In the topsy-turvy world of homeowners insurance, first-quarter loss ratios have been bouncing around for the last five years—from below 50 in 2020 to over 70 in 2021 and 2023, a new analysis shows.

The S&P Global Market Intelligence analysis published earlier this week reveals a 14.7 point improvement to 56.5 for the industry overall—and improvements more than twice as large for insurers Allstate and Nationwide.

The S&P GMI report, which displays direct written premiums, growth, market shares and direct loss ratios for each of the 10 biggest writers of homeowners insurance, shows that Nationwide’s loss ratio drop of 30.7 points to 58.0 from 88.7 came as the carrier recorded a 4.1 percent decline in direct written premium.

Nationwide, ranked eighth in first-quarter 2024 premium volume, was the only insurer in the top-10 with lower premiums in first-quarter 2024 than first-quarter 2023. Industrywide, premiums grew 13 percent to $35.7 billion, with top players State Farm and Allstate growing a bit more.

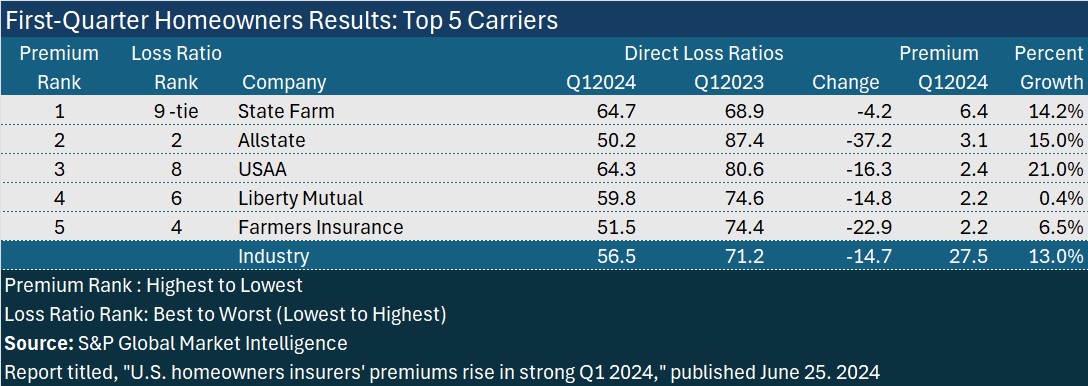

Premiums and loss ratios extracted from the report for the top 5 players are set forth below.

While not shrinking premiums overall, Liberty Mutual, Farmers Insurance and Travelers were the only three homeowners insurers among the top-10 (ranked by first-quarter 2024 direct premiums) to post growth numbers below the industry’s 13 percent sprint.

While not shrinking premiums overall, Liberty Mutual, Farmers Insurance and Travelers were the only three homeowners insurers among the top-10 (ranked by first-quarter 2024 direct premiums) to post growth numbers below the industry’s 13 percent sprint.

Farmers, posting a 6.5 percent rise in premium, had the third biggest loss ratio drop—improving nearly 23 points to 51.5.

Travelers was the only top-10 player to record a worse loss ratio in first-quarter 2024 than first-quarter 2023. Travelers’ 64.7 loss ratio, up 3.2 points from first-quarter 2023, tied with State Farm’s first-quarter result as the worst loss ratio among the 10 largest writers nationwide.

Allstate, reporting the biggest improvement in its first-quarter homeowners loss ratio at 37.2 points, also reported the second-lowest first-quarter 2024 direct loss ratio among the top 10 writers (50.2)—more than 6 points better than the overall industry result of 56.5.

Progressive, ranked 10th by premium volume, scored the best first-quarter 2024 loss ratio at 46.8.

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book

Earnings Wrap-Up: AXIS Expanding Insurance Biz, Shrinking Re Book  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid