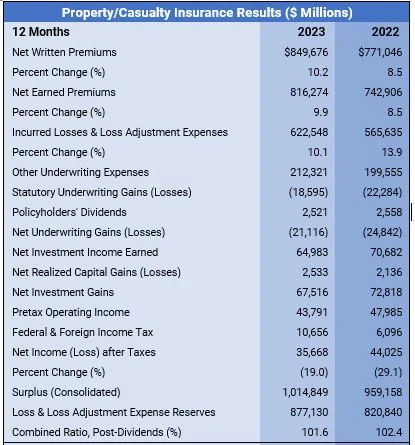

The U.S. property/casualty market sustained an estimated $21.1 billion in underwriting losses in 2023, highlighting the challenges the industry faces as a result of natural catastrophes and inflation.

According to joint analysis by global data analytics and technology provider Verisk and The American Property Casualty Insurance Association (APCIA), 2023 followed similar trends in underwriting losses to those seen in 2022.

Underwriting losses in 2022 totaled $24.8 billion.

Net income is at the lowest level seen in more than 10 years, the companies reported.

In 2023, in net income declined to $35.7 billion, compared to $44 billion the preceding year, representing a 19 percent decrease.

Incurred losses and loss adjustment expenses for 2023 increased by 10.1 percent, while earned premiums grew by 9.9 percent, the analysis showed.

The combined ratio showed little change at 101.6 percent in 2023 versus 102.4 percent in 2022.

The results for 2023, as shown in the table below, represent consolidated estimates derived from annual statements submitted by insurers to insurance regulators.

The results, according to Verisk and the APCIA, are based on approximately 96.9 percent of all business underwritten by private U.S. property/casualty insurers.

“Insurers experienced a second straight year of net underwriting losses with over $21 billion in red ink in 2023 following nearly $25 billion in 2022,” said Robert Gordon, senior vice president of policy, research, and international at APCIA. “While overall industry surplus – representing the supply capacity for insurance coverage – modestly increased in 2023 thanks to investment gains, it has still not recovered from the $72 billion contraction in 2022 and fell to a five-year low relative to premium revenue. Homeowners and auto insurance performed particularly poorly: in both 2022 and 2023, loss ratios exceeded levels not seen in more than 20 prior years. As insured losses skyrocket, many policyholders in the U.S. face rising insurance costs and availability challenges, which is why the insurance industry is analyzing these issues and advocating for solutions. However, the market won’t fully stabilize until insurers can close the gap between losses and rates.”

Policyholders’ surplus improved from Q3’s $950.8 billion to $1,014.8 billion in 2023, though insurers’ rate of return on average policyholders’ surplus decreased to 3.6 percent in 2023, down from 4.4 percent in 2022.

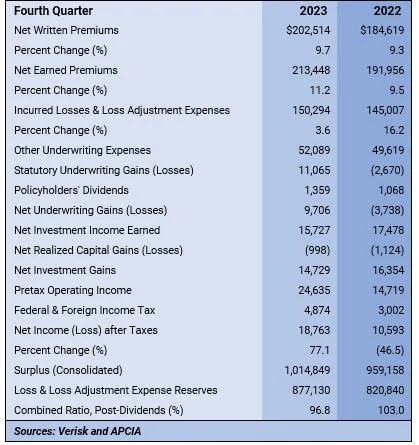

Year-over-year improvement is seen in the fourth quarter in premiums and combined ratios, attributable to a sharp decrease in cat events, the analysis showed.

In the fourth quarter of 2023, the industry’s net income increased to $18.8 billion, up from $10.6 billion in the same period of 2022.

“Despite only one U.S. landfalling hurricane in 2023, we saw elevated catastrophe activity. Severe convective storms were a key driver of underwriting results for the year, particularly in homeowners,” said Saurabh Khemka, co-president of underwriting solutions at Verisk. “On the premium side, the hard market and steady exposure growth have eased some of the pressures in commercial lines. However, even with another year of double-digit rate increases, rate adequacy continues to be a major challenge for personal auto driven by inflation, supply chain shortages, and labor shortages.”

Some additional insights show that while the first half of the year experienced record-breaking catastrophe activity, there was below-average activity in the second half.

Catastrophe losses in the last quarter of 2023 were the lowest quarterly losses recorded since 2015 and the fewest quarterly losses since 2016, the joint analysis showed.

Net written premiums increased by $17.9 billion in the fourth quarter of 2023, representing a growth of 9.7 percent compared to the previous year.

Net underwriting gains rose to $9.7 billion in the fourth quarter of 2023, rebounding from $3.7 billion in losses reported in the same quarter one year earlier, the Verisk/APCIA analysis revealed..

The combined ratio improved from 103.0 percent in the fourth quarter of 2022 to 96.8 in the same period this year.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages