State Farm has applied for large rate increases in California, a year after the carrier got rate approvals of 7 percent and 20 percent—adding fuel to a burning homeowners crisis in a state that’s seen an increasing number of carriers pullback or raise rates in the last year.

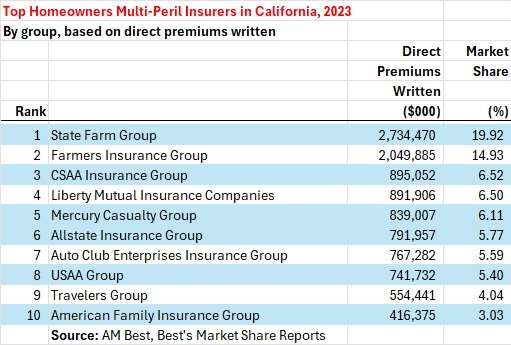

The Bloomington, Ill.-based insurer, the largest in California, insuring nearly one-in-five homes in the state, requested a 30 percent rate increase for its homeowners line, a 52 percent rate increase for renters and 36 percent rate increase for condo coverage.

A growing number of carriers have grown disenchanted with California as larger and more frequent wildfires rear up in the state’s increasingly longer wildfire season. The season ahead doesn’t look like it will give much relief. So far, it’s been far busier for firefighters than last year—and the state is heading into a week of triple digit temperatures and a holiday with fireworks.

A Cal Fire official on Monday said there has been a 1600 percent increase in acres burned this year compared to last year in the same timeframe, and “if the future is any indication of what has occurred already this year, it’s going to be a challenging season for firefighters across the state.”

The rate hike would impact an estimated 1.2 million homeowners. Consumer advocates say the rates, if approved, would be “a financial blow to many renters and home and condo owners” in California.

The insurer said rates will help shore up its financial situation following massive losses from wildfires and other natural catastrophes.

State Farm is “working toward its long-term sustainability in California,” according to a statement from the company provided in request for a comment for this article.

“Rate changes are driven by increased costs and risk and are necessary for State Farm General to deliver on the promises the Company makes every day to its customers,” the statement reads. “We continue to look for ways to maintain competitive rates and help our customers manage their risk.”

The statement notes that rate filings are not final until approved by the California Department of Insurance. It urges customers with questions to speak with their local State Farm agent.

When reached out to for comment, the CDI’s media relations office emailed a statement to be attributed to California Insurance Commissioner Ricardo Lara.

“State Farm General’s latest rate filings raise serious questions about its financial condition,” the statement reads. “This has the potential to affect millions of California consumers and the integrity of our residential property insurance market.”

The statement promises an investigation into State Farm’s financial situation, including a rate hearing on the rate hike applications if necessary.

“I want to be clear: Nothing changes today for State Farm policyholders as a result of these filings,” the statement reads. “We are going to lead with facts to make sure Californians are protected. The Department has made tough decisions in approving major State Farm rate increases to address their financial situation including 6.9 percent in January 2023 and 20 percent for homeowners and condominiums signed off by an intervenor group in December.”

State Farm is the state’s top property/casualty insurer. AM Best reports the carrier has a 19.9 percent market share and $2.7 billion in direct written premiums in California.

Last year, State Farm announced it had stopped accepting new policy applications for property/casualty insurance in California due to increased risks from wildfires and inflation. More recently, State Farm said it would non-renew 30,000 California homeowners, rental dwelling, and other property insurance policies.

Tokio Marine America Insurance Co. and Trans Pacific Insurance Co., in April announced plans to withdraw from the wildfire-prone state entirely starting in July. In June, The Hartford confirmed it will discontinue writing new homeowners policies in California.

Other large carriers that have announced a reduced appetite for writing California homeowners insurance include American International Group (AIG) and Chubb.

A new report from Gallagher Re released late last year showed the threat of damaging wildfires in conjunction with inflation and pricing challenges has led to a distressed insurance and reinsurance market, particularly in California.

Consumer advocates will likely fight the rate request in intervenor hearings, which are part of the state’s prior approval process under Proposition 103, its long-standing insurance law. Efforts to change the law are under way. The law has been blamed by some for making the crisis worse, including by preventing rate requests from being approved quicker.

“State Farm is asking for a massive $1.4 billion more than is justified under the standard rules, so there’s a very high bar to prove that’s necessary,” Carmen Balber, executive director of Consumer Watchdog, said in an emailed response to a request for comment. “Simply because State Farm says it needs an exception to the rules to protect its solvency doesn’t make the case – the insurer still has to prove the variance it seeks is justified. The size of the rate hike State Farm wants – 30 to 52 percent – will be a financial blow to many renters and home and condo owners. Every penny of this request will need careful review.”

The CDI, the insurance industry and others have made several proposals to address the growing homeowners insurance crisis in California.

Lara said he will allow catastrophe modeling to be used in rate regulation for wildfires, a move he says will help restore insurance options for Californians. It was the latest phase of Lara’s Sustainable Insurance Strategy.

The American Property Casualty Insurers Association is one group that would like to see catastrophe modeling allowed in ratemaking, as well as other changes made to Prop 103.

“California’s insurance market is disrupted because the regulatory system is broken,” Denni Ritter, APCIA department vice president, said in a statement. “Current market decisions demonstrate the need for meaningful reform including allowing the use of catastrophe modeling and reinsurance in ratemaking and creating a reliable and dependable rate filing approval process. Insurers are working closely with Insurance Commissioner Lara to implement his Sustainable Insurance Strategy to implement the desperately needed reforms to fix California’s insurance crisis.”

John Meder, head of risk consulting and claims advocacy with Risk Strategies, is encouraged by the latest proposals, which he believes will bring some relief to the state’s insurance market—if they are implemented smartly yet quickly.

He pointed to one example as proposal to enable insurers to use forward-looking CAT models in their ratemaking processes that was generally well-received, but it included a requirement for carriers to maintain 85 percent of their insurance writing in high-risk areas.

“This percentage is considered unrealistic and will likely be a nonstarter for many insurance carriers who have already exited the insurance market,” Meder said. “Some independent insurance groups are proposing a more feasible target of 66 percent, which would allow carriers to better spread the risk across their entire portfolio.”

He considers the regulatory changes proposed “positive activity” that will help retain carriers, and ensuring they can profitably write business in California. “But the CDI also needs to expedite its efforts,” he added. “We are just starting into the wildfire season and so far the wildfire season has been very active.”

This article was previously published on Insurance Journal. Reporters Don Jergler and Chad Hemenway are the West Coast and National editors of Insurance Journal

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll