Even though direct loss ratios for commercial auto and other liability lines rose in first-quarter 2024, across all lines U.S. property/casualty insurers posted a net combined ratio of 94—the best since first-quarter 2007.

Translating to an aggregate underwriting profit of $9.5 billion (compared to an underwriting loss of $8.0 billion in first-quarter 2023), the industry is poised for a full-year underwriting profit, too, analysts from Fitch Rating predicted in a recent research note documenting the first-quarter numbers and commenting on the trends that lie beneath them.

Fitch analysts are careful to point out that given the uncertainty related to loss reserve experience and natural catastrophes, it is likely that net loss and combined ratios for the year will end up above the first-quarter 2024 levels of 68.8 and 94.0. But Fitch analysts still expect strong full-year returns even considering the prospect that commercial lines pricing won’t continue to outpace loss cost inflation and heightened litigation-related risk in several segments.

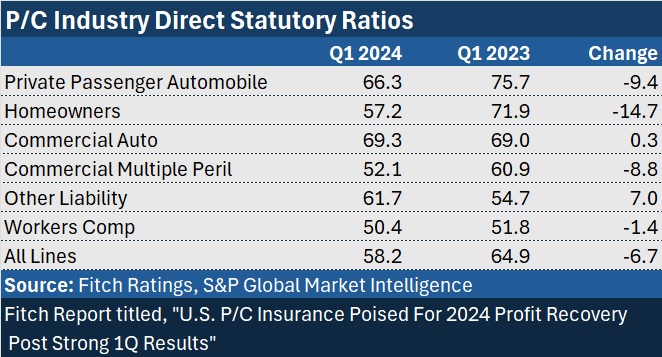

Key metrics presented in the first-quarter 2024 research note resemble the results presented in an earlier report from AM Best, but the Fitch report adds direct loss ratio information by line of business that is not included in the Best report. Both reports include information on direct written premium growth by line in the quarter.

Related article: P/C Insurers Record $9.3B Q12024 Underwriting Gain: AM Best

On a summary graph in the Fitch report, drops in the direct loss ratio for private passenger auto and homeowners stand out as the biggest improvements, supporting Fitch analysts’ insight that lower winter storm losses and a recovery in personal auto results were the two main drivers of the shift to a strong statutory underwriting profit industrywide. Providing more detail behind the numbers, James Auden, managing director, North American non-Life Insurance at Fitch Ratings, noted that the industry direct loss ratio for auto physical damage fell more than 15 points in the quarter, contributing to the 9.4-point drop in the private passenger auto loss ratio.

Also noticeable, however, are the upward movement in the other liability loss ratio, a flat commercial auto result and just a small improvement for the workers compensation line. For workers comp, premium growth turned negative in the quarter.

“Improvement in performance for 2024 will continue to be driven by personal lines results, attributable to recent substantial pricing actions and a moderation of unusually high loss severity trends.”

“Overall commercial lines underwriting results are anticipated to remain profitable with modest loss ratio deterioration” going forward, the Fitch Ratings note says. So far, “ongoing weakness in commercial auto and other liability-occurrence business has been mitigated by continued highly favorable workers compensation results.”

Auden recently wrote about trends in commercial auto insurance in the related Carrier Management article, “Commercial Auto Insurance Profit Struggles Continue.”

With loss ratios sharply diverging for personal and commercial lines, Fitch recently moved the sector outlook for U.S. personal lines insurance to Improving. (“Global Insurance Mid-Year Outlook 2024,” June 11, 2024)

The sector outlook for U.S. commercial lines insurance remains Neutral.

“Improvement in performance for 2024 will continue to be driven by personal lines results, attributable to recent substantial pricing actions and a moderation of unusually high loss severity trends,” the Fitch writeup said.

For commercial lines, persistent inflation and slowing economic growth raise the “potential for an unfavorable shift in loss reserve adequacy that clouds the earnings picture, led by commercial auto and other liability product lines.”

A streak of nearly two decades of favorable calendar-year loss reserve development could come to an end in 2024, the research note suggests. The year 2023 marked the 18th straight year of favorable loss development for the P/C industry overall, but “the accuracy of insurers’ loss projections for claims severity tied to inflation and litigation risks in commercial auto and other liability business will determine” if the span extends to 19 years in 2024, the note said.

Related articles: “After 18 Straight Years, Favorable Loss Reserve Development Streak Could End,” “Commercial Auto Insurance Profit Struggles Continue“

During the first quarter, a 32 percent increase in investment income combined with the underwriting turnaround to improve the profit picture for the U.S. P/C insurance industry, pushing operating income up 300 percent to $26.2 billion. Together, growth in underwriting and investment income fueled an annualized operating return on surplus over four-times higher—10.2 percent in first-quarter 2024 vs. 2.4 percent in first-quarter 2023, according to Fitch Rating analyst calculations.

The report notes, however, that in addition to higher yields, the jump in investment income was affected by a one-time $2.1 billion dividend from affiliates for Liberty Mutual.

Net income, which leapt to $40 billion from $9 billion in the year earlier period, also reflected the impact of activity at one company, Fitch reported, noting realized gains of $14 billion for National Indemnity Company from the sale of Apple stock, which impacted the industry result.

Preparing for an AI Native Future

Preparing for an AI Native Future  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality