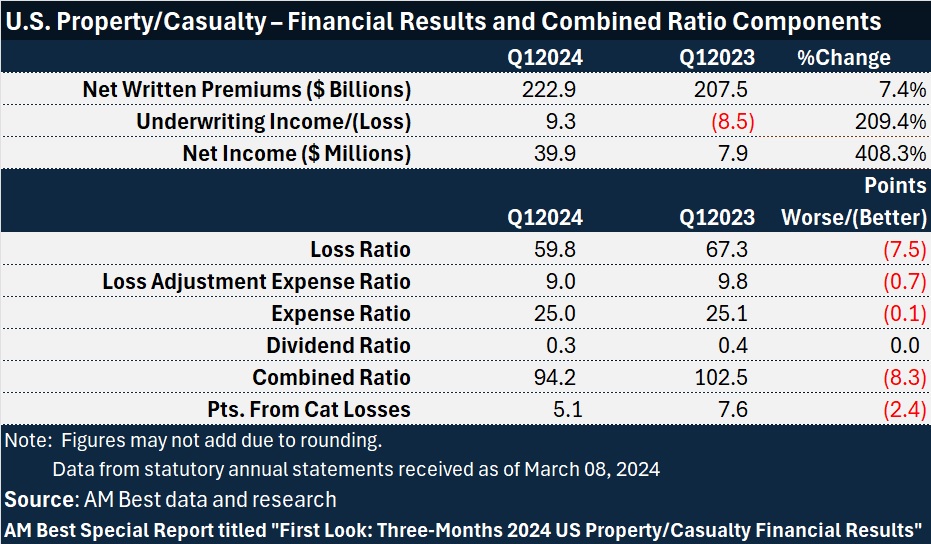

The U.S. property/casualty industry recorded a $9.3 billion net underwriting gain in the first three months of 2024, according to a recently published AM Best report.

The gain marks a reversal of an $8.5 billion loss recorded in the same period in 2023, AM Best notes in the report titled “First Look: Three-Month 2024 US Property/Casualty Financial Results.”

The aggregated financial results detailed in the six-page report—such as components of $39.9 billion of net income, contributors to a 94.2 combined ratio, and balance sheet items including over $1.0 trillion of policyholders surplus—were derived from companies’ annual statutory statements received as of May 29, 2024, representing an estimated 98 percent of the total P/C industry’s net premiums written.

Overall, net premiums written reached $222.9 billion in first-quarter 2024, a 7.4 percent jump over last year’s first quarter, the report shows.

The report notes that the turnaround in the personal lines segment was primarily responsible for the improvement in underwriting results. A chart in the report displays direct written premiums by line for the first-quarter periods in 2020, 2021, 2022, 2023 and 2024 but not underwriting results for each line. For the personal auto liability and homeowners lines, direct premiums jumped about 14 percent in first-quarter 2024 vs. first-quarter 2023, while total direct premiums for all lines rose by roughly 11 percent.

Across all lines, the industry aggregate loss and loss adjustment expense ratio declined 8.2 points, accounting for almost all of the improvement in the industry combined ratio of 8.3 points to 94.2. The other underwriting expense and policyholder dividend ratios were essentially flat.

Catastrophe losses came in at $10.9 billion for first-quarter 2024, adding 5.1 points to the loss and combined ratios. That was roughly $3.8 billion lower than first-quarter 2023, when $14.6 billion of cat losses contributed 7.6 points to the industry loss ratio.

U.S. P/C insurers in aggregate reported $7.1 billion of favorable loss reserve development in the first quarter of this year, according to AM Best’s tally, shaving 3.3 points off reported calendar year loss and combined ratios. In 2023’s first quarter, loss reserve development had little impact on the ratios.

The industry’s underwriting gain, taken together with a 33.3 percent jump in earned net investment income, drove pre-tax operating income up 332.9 percent to $30.0 billion for first-quarter 2024, compared to $6.9 billion for first-quarter 2023.

Bottom-line net income of $39.9 billion for first-quarter 2024 was more than four-times higher than $7.9 billion for first-quarter 2023. The AM Best report notes that a $10.2 billion change in net realized capital gains at Berkshire Hathaway’s National Indemnity Company accounted for most of the difference between operating profit and net income for the industry overall.

Source: AM Best

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk