The board of governors for Florida’s state-created Citizens Property Insurance Corp. voted unanimously Wednesday to raise personal lines rates by an average of 14 percent statewide – near the maximum allowed under the insurer’s glide path – starting next year.

The rate increase, if approved by the state Office of Insurance Regulation, would still be well below the actuarially indicated rate, a Citizens actuary said at the board meeting. But that indicated rate increase for 2025 is about 25 percent, a vast improvement over the 41 percent that would have been indicated before Florida lawmakers passed major litigation reforms in 2022.

“The news today will be about the rate increase. But to me the real story is that the uncapped, indicated rate is so much lower than it was just a year ago,” board member Scott Thomas said at the meeting. “That’s a phenomenal change.”

It’s all because of Senate Bill 2A, approved in late 2022, which ended one-way attorney fees for plaintiffs and barred assignment-of-benefits agreements with contractors. Those were two quirks of Florida law that property insurers had blamed for incentivizing claims lawsuits and overwhelming some carriers with litigation costs.

Litigation rates for non-catastrophe claims have fallen significantly for Citizens, from a high of 14 percent in 2020 to 6 percent in 2023. In the three most populous south Florida counties, litigation rates dropped from 28 percent in 2020 to 16 percent last year, Citizens’ data show.

“The primary driver of Citizens’ improved results is due to the continued decrease of the litigation rates for non-catastrophe losses,” reads an actuarial slide presentation at the meeting.

Another bit of good news for insurers: Citizens’ depopulation plan appears to be working, perhaps better than expected. Citizens policies topped 1.2 million this year, but the number is expected to drop below 1 million by year’s end, officials said. As many as 400,000 policies should be moved to private carriers this year, thanks partly to take-out offers made by insurance companies.

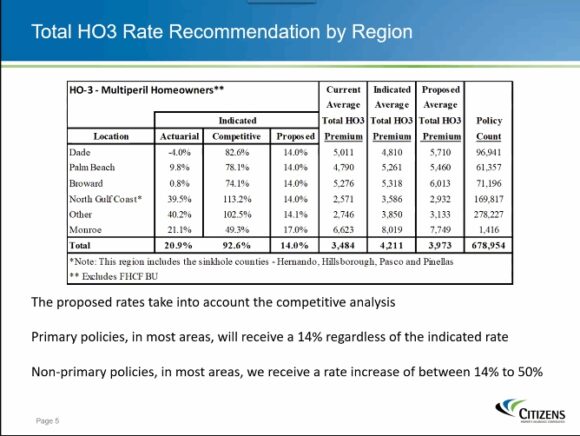

The 2025 recommended Citizens rate changes, which would take effect Jan. 1 if approved by regulators, would raise homeowner multiperil (HO-3) rates by an average of 13.5 percent. Actual premiums will vary by property and by county. Condominium coverage would increase 14.2 percent, and commercial policy rates would jump an average of 13.5 percent.

The 2025 recommended Citizens rate changes, which would take effect Jan. 1 if approved by regulators, would raise homeowner multiperil (HO-3) rates by an average of 13.5 percent. Actual premiums will vary by property and by county. Condominium coverage would increase 14.2 percent, and commercial policy rates would jump an average of 13.5 percent.

For second or non-primary homes, which are not subject to the same glide path that limits primary HO rate increases to no more than 15 percent per year, average rates would rise 18 percent for homeowners policies and by 15 percent for condominium units.

Board member Robert Spottswood asked if further consideration has been given to making Citizens the primary wind-only carrier for Florida. A bill in the legislature this spring proposed the change, but the bill died in committee. On Wednesday, Citizens CEO Tim Cerio said that a staff analysis of the proposed idea indicated that it would create more than $3 trillion of exposure for Citizens, requiring the purchase of $5.5 billion of reinsurance.

“It might get floated again, and there’s more than one way to skin a cat, but we found that it would be cost-prohibitive,” Cerio said.

Chief Actuary Brian Donovan noted that Citizens’ multiperil policies, most of which include wind coverage, subsidize the cost of providing Citizens’ wind-only coverage.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation