Despite only one landfalling hurricane, 2023 wasn’t a good year for property/casualty insurers, and severe convective storms (SCS) are being blamed for the bad results, according to Karen Clark & Company (KCC).

KCC’s white paper, “The 2023 SCS Season: How Extreme Was It and Why?” explores the 19 SCS events that exceeded $1 billion in losses and annual aggregate losses of nearly $50 billion.

The most frequent and intense convective storm activity in the world occurs in the U.S., the catastrophe modeler said. Atmospheric instability, wind shear and lifting mechanisms (such as cold fronts) are the key ingredients for SCS.

An example is how they frequently present together over the U.S., “especially in Tornado Alley and the Deep South Tornado Corridor,” the KCC report stated.

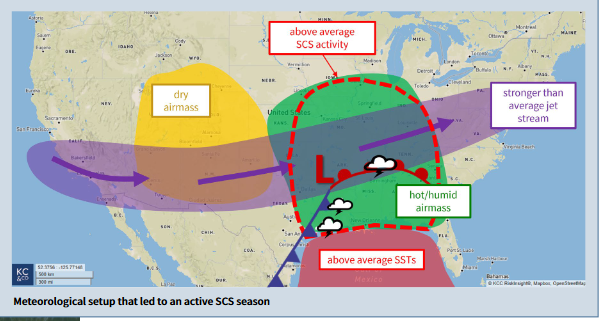

In 2023, the El Nino-fueled jet stream in the U.S was stronger than average and added to the marked SCS activity in the Midwest and the Southeast.

According to KCC, “the atmospheric pattern exhibited a more persistent ‘locked’ behavior, which allowed severe thunderstorms to repeatedly form over the same geographic areas as the atmospheric ingredients continually intensified and replenished due to the low variability in wind and pressure patterns.”

A humid, unstable air mass spread over most of the southern U.S. throughout the spring and summer months due to persistent winds near the ground out of the south.

A late-March storm also added to the damage seen in 2023.

Over 130 tornadoes touched down between March 31 to April 1, making it the third most prolific day for tornadoes on record, KCC said.

In just three months, KCC said nine events equated to insured losses exceeding $1 billion and two events caused losses exceeding $3 billion.

From June through September, the weather events became hail-dominated. According to the global catastrophe modeling and risk consulting firm, there was record-setting large hail activity during the summer months, with over 800 reports of large hail (hailstones exceeding two inches in diameter)—more than twice as many as the average annual number of large hail reports going back to 1990.

Hail typically occurs in spring, but in 2023, “an unusual amount of storm-level winds out of the north allowed cold air to penetrate southward and provide a sub-freezing mid-level storm environment to fuel hail growth,” the report noted.

A widespread hail event on June 10, with hail measuring over five inches in diameter, was reported at several locations, including Sanger, Texas where a hailstone measuring 5.9 inches fell.

The modeling data showed that the event lasted for more than a week and resulted in over 1,500 hail reports and nearly $6 billion in insured losses.

According to KCC, insurers and reinsurers that have not yet adopted the more accurate second-generation modeling technology will fall behind companies already using the most advanced tools for understanding, pricing and managing SCS losses.

First-generation catastrophe models underestimate SCS losses, according to KCC, because they define events by a set of parameters and “use those parameters to generate a stochastic set of potential future events.”

Though hurricanes have relatively similar structures, with 10-12 parameters, first-generation models can estimate the shape and size of hurricanes reasonably well, KCC said.

But according to the catastrophe modeler, severe convective storms are amorphous and dynamic and change over time as they move across the country. “There are no predictable shapes or static set of parameters that can represent these weather systems accurately.”

While some models may capture parametrics of individual storms, they don’t capture the full extent of the damage and “static storm reports from even a decade ago do not reflect current changes in the atmosphere,” KCC added.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs