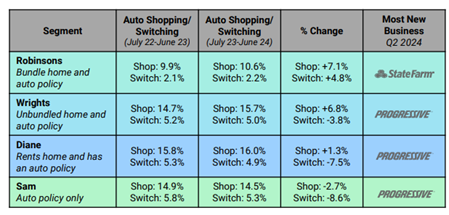

“Two years after we introduced the insurance neighborhood, we find the same six household types still dominate the landscape,” J.D. Power said in the report. “The propensity to shop and switch, however, has changed dramatically. The unprecedented increase in rates has driven an increase in households shopping and switching — particularly those more lucrative multi-vehicle, multi-driver households.”

NJM, Amica, USAA, MAPFRE and Erie were listed as “higher loyalty” insurers. Lower loyalty companies named in the report were National General, Kemper, Auto-Owners, ACSC, Mercury and Progressive. GEICO was identified as the top destination for those defecting from Allstate, Progressive and State Farm.

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster