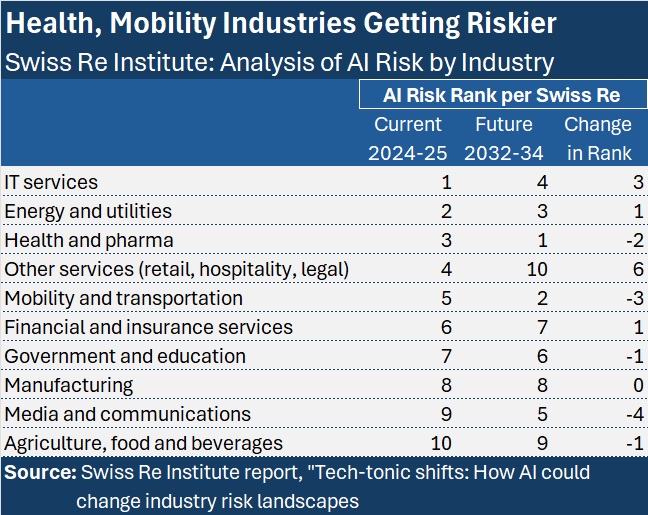

The insurance industry came in sixth in a ranking of 10 major industries based on current AI risk, and seventh based on future risk, with health care replacing IT as the most exposed sector in the next 10 years.

The rankings appeared in a new white paper from Swiss Re institute titled “Tech-tonic shifts: How AI could change industry risk landscapes,” which highlights the opportunities for insurers to cover AI risks of those industries more exposed today and in the 2032-2034 time frame with existing policies and with new products targeting specific AI risks such as algorithmic underperformance.

“Providing AI risk solutions is a significant opportunity for the [insurance] industry. It is also a potential vulnerability, particularly when AI risks accumulate unseen within insurers’ portfolios,” says the white paper, which shows the insurance industry’s own AI risk ranking moving only slightly and in a favorable direction—from a sixth-place ranking currently to seventh place in the next decade.

Meanwhile, AI risks will grow for many sectors they cover, such as mobility and transportation and health care, the analysis shows. The table below, summarizing Swiss Re’s AI Risk rankings at a high level, shows that only the IT and other services (retail/hospitality/legal) sectors exhibit more favorable ranking changes than insurance in the future.

The white paper itself provides much more detail, indicating severity and frequency risk rankings for each of the 10 industry groups. In addition, for six of the industries analyzed, the white paper shows the contribution of each of six specific risks related to the use of artificial intelligence: data bias, cyber, algorithmic and performance risk, ethical lapses, intellectual property and privacy risks.

Key findings include these:

• Across industries, while risks such as ethics, bias and privacy are prominent in the short term, over the longer term, performance risk will grow in importance in terms of frequency.

• IP risks are currently the most severe loss category—”likely associated with the use of generative AI and copyright material”—but over the longer term, Swiss Re expects the single most severe risk to be one of performance as AI becomes embedded across a wide range of industries. Think “vehicles, manufacturing plants, crop modeling, consumer chatbot interfaces or any manner of other uses” when gauging potential future performance risk, the white paper suggests.

• Frequency risk is currently concentrated in a few sectors, with the IT sector in the lead, followed by the government and education sector and then media. Currently, more than half of the risk flow (55 percent) falls to the technology sector, which “is reflective of the sector’s ‘first mover’ status” in developing AI technology and putting it to use.

• Within the next 8-10 years, when AI is being used extensively across a range of industries, frequency risk will be more evenly distributed, but the health and pharma sector will edge out IT slightly in terms of frequency and overall risk.

• Severity of incidents is currently highest in the energy and utilities sector, reflecting the critical nature of infrastructure, even though frequency is low (ranked ninth out of the 10 industries). That’s set to change with the energy sector’s severity ranking falling to fifth place in the next decade, but frequency risk is growing “as smart grid technologies powered by AI increasingly come on stream to support net zero transition,” Swiss Re said. The white paper indicates a third-place overall and frequency risk rank for the sector in the 2032-2034 time frame.

• Health and pharmaceuticals is the second most severely impacted sector today, and AI risk severity will remain high for the sector in the next decade (with potentially high-dollar losses for bodily injury and professional liability). This will be exacerbated by a rise in frequency, Swiss Re Institute says, noting that a high number of applications across the health care value chain could use AI in the future, pushing the sector up to the first-place spot on all three scores—frequency, severity and overall.

Bias in pharmaceutical development as well as AI diagnoses (performance risks) are among the specific risks to watch when covering insureds in this sector, the white paper notes.

• Self-driving cars are set to drive AI risk rankings higher for the mobility and transportation sector, the white paper notes. Contributing to a higher risk ranking—a second place overall risk ranking for the next decade vs. a fifth place ranking today—is a 66 percent jump in the severity score for algorithmic and performance risk calculated by Swiss Re.

Coverage Insights

A detailed loss severity matrix for all 10 industry sectors shows that the financial and insurance services sector will have lower severity scores for every risk type in the future vs. the current level of risk. In both periods, algorithmic, IP and bias risks are the top three contributors to AI risk severity scores for financial and insurance companies.

Meanwhile, the insurance industry has an important role to play in addressing AI-related risks and helping build the digital trust needed to harness the full potential of emerging technologies. “Providing risk protection products and services for those vulnerabilities” potentially created by AI “is the business of insurers,” the white paper states.

The newest coverages to address AI risks are AI performance guarantees including offerings from Armilla Assurance. Armilla Assurance offers verification and assessment of AI model quality and since late 2023 has been offering performance warranty products backed by Swiss Re, Greenlight Re and Chaucer, indemnifying the performance of AI models.

But there may also be coverage under existing policies, the paper suggests, noting that AI’s failure to perform could “spill over into property damage,” for example. As for other risks, IP infringements may fall under professional lines, and data bias may fuel liability claims.

The white paper later references “silent AI risk,” noting that when traditional insurance lines neither specifically include nor exclude coverage for AI-triggered events, this could have “potentially serious consequences for accumulation risks in insurance portfolios.” (The white paper promises more information on silent AI risk as the focus of an upcoming Swiss Re Institute publication.)

The paper also notes that while cyber insurance already exists as a possible coverage of cyber risks related to AI, cyber risk scored lowest in terms of both frequency and severity across industries in the current environment and for severity in the future environment. “We only have limited past experience of AI-targeting attacks,” the paper says, providing one explanation, also adding “our forward-looking data does not include illegal activity.”

“If cyber criminals come to target AI systems in the same way they target non-AI digital systems, the risk could be significantly higher,” the paper suggests. “One can imagine the damage that could be caused by, for example, hacking the AI of an autonomous car fleet, let alone the use of AI as a hostile attack weapon.”

Methodology for Scores and Rankings

To develop the rankings, Swiss Re isolated six specific risks related to the use of artificial intelligence: data bias, cyber, algorithmic and performance risk, ethical lapses, intellectual property and privacy risks. Using a text mining approach, Swiss Re mined data on historical events from the OECD AI Incidents Monitor (which identifies AI incidents in global media sources) and forecasted forward-looking views for each industry referencing the PATENTSCOPE database of the World Intellectual Property Organization.

The paper notes that Swiss Re Institute analysts used a combination of 22 AI technology terms along with industry-specific keywords to classify the patents by relevant industries, resulting in a total of 41,742 AI-relevant patents (granted between January 2022 and March 2024) being used for the analysis.

For its investigation of the current risk landscape, Swiss Re notes that the OECD AI Incident Monitor provided a database of 13,398 incidents since 2014 available after cleaning the data.

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk