As the U.S. car market swiftly and steadily goes electric, the Volkswagen ID.4 remains near the front of an increasingly crowded field. Americans bought nearly 6,200 of them in the first three months of this year.

But if you want an ID.4 in South Dakota, you better act fast — only three in the state are unspoken for. The same is true in Arkansas and Mississippi, according to the latest data from CarGurus Inc., a listing platform that captures most U.S. new car inventory.

The ID.4 isn’t an outlier, either. Consider the Nissan Ariya, another popular newcomer in the EV game. Nebraska and West Virginia each have a single Ariya on offer; Wyoming, meanwhile, has two.

Much has been made about a slowdown in EV adoption in the US, where sales of electric vehicles are expected to grow 20 percent this year, according to the International Energy Agency, well below the 40 percent sales growth seen in 2023. A series of auto companies, from Ford to Mercedes to Volkswagen, have announced plans to pump the brakes on production of electric models, citing flagging consumer interest and a glut of battery-powered inventory.

Much of that inventory, though, is ending up in the same few places: along the coasts and in the nation’s busiest auto markets, leaving would-be EV buyers in other regions with precious few options. The dynamic reflects something of a chicken-and-egg situation for automakers: Their ability to push electric vehicles beyond early adopters hinges on second-wave buyers in a broader swath of states. Yet drivers in rural states may be slower to buy electric because they aren’t seeing many available options.

“We’ll probably need to see more inventory on individual dealership lots to get this going,” says Kevin Roberts, director of industry insights at CarGurus. “Not being able to actually see the vehicles could be holding things back.”

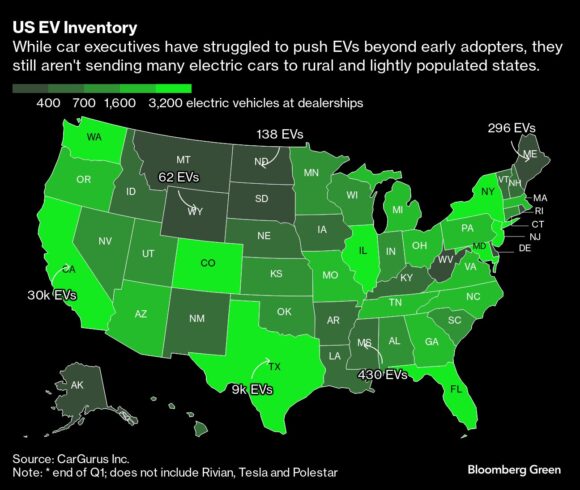

While car executives have struggled to push EVs beyond early adopters, they still aren’t sending many electric cars to rural and lightly populated states.

Almost one-third of new electric vehicles are going to one of three states: California, Florida or Texas, according to CarGurus data. To some degree, that makes sense — they are the most populous states. If a third of drivers are interested in buying an EV, that third represents more potential buyers in California than Montana.

But the byproduct is a dearth of options for drivers elsewhere. At the end of the first quarter, some 23 states had fewer than 1,000 electric vehicles on offer, excluding brands like Tesla that do an end-run around traditional dealerships. Nine states had fewer than 400.

Those numbers make buying an EV daunting for people like Vincent Rossano, a carpenter who lives near Montpelier, Vermont. Rossano was set on purchasing a Chevrolet Bolt, but the closest one he could find was 360 miles away in upstate New York. (His mother was kind enough to drive him to the dealership.)

“I called like 60 dealerships all around New England,” Rossano says. “It was ridiculous — none in Vermont, none in Massachusetts, none in New Hampshire. We even called someplace down in Delaware.”

CarGurus doesn’t capture data on companies that sell cars directly to consumers, namely Tesla, Rivian and Polestar. And unlike those companies, incumbent carmakers are juggling the need to manufacture both battery-powered and internal-combustion drivetrains simultaneously, at least in the short term.

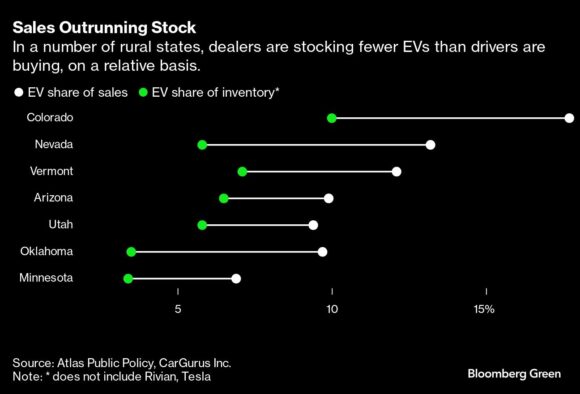

But in much of the U.S., incumbents’ EV inventory is well below local adoption rates. In Colorado, for example, almost one in five new cars purchased in the fourth quarter was battery-powered, yet EVs accounted for just 10 percent of new car inventory in the first quarter. The gap is similar in Nevada, where 12 percent of cars purchased at the end of 2023 were electric, yet only 6 percent of those sitting on lots are.

“There’s this whole narrative that EV demand is down,” says Joel Levine, executive director of EV advocacy group Plug In America. “This year, EV sales are on track for a 20, 25 percent increase. The curve has shifted, but it’s not like people aren’t asking for the cars.”

In a recent BCG survey of U.S. consumers, 38 percent of respondents said their next car would definitely be electric and another 27 percent said they were considering an EV.

In a number of rural states, dealers are stocking fewer EVs than drivers are buying, on a relative basis.

Auto executives have long had sound rationale for keeping EVs clear of the country’s vast open spaces: charging infrastructure, or the lack thereof. The U.S. has traditionally been a patchwork of vast electron deserts. As recently as 2020, China had almost 10 times more public charging plugs.

The deserts, however, are all but gone. A building blitz has switched on thousands of chargers all over the U.S., including in some of its emptiest corners. At the end of the first quarter, there were almost 8,200 public, fast EV-charging stations in the country — one for every 15 gas stations.

A larger issue may be the auto industry’s franchise dealership model. Volkswagen, for example, says its ID.4 sells well in the Sun Belt — the so-called smile states — and in places like Chicago and Minneapolis, where the brand has long had a strong following.

“If places like West Virginia or North Dakota have a very small percentage of ID.4 sales, that reflects the fact that our dealers aren’t ordering them because no one is asking for them,” says VW spokesman Mark Gillies.

But dealers themselves may not be the best stewards of the EV transition. Many are hesitant to stray from what has been a profitable playbook — namely, selling gas-burning trucks and SUVs.

“I don’t think there’s an evil conspiracy,” says Levine at Plug In America, which has a curriculum to train car dealers on how to transition to electric inventory. “It’s sort of the nature of auto dealers to sell cars that they know people want to buy. If you’re in West Texas, you’re going to specialize in pickup trucks.”

At the moment, only about half of Americans say they know someone who owns an electric car, according to a CarGurus survey.

“If you live in Idaho, you’re not likely to have experienced an EV,” says Elaine Buckberg, formerly an economist with General Motors. “Plus, dealers have to order the stuff or be willing to take it and the dealers are not necessarily the most technologically advanced, trend-seeking people.”

The good news for EV advocates is that adoption tends to happen slowly and then all at once. Buckberg says there’s a network effect at play. The more electric cars are stocked, the more people notice them; the more people notice them, the more people try them.

Top photo: A 2023 Chevrolet Bolt electric vehicle (EV) at a dealership in Pasadena, Texas, on Monday, Nov. 6, 2023. Partisan politics appear to be shaping consumers adoption of electric vehicles, as sales lag in Republican strongholds where gas prices are cheaper.

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Preparing for an AI Native Future

Preparing for an AI Native Future  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market