Many more properties, including hundreds of thousands of homes across Florida and other parts of the Southeast, will be required to purchase flood insurance after July 31, due to revisions in federal flood maps.

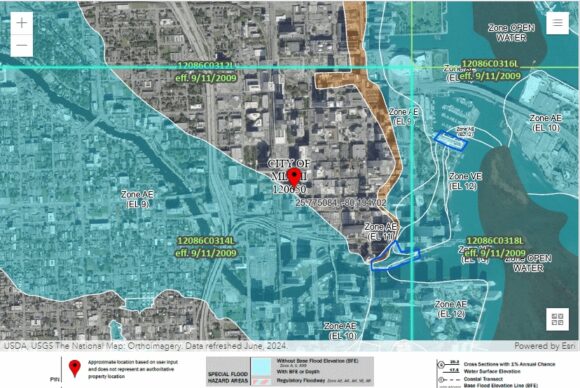

For some of the most exposed and populous parts of the region, in south Florida, the changes means about 138,800 more structures in Miami-Dade, Palm Beach and Broward counties are now considered to be in the special flood hazard area, a significant increase from previous flood maps, according to the Federal Emergency Management Agency. For properties with mortgages, most owners will be required to buy flood coverage, bringing opportunity to insurance agents and private flood insurers, but more costs for insureds.

“The maps for some parts of Florida have not been updated in 20 years,” said Trevor Burgess, president and CEO of St. Petersburg-based Neptune Flood, one of the largest private flood insurance providers in the country.

Neptune now writes more than 191,000 policies, and Burgess expects that number to grow with the Federal Emergency Management Agency’s flood map revisions.

“The water levels are much higher now, the population has grown, and there have been a lot of changes to the landscape,” Burgess said.

The map revisions put about 252,015 structures in Miami-Dade County into the special hazard area, an increase of 45,420 structures from previous maps, FEMA data show. In Palm Beach County, some 34,154 properties are now in the flood zone, an increase of 5,800.

In Broward County, home of Fort Lauderdale, almost 89,000 parcels that were previously in a low-risk area are now in a higher-risk flood zone, the South Florida Sun Sentinel reported.

An agency official did not provide an estimate of the number of properties nationwide or across the Southeast, but people familiar with the maps said many parts of the region will be affected.

The FEMA map revisions came out this month, just as a tropical disturbance dumped as much as 20 inches of rain on parts of Miami-Dade and Broward counties. The flooding is expected to trigger thousands of claims on cars, homes and businesses, with insured losses in the hundreds of millions of dollars, Aon reported earlier this month.

The changes also come at a time when many vulnerable residents and businesses in parts of the Southeastern United States have backed away from flood insurance. In Texas, the number of National Flood Insurance Program policies has dropped by 6 percent in the last 12 months, according to Neptune, which analyzed the NFIP data. Louisiana, which has 440,000 flood policies, also has seen the number of policies shrink by 6 percent in the last year.

Burgess pointed out that while FEMA has revised its maps, it’s partly up to communities to enforce the rules and disallow rebuilding in flood hazard areas. Many local jurisdictions have failed to do that.

In Lee County, Fla., where Hurricane Ian brought heavy storm surge and flooding in 2022, FEMA this spring stripped local governments of community-wide flood insurance discounts after the federal agency determined that many structures were allowed to rebuild without elevating or taking other flood-damage prevention measures. Local officials are continuing to work with FEMA on lightening the penalties.

A FEMA analysis of Hurricane Ian flood losses can be seen here.

FEMA Last Year Released New Flood Insurance Rates by ZIP Code

Featured photo: Flash flooding in mid-June brought water into homes and cars in North Miami and elsewhere in south Florida. (AP Photo/Marta Lavandier)

This article was previously on Insurance Journal’s website. Reporter Will Rabb is the Southeast editor of Insurance Journal.

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster